Cross-border Riches Beget Cross-border Problems

The world’s rich are now facing a number of headwinds that include succession and inheritance issues, higher taxes, and a potential slowdown in the global economy, according to the latest edition of Knight Frank LLP’s 2016 Wealth Report.

“One of the most interesting findings is that a significant proportion of respondents, leading wealth advisors and private bankers from around the world,expect their clients’ wealth to increase at a slower rate over the next 10 years than the past decade,” the report said.

Almost 6,000 people fell out of the ultra-high-net worth group last year, a 3% decline from the year before and the 1st annual drop in the world’s population of rich people since the Y 2008 financial crisis, according to Knight Frank.

The world’s wealthy have invested in foreign countries as never before, a move that has contributes to cross-border flows but also appears to have exposed the rich more to a potential slowdown in the global economy, as well as to cross-border crackdowns on wealth.

Some 67% of respondents to Knight Frank’s survey said they expect their clients’ rate of wealth growth to slow over the next decade, while 84% of respondents in Oceania-Asia believe that an economic slowdown is on its way.

That is not surprising, the report noted, given that “much of the wealth creation in the region has been powered by China’s economic growth, which is now slowing.”

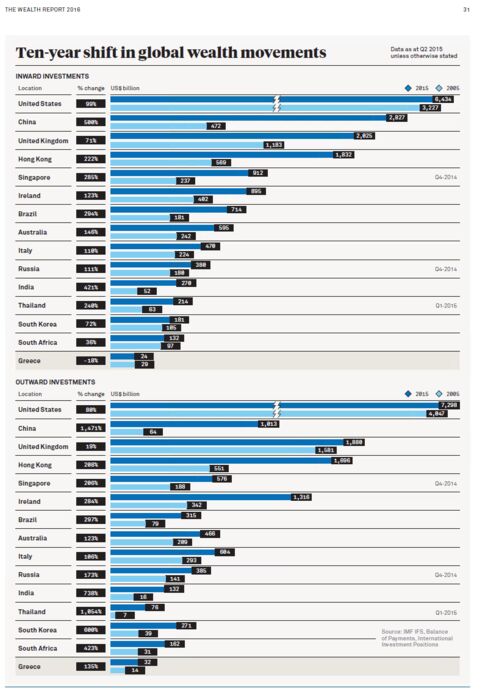

China’s outward investment in other countries has jumped a massive 1,013% over the last 10 years, according to Knight Frank analysis based on data from the International Monetary Fund (IMF).

That, alongside the liberalization of some emerging markets, has helped propel the boom in cross-border investment by the world’s wealthy.

“The impact of domestic economic growth and wealth creation, and in some cases more liberal credit controls, has seen rapid growth in outflows from markets such as Indonesia, Thailand and South Korea,” the report said. “Economic instability in markets such as Italy and Greece has led to relatively strong outbound investment flows in a European context–with 106 percent and 135 percent growth respectively–over the past decade.”

Knight Frank attributed much of the rise in cross-border investment to the increased popularity of buying properties in foreign countries.

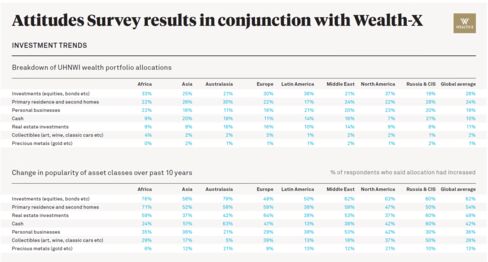

The firm’s data back up this claim, noting a 49% increase in the number of survey respondents that said their clients’ allocation to property had increased over the past 10 years.

Only allocations to such things as stocks, bonds, and homes that were not bought purely for investment purposes, experienced larger gains in popularity during that time.

Have a terrific week.

Paul Ebeling

HeffX-LTM

The post Cross-border Riches Beget Cross-border Problems appeared first on Live Trading News.