China increases liquidity

China’s central bank announced on Sunday a 50bps reduction of reserve ratio requirements for some banks effective July 5, according to its website update. This is the third reduction this year and suggests a liquidity boost of about 700b yuan (approximately $108b) for the local banking system. The central bank says it targets to support small and micro enterprises and to further promote its debt-to-equity swap program. The move had been widely expected, since Chinese authorities announced last Wednesday that it would “comprehensively use all kinds of monetary policy tools” to help the economy, especially given the risk of a protracted trade war.

No rest for the weary

Despite the announcement of the liquidity boost, Asian shares struggled to benefit with the cloud of escalating trade wars hanging over markets. Latest developments suggest US President Trump plans to bar many Chinese companies from investing in US technology firms and block additional technology exports to China. And it’s not just China, Trump threatened to impose a 20% tariff on Friday on all imports of EU-assembled cars, tweeting “build them here!” A senior European Commission official said on Saturday that the European Union will respond to any US move to raise tariffs on cars made in the bloc. Tit-for-tat exchanges appear not just confined to China.

Did OPEC do enough?

The 2018 OPEC meeting in Vienna concluded Saturday with a commitment to increase production, though the fines details were left noticeably vague. The general thrust is that overall production will revert to 2016 levels, before cuts were put in place to reduce a global inventory glut. That has now almost been eroded, though the increase in production level is not expected to start replenishing those stocks, merely to bring the demand/supply equation more into equilibrium. No official production targets were allocated to each producing nation, rather a more “fluid” approach to additional production was introduced, more likely because not all producers have the capacity to crank up the pumps so easily. Indeed, it is suggested that only Saudi Arabia, United Arab Emirates, Kuwait and Russia have access to immediate spare capacity.

Technical resistance caps for now

Comments and calculations suggest the actual increase could be between 600k to one million barrels per day. This may have been lower than some expectations and would explain the surge in oil prices late on Friday, with WTI closing more than 5% higher on the day. Today’s Asia session saw oil give back some of the gains amid profit-taking and re-analysis of the true impact of higher production. WTI (WTICOUSD) currently trading 0.83% lower at 68.772. The 61.8% Fibonacci retracement of the drop from May 22 to June 18 sits at 69.324

Sparse data calendar

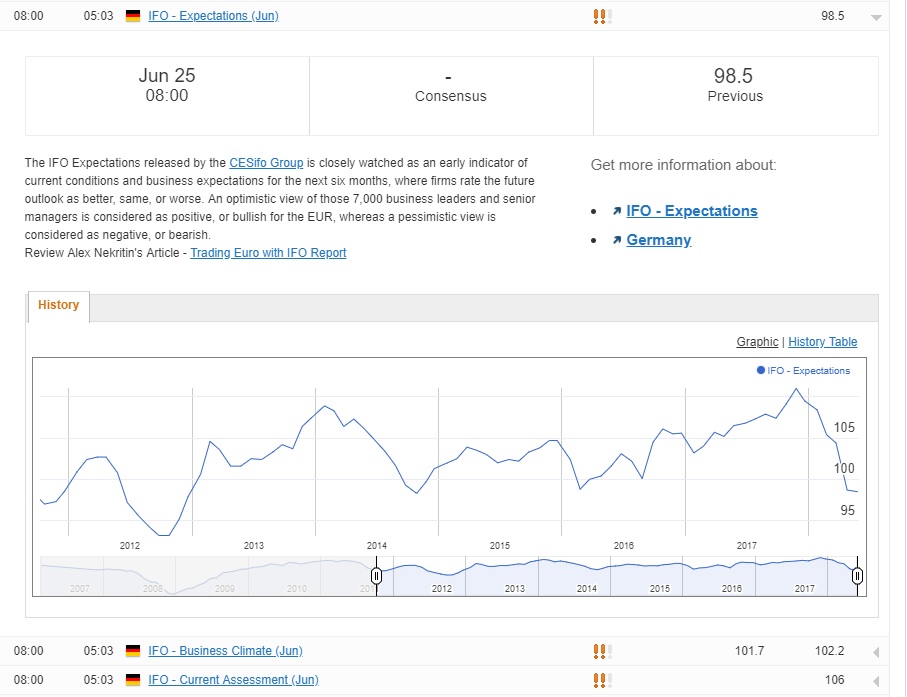

It is a slow start to the week on the data deck. Today’s highlight could be the German IFO surveys for June. The expectations index has been sliding since November last year with the May reading at 98.5. Another weak number the EUR may find it a challenge to cling on to gains made after Friday’s PMI numbers. The US calendar features May’s Chicago Fed activity index and new home sales.