US equity markets are expected to open slightly higher again on Wednesday, boosted by expectations that the Fed will once again have to wait before raising rates following mediocre jobs and poor ISM PMI reports in recent days.

Markets never have been convinced about a rate hike this year but these reports have once again tipped the balance back in favour of a March 2017 move, rather than December, while September is only 15% priced in.

Source – CME Group FedWatch Tool

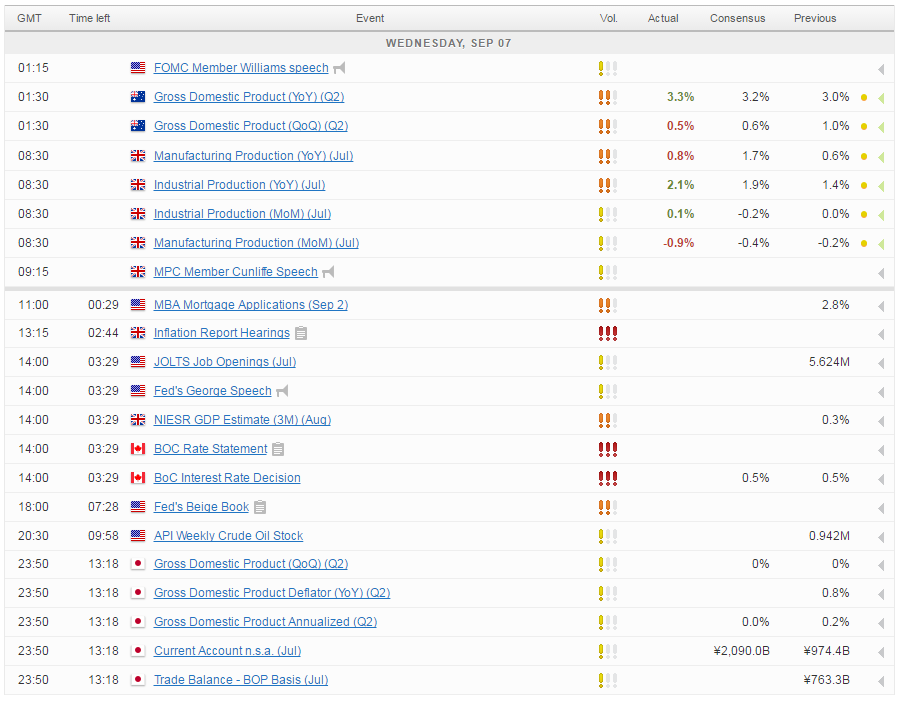

John Williams – who favours a new targeting mechanism for the central bank – commented yesterday that gradual rate increases should continue sooner rather than later, clearly undeterred by the underwhelming labour market numbers on Friday. It will be interesting to see whether these views are shared by his colleagues, Esther George and Dennis Lockhart, when they appear before the House Financial Services Committee today. Although it may take more to convince investors that a hike this year remains the base case scenario.

Is the Fed a ‘No Go’ after Service Activity drop?

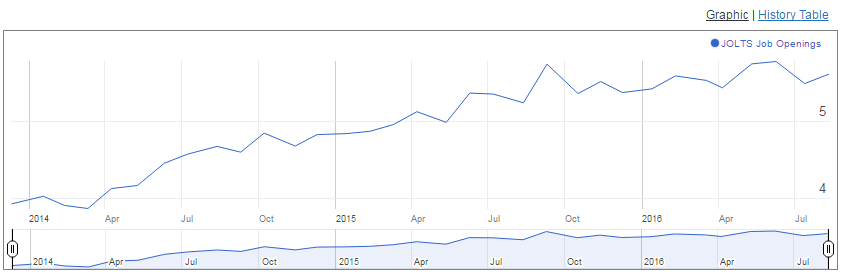

In the meantime, we’ll get some more labour market data from the US, with JOLTS job openings being released for July. The number of openings has stabilised over the last year but there’s nothing to suggest that we’re about to experience a slowdown in job creation. As long as we remain at these levels, it will be enough to convince the Fed that unemployment will continue to edge lower and competition lead to sustainable wage growth.

The other focus today is the UK, where we’ll hear from Bank of England Governor Mark Carney in his appearance before the Treasury Select Committee. The inflation report hearing is often an uncomfortable occasion for Carney but today is likely to be a gruelling affair due to his position prior to the Brexit vote and the central bank’s policy response in the aftermath of the event. The BoE’s independence has repeatedly been called into question by Brexit campaigners, unsurprising considering he was of many warning about the economic risks of voting to leave the EU, and now he must face some of those that have been most forthcoming in their criticism of him and his leadership.

The fact that the UK economy has bounced back following the initial shock is something Brexit campaigners within the committee are going to be keen to point out. They are also likely to question the reasoning behind the decision to announce substantial stimulus measures despite the economy showing signs of resilience in the aftermath of the vote, suggesting either implicitly or explicitly that the move was made to cover its own back, rather than being in the best interests of the economy.

USD/JPY – Yen Soars After Weak US Services Report

Carney will be well prepared for such questions and will likely point to a number of data points that were available at the meeting to suggest that the economy had suffered immediate stress while also driving home the need for a proactive response to what it believes is a highly likely slowdown in the medium term. He’s likely to stress that the short term rebound is unlikely to last and more accommodation was necessary to protect the economy going forward, thereby standing by the BoEs pre-Brexit warnings. It will be interesting to see whether the BoE stands by the probable need for more stimulus this year in the face of such a backlash from the Select Committee. This is primarily what the markets will be focused on, especially as the pound has rebounded in line with the improvements to the economic data, on the belief that further stimulus this year won’t be necessary.

For a look at all of today’s economic events, check out our economic calendar.