Mixed economic data has depreciated the USD awaiting NFP

Employment has been the strongest pillar of the U.S. economy but at near full employment it has been hard for the U.S. Federal Reserve to justify a rate hike on jobs data alone. The U.S. non farm payrolls (NFP) report will be published by U.S. Bureau of Labor Statistics on Friday, September 2 at 8:30 am EDT. After two consecutive 200,000 plus job gains the forecast is calling for a 170,000 to 190,000 new positions added in August.

A strong report will keep the September rate hike on the table, but a disappointing addition of jobs could complicate the possibility of higher rates ahead of the U.S. presidential elections in November. The September Federal Open Market Committee (FOMC) could be too close for comfort for U.S. policy makers as there is little urgency in raising rates in a global low rate environment.

The words by U.S. Federal Reserve Chair Janet Yellen at Jackson Hole have once again made the NFP report the biggest indicator and could decide the future of the September rate hike. Central banks have struggled when communicating with investors. Forward guidance is a thing of the past and now monetary policymakers have abused rhetoric leaving a markets confused and diluted the power of verbal intervention. The U.S. central bank’s credibility will be under threat if the job market delivers job gains and higher wages only for the Fed to fail to hike in September after the majority of Fed member comments.

The EUR/USD gained 0.406 percent in the last 24 hours and is trading at 1.1199. The single currency has appreciated versus the USD after the disappointing Institute for Supply Management manufacturing survey. U.S. manufacturing contracted for the first time in six months in August. The ISM index dropped to 49.4 just below the 50 mark that is considered expansion. The indicator sapped strength for the USD that was riding high after the words out of Jackson Hole that pointed to a possible September rate hike if the economy kept growing at a steady pace. The slowdown in American factories was evenly distributed with 11 out of 18 industries showing a contraction.

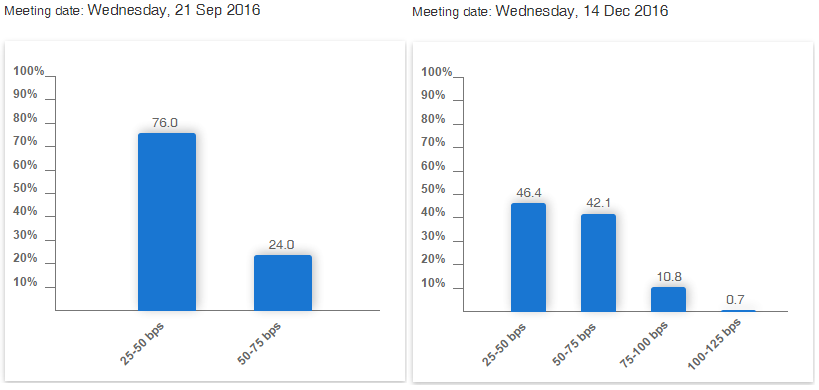

Market participants are pricing in a 24 percent chance of a rate hike in September as per the CME’s FedWatch tool. The December FOMC meeting has a higher probability as investors find it more likely the Fed will avoid interfering with the presidential elections and once again hike once at the end of the year.

Economists and analysts are divided on how much a strong or weak jobs report could determine the fate of the anticipated rate hike from the Fed. Allianz’s Mohamed El-Erian sees an 60 percent chance of a rate hike that could go up to 80 percent if there is a strong NFP report. The Fed has let robust job gains pass without change in the past, but a solid report plus the emphasis on the Fed of economic data making a case for a rate hike could finally result in action for the central bank.

The Fed has tinkered with the timing of a rate hike based on macro economic conditions more than on domestic ones. In the last two FOMC statements the central bank has said risks have diminished and while the domestic picture is mixed it has focused on the positive which is mostly job gains. Inflation and consumer demand are still weak and the data dependant Fed is likely to hit the snooze button on rates even if the NFP impresses, but CPI and retail sales disappoint next week.

Market events to watch this week:

Friday, September 2

4:30am GBP Construction PMI

8:30am CAD Trade Balance

8:30am USD Average Hourly Earnings m/m

8:30am USD Non-Farm Employment Change

8:30am USD Unemployment Rate

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar