Cheap Crude Oil & Nat Gas Not Going Away In ‘The Age of Plenty”

$OIL, $USO, $UNG

Tuesday in London, Michael Liebreich, founder of Bloomberg New Energy Finance, set out the trends upending the global energy markets and ushering in what he termed an “Age of Plenty.”

He said the following:

1. Cheap fossil fuels , Crude Oil and Nat Gas, are here to stay because production costs are diving.

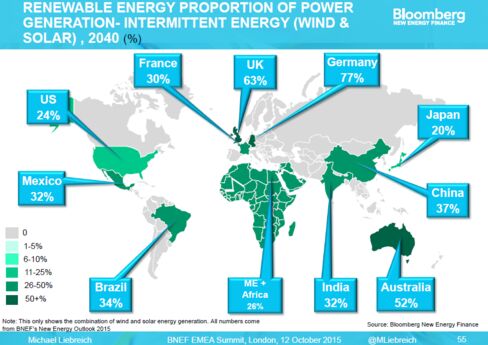

2. Intermittent renewables will dominate electricity supply by Y 2040, with huge challenges for grid managers.

The implication is that energy will be plentiful for years to come. Crude Oil will linger closer to 50 than to 90 bbl, and renewables will gain market share.

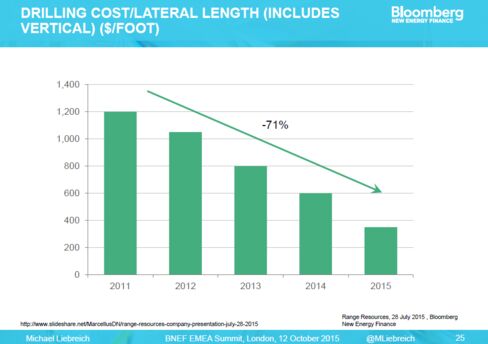

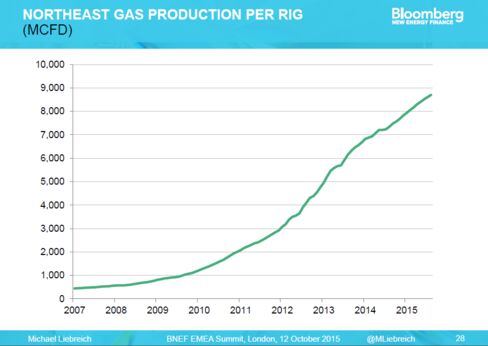

“There has been an enormous amount of innovation in the unconventional gas industry,” he said. “The cost reductions have been similar to what’s happening in solar.”

Below is what he identified, as follows:

The cost of shale Gas is falling fast

… and each Oil and Gas well is producing more.

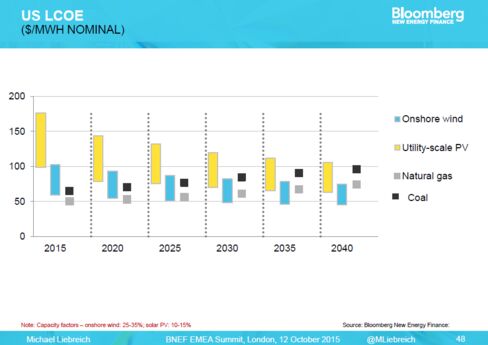

Renewables costs are falling to the level of fossil fuels (Crude Oil and Nat Gas)

The chart above shows forecasts for the cost of building and operating a new power plant in each technology. Rising costs for running a Coal plant and falling solar panel prices mean photovoltaics may rival fossil fuels on price within 10 years, according to Bloomberg New Energy Finance.

Renewables will grab market share everywhere

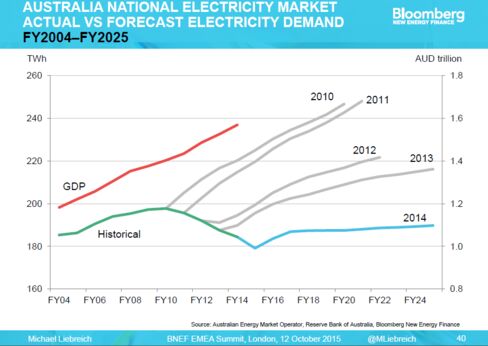

Electricity demand is flat, falling short of forecasts

All those LED light bulbs are starting to have an impact.

Energy-efficient technologies of all kinds are squeezing electricity demand. The chart above shows Australia’s experience. Actual power consumption is shown by the green line. The gray lines show demand forecasts made each year since Y 2010 by regulators, and the blue line represents their most recent forecast.

Together, the trends may hit Coal hardest, as curbs on pollution drive up the cost of burning the dirtiest fossil fuel.

“There’s plentiful supply and weak demand,” Mr. Liebreich said. “The price of Coal is on a gentle glide path toward the shutting of large amounts of capacity.”

As I have said for the past year, Crude Oil is headed to its 1998 low of 18-22 bbl and Nat Gas headed to 1.50 a pay unit.

| HeffX-LTN Analysis For OIL: | Overall | Short | Intermediate | Long |

| Neutral (0.04) | Neutral (0.22) | Bullish (0.25) | Bearish (-0.33) |

| HeffX-LTN Analysis for USO: | Overall | Short | Intermediate | Long |

| Neutral (-0.07) | Neutral (0.19) | Neutral (-0.21) | Neutral (-0.18) |

| HeffX-LTN Analysis for UNG: | Overall | Short | Intermediate | Long |

| Bearish (-0.43) | Bearish (-0.31) | Very Bearish (-0.51) | Bearish (-0.46) |

Stay tuned…

HeffX-LTN

Paul Ebeling

The post Cheap Crude Oil & Nat Gas Not Going Away In ‘The Age of Plenty” appeared first on Live Trading News.