US Futures Flat After Uneventful Session in Europe

A sense of calm appears to be gradually returning to financial markets as we near the end of the week, with indices in Europe trading a little lower and US futures flat after ending Wednesday’s session in a similar manner.

While volatility in the markets has eased over the last couple of days, it has remained at very high levels which is probably a sign of the ongoing nervousness among investors which may leave markets vulnerable to further declines. Still, the European session has so far been relatively uneventful compared to the last few days which may be a positive sign ahead of the open in the US.

The sell-off on Monday was widely attributed to rising yields on the back of higher interest rate expectations in the US and Europe, although it was likely exacerbated by a combination of other factors, such as automated trading and fear of a broader correction given how long it had been since the last. It’s interesting then that while yields fell after the stock market sell-off, they have been creeping higher again and now find themselves not far from the levels they were at on Monday. Should we avoid another plunge in stocks, it would suggest that yields may have been the catalyst but ultimately, the selling that followed was driven by other factors, perhaps including a belief that a correction was overdue.

Are BoE Interest Rate Expectations Too Bullish?

Will Carney Adopt Cautious Approach Given Market Volatility?

It will be very interesting to see what approach the Bank of England takes when it holds its quarterly press conference later on, given the recent market volatility. Central banks typically approach these events with incredible caution due to the ability of a seemingly harmless comment to cause excessive swings as traders pick apart everything that’s said.

Governor Mark Carney may have to be extra careful today then, particularly if the BoE is planning to lay the foundation for a rate hike this year, with an increasing number of people suggesting one will come in May. I remain unconvinced by this given the amount of economic uncertainty, soft economic data and the fact that inflation is believed to have peaked. Should the new forecasts contain an upgrade to the inflation outlook then perhaps this will nudge policy makers towards raising interest rates again.

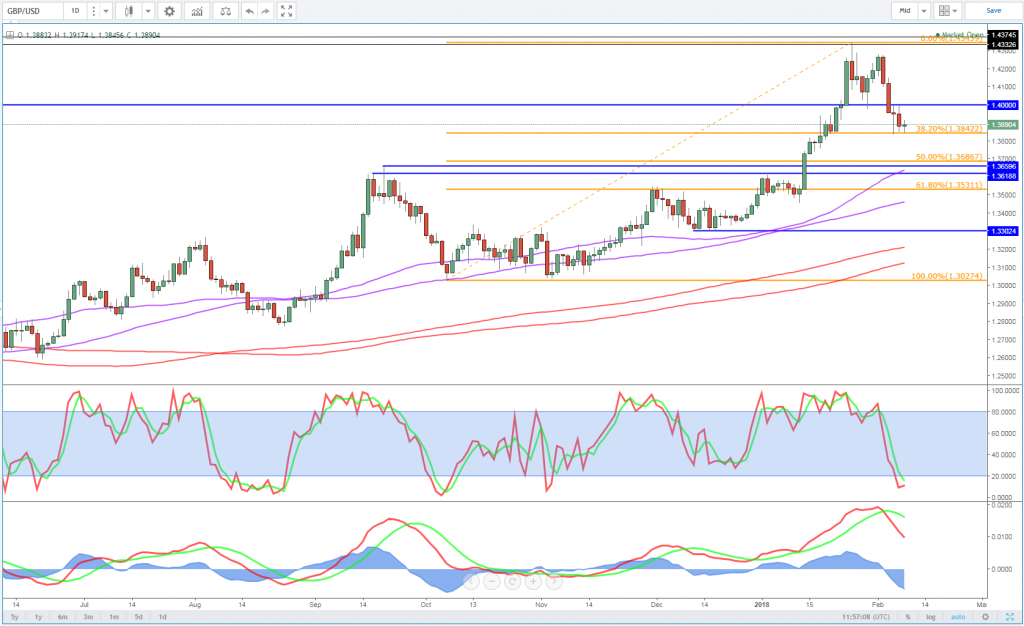

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

With no change in interest rates expected, traders will be paying very close attention to the new forecasts, as well as the press conference with Carney and his colleagues. If the BoE is considering a hike in May, you would expect it to start laying the groundwork for it today and at the meeting in March, which could provide additional upside pressure in UK debt and sterling, which is already trading at pre-referendum levels against the dollar.

Crypto Rebound May Be Short-Lived

The rebound in bitcoin is continuing today, with the cryptocurrency now up more than 40% from the lows posted two days ago. In any other asset other than cryptocurrencies, this kind of move would be staggering but instead this is just another day for bitcoin. It is also only a small rebound compared to the declines it’s seen over the last couple of months and may prove to be yet another dead cat bounce, albeit one that exceeds 40%.

Bitcoin Daily Chart

Source – Thomson Reuters Eikon

I’m not convinced yet that any rebound will be sustained as we continue to see a steady stream of negative news flow which has severely damaged sentiment in cryptocurrencies. The rally towards the end of last year was driven by the buzz and positive sentiment towards bitcoin and its peers – as well as a large speculative push from FOMO traders – and the reversal of this has equally weighed heavily on it. If that continues, I see no reason why it won’t be back below $6,000 in the not too distant future.

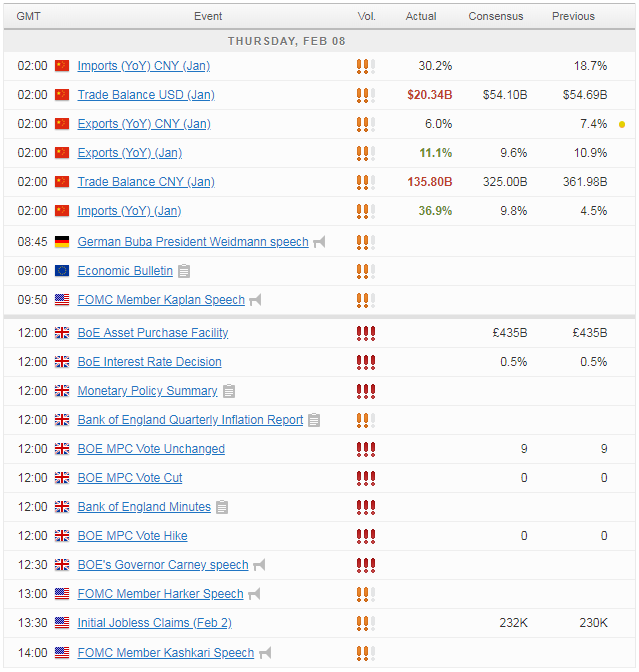

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.