It’s been a relatively calm start to trading on Tuesday with traders eyeing more appearances from central bankers in the absence of much economic data, as well as a number of earnings releases from companies reporting third quarter results.

Mark Carney’s appearance in front of the House of Lords Economic Affairs Committee stands out as the most important of these today for a couple of reasons. The first is that he is due to comment on the economic consequences of the Brexit which given his warnings prior to the vote, the relative stability in the economy so far and the pressure he has come under to resign because of his apparently politicized views, should make for interesting hearing. Further warnings that the economy is heading down a bumpy road or that signs are already appearing that the economy is coming under strain may hit the pound during Carney’s testimony, while any concessions, however improbably, that the BoEs assessment was inaccurate may offer some support to an already heavily depreciated currency.

Dollar Reluctantly Grinds Higher For Now

What could cause bigger issues for the pound is whether Carney offers any insight into his future, with him previously indicating that a decision on whether to serve the full term or leave when his current stint expires in 2018 will be made by the end of this year. If Carney believes his position has become untenable due to the political situation and the independence of the central bank being constantly called into question and his position continually undermined, it will be interesting to see whether he signals an intention to leave his post even earlier. That could be very damaging for the pound.

We’ll also hear from Mario Draghi today, another central bank President that is expected to be very busy between now and the end of the year. After the last meeting, Draghi indicated that the ECB will look to modify its stimulus package at the meeting in December when it releases its latest economic projections. While he may not be speaking directly on the issue today, there can often be comments on the subject and his response to them will be of keen interest to traders.

Copper Flirts With Yearly Support

From a US perspective, we’ll get the latest views of Fed official Dennis Lockhart today, although it is worth noting that he won’t be a voting member of the FOMC until 2018. We’ll also get the latest CB consumer confidence reading for October, as well as earnings from just under 10% of S&P 500 companies which should ensure we have an active session on our hands.

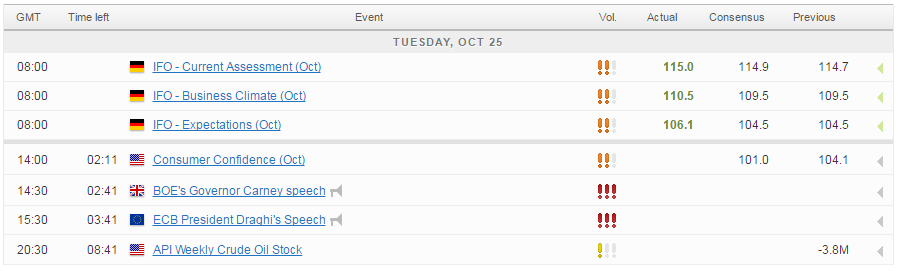

For a look at all of today’s economic events, check out our economic calendar.