It’s been a bright start to trading in Europe, with UK retail sales brushing off any early side effects of Brexit to post strong July gains, while US futures look relatively flat ahead of the open.

The third quarter of the year got off to a good start for the UK consumer, with Brexit appearing to support the retail sector rather than hinder it in the immediate aftermath of the vote. While I don’t expect Brexit to continue to be a blessing for retailers in the months ahead, it would appear the depreciation of the pound is certainly giving them a lift for now, with tourists taking advantage of the weaker currency to buy jewellery and watches.

OANDA MP – UK Retail Sales and ECB Key (Video)

While this may continue, I would expect domestic spending to dry up a little if unemployment starts to creep up as the Bank of England anticipates and the economy falls into or comes close to recession. Still, the boost to consumer spending is welcome, especially for the UK which is so heavily dependent on consumer spending.

The full retail sales report can be found here.

The pound responded brightly to the data, trading up around 1% on the day to trade at near two week highs against the dollar. The pair has responded well after coming within touching distance of the post-Brexit lows on Tuesday, only for the Fed’s John Williams to deliver a blow to the US dollar with his comments on the need to raise the inflation target in order to adapt to the current environment.

Source – OANDA fxTrade Platform

The FOMC minutes on Wednesday highlighted the clear divide among policy makers on Wednesday, between those that believed a hike was near and those that wanted more data, making a September rise all the more unlikely. While the markets didn’t believe this would happen anyway, they had just about priced in a hike in December prior to the release, which has now once again been pushed back to March next year and weighed on the dollar further.

U.K. Retail Sales Surge as Hot Weather, Pound Drop Fuel Spending

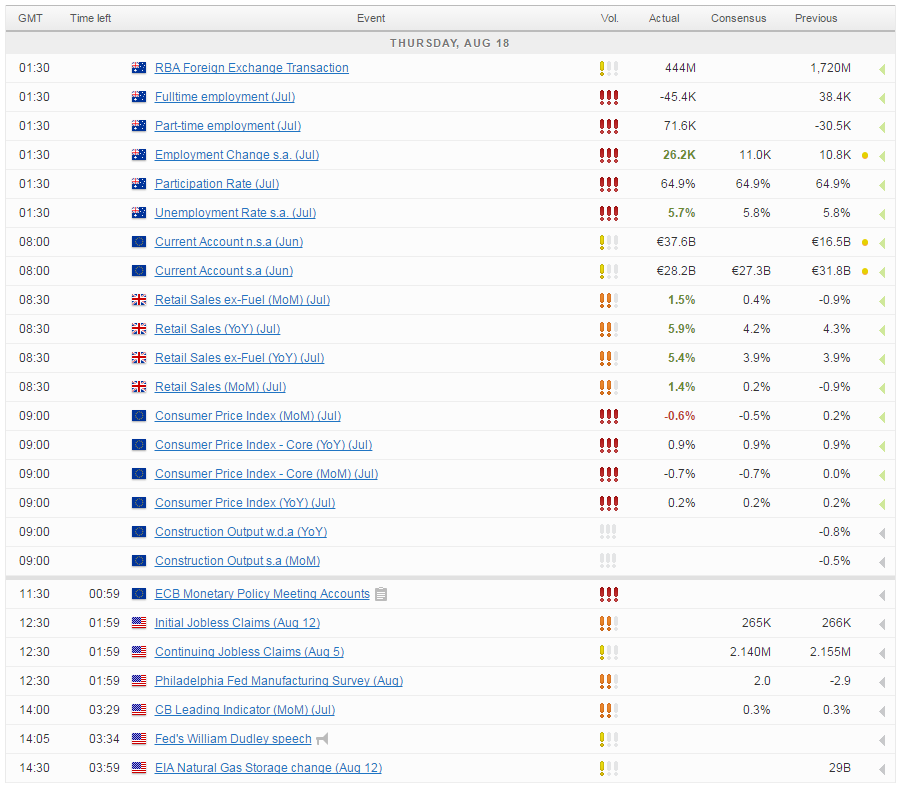

With both John Williams and William Dudley due to speak today, as well as Robert Kaplan – another non-voter – we can expect the dollar to remain quite volatile throughout the session. There’s also a number of US economic data releases including jobless claims, the Philly Fed manufacturing index and the CB leading indicator, which should ensure it’s another lively session.

For a look at all of today’s economic events, check out our economic calendar.