Daily Markets Broadcast

2019-02-01

Wall Street extends rally on trade hopes

While there was no concrete deal announced, the mood coming out of the two-day US-China was positive, with US President Trump announcing he will meet with China Xi “in the near future” to finalise details.

US30USD Weekly Chart

-

January saw the US30 index post the biggest monthly gain since Oanda records began in 2003. A dovish Fed and hopes for progress in the US-China trade talks continue to support

-

The index looks poised for a weekly close above the 55-week moving average at 24,950 for the first time since the week of November 26

-

The US payroll report is due today and an add of 165k jobs is expected, lower than December’s 312k. Unemployment is expected to hold at 3.9%. The ISM manufacturing PMI is also due, with forecasts of a dip to 54.2 in January from 54.3 the previous month.

DE30EUR Daily Chart

-

It was a volatile session for the Germany30 index yesterday before closing slightly in the red. Despite the weaker close, the index recorded its first monthly advance in six months in January

-

The index remains confined between 100-day moving average resistance at 11,388 and 55-day moving average support at 11,026

-

Euro-zone consumer prices are expected to rise 1.4% y/y in January, according to the forecasts for today’s preliminary reading. That’s a slower pace than December’s +1.6%.

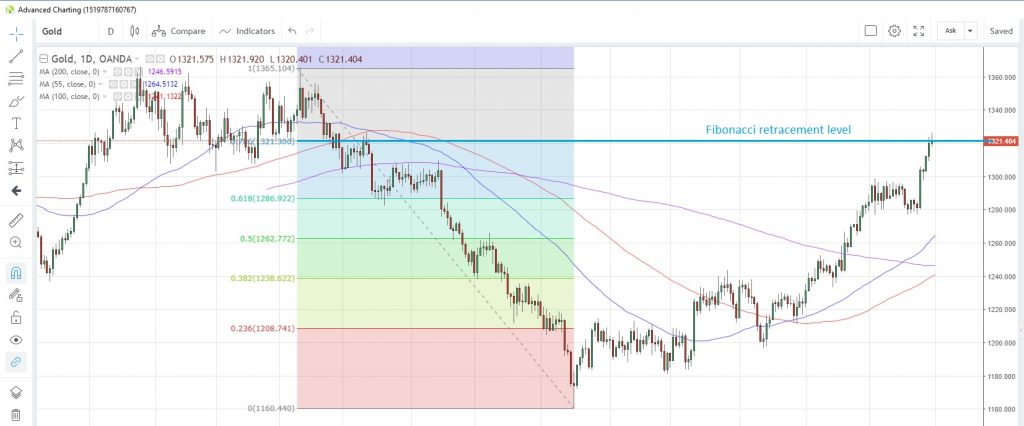

XAUUSD Daily Chart

-

Gold advanced versus the US dollar for the fourth consecutive month in January, bringing total gains from the October low to more than 12%. The metal touched the highest since April 26 yesterday

-

Gold is straddling the 78.6% Fibonacci retracement level of the April to August drop at 1,321.30

-

Gold spent most of January attempting to break above the psychological 1,300 level, which eventually fell on January 25. The metal is looking to consolidate and extend this move amid a broadly bearish outlook for the US dollar.