Will ECB Follow Fed in Signalling Tightening?

European markets are trading slightly in the red on Thursday, while US futures are relatively flat ahead of the open, as we await the ECB monetary policy decision.

The ECB announcement follows the Federal Reserve’s decision on Wednesday to raise interest rates and signal that two more will follow this year in a slightly hawkish shift from the last meeting. While four rate hikes this year won’t come as a major surprise to anyone, it was an interesting shift from the central bank given its hesitance to do so previously and the global concerns over a trade war.

EUR/USD – Euro Edges Higher Ahead of ECB Meeting

While the Fed has shown a willingness to tolerate above target inflation, the uptick we have continued to see has clearly been a key influence in its decision to signal a fourth hike this year. There will naturally be some concern among investors about the potential negative impacts that tightening too fast will have which may have contributed to the slight decline we’ve seen in equities but generally, they do appear comfortable with them.

The ECB on the other hand is likely to be far more cautious in its approach to tightening monetary policy. This has been evident by its insistence that the winding down of quantitative easing is not tapering, clearly an attempt to disassociate itself with the taper tantrum the Fed experienced when it was going through the same process.

Today we should get some insight into the ECBs plans for when the current purchases expire in September. While I don’t expect the central bank to commit to anything yet – be it an short extension and reduction or anything else – they may hint at discussions that have been had and the options that are on the table. Naturally, there’ll be plenty of questions in the press conference after on its plans beyond QE but I expect President Mario Draghi to keep his cards relatively close to his chest.

Given the political situation in Europe right now, most notably Italy, and the prospect of a trade war with the US, the ECB will want to be extremely careful with exiting QE and laying the groundwork for a potential rate hike next year. Especially as growth remains modest and inflation well below target.

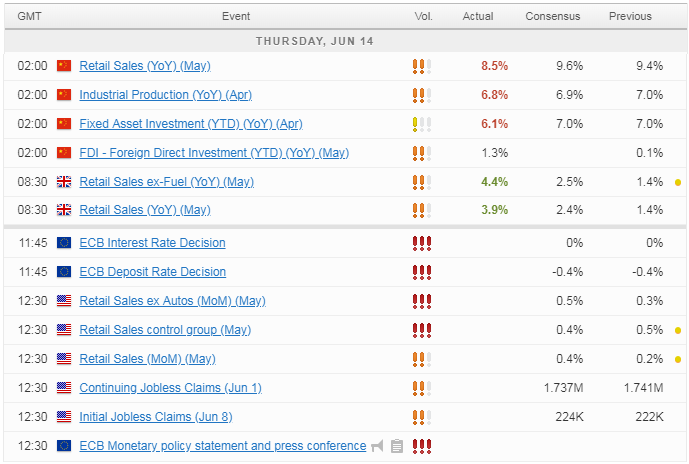

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.