Premier Xi jumps in with more verbal support

It was a heady start to the trading week for Chinese equities, with the China50 index powering ahead to the biggest one-day gain since 2016. Today’s move brings the two-day advance from Friday, triggered by a three-pronged verbal commitment by Chinese officials from regulators and the central bank to support non-state linked companies, to more than 8.2%.

At the weekend, Chinese President Xi Jinping added his voice to the verbal support, saying in a letter to private entrepreneurs that the government would offer “unwavering support” for the country’s private sector, while the country’s exchanges committed to help manage share-pledge issues. Earlier this morning PBOC advisor Ma Jun said he expects policy measures to support the market.

The index has risen to test the 100-day moving average at 11,484 for the first time since October 3 while the September 28 high of 11,925 is likely to act as the next resistance point. The daily stochastics momentum indicator is still showing a bullish signal.

China50 Daily Chart

Outside of China, the sentiment is not quite so buoyant. The Japan225 index is just 0.71% higher while the US30 index added just 0.1% and the NAS100 index gained 0.42%. Hong Kong stocks were closest to China gains, with an advance of 2.67%.

Aussie dollar underperforms

The Aussie dollar was the worst performer in the G-10 space versus the US dollar, as a weekend by-election meant the Liberal government lost a seat and thereby its governing majority, now holding 74 out of the 150 seats.

AUD/USD slid as low as 0.7087, the lowest in eleven days, before consolidating above the 0.71 handle. Previous lows near 0.7040 still offer some technical support.

AUD/USD Daily Chart

Earlier this morning RBA Deputy Governor Debelle said he had an open mind on what constitutes full employment. His remarks come after data last week showed the unemployment rate falling to 5.0%, a 6-1/2 year low and a rate that many viewed as the full employment rate. Last week, Debelle had said that that it is possible the country’s jobless rate would have to fall further than on previous occasions before wage growth would increase at a faster pace.

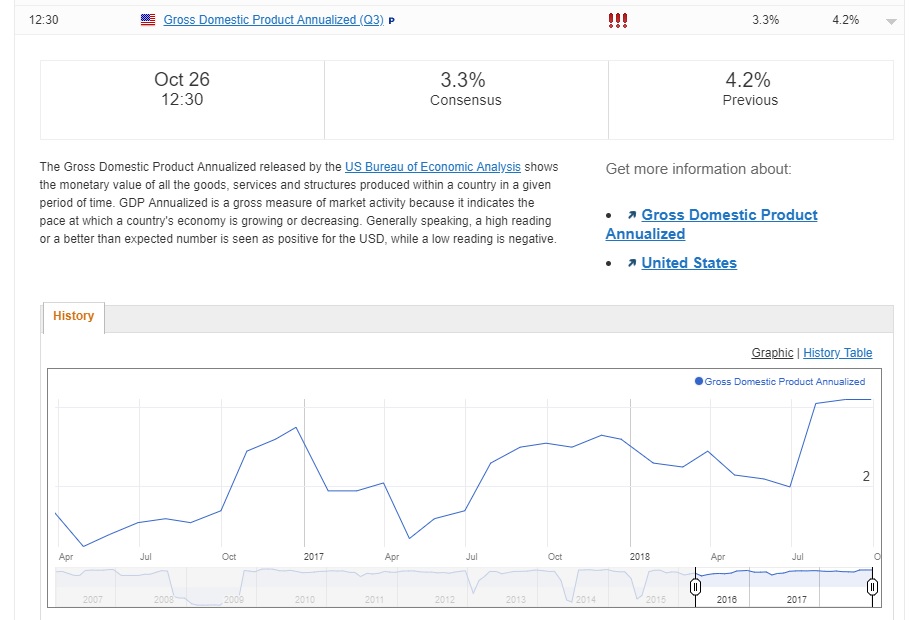

A slow start to US GDP week

There’s not much to excite on the data front today, with US Chicago Fed activity index for September the only release of note. We also see Canada’s August wholesale sales. Things remain quiet until Wednesday when we see Markit flash PMIs for Germany, the Eurozone and the US. Wednesday also sees the Bank of Canada’s rate decision, where economists are evenly split whether we will get a rate hike or not. The ECB rate decision follows on Thursday but the main event is left until Friday, with the release of US Q3 GDP numbers, which are expected to slow to 3.3% y/y from Q2’s 4.2%. At 3.3%, this would still be the highest growth since Q3 2016.

US GDP Growth Historical Snapshot

You can view the full MarketPulse data calendar at https://www.marketpulse.com/economic-events/