Sterling plunges after initial post-data gains

The start of the European session has been dominated by data releases from the UK and euro area, with investors also keeping a close eye on trade developments involving the US, not to mention Brexit.

It’s been another volatile day for the British pound, which rose in the immediate aftermath of a decent jobs report for the UK before plunging despite there not being a clear trigger to warrant such a move. The jobs report itself paints a much better picture of the UK economy than many people generally have, with unemployment standing at 4% – the lowest since March 1975 – and wage growth nearing its highest levels since the financial crisis.

While these levels are still well below what we were seeing prior to a decade ago, they’re certainly supportive of the Bank of England’s policy of gradually raising interest rates when taken in isolation and the jump in earnings further aids this which is why we saw a bump in sterling. The flip side of this is the one-off factors that are likely contributing to the gains, rather than them being entirely organic and a result of a tight and competitive labour market, not the mention the uncertainty and risk with regards to the outlook.

Commodities Weekly: Gold short bets at highest in 17 years

The plunge in the pound shortly after has got people more interested though as there doesn’t appear to have been much of a trigger, despite the currency slipping from close to 1.31 against the dollar to briefly below 1.30. It has since stabilised somewhere in the middle which suggests there may be something to the move even if the initial drop may have been overdone. If no news surfaces, it will be interesting to see whether the pound regains the lost ground over the course of the rest of the session.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

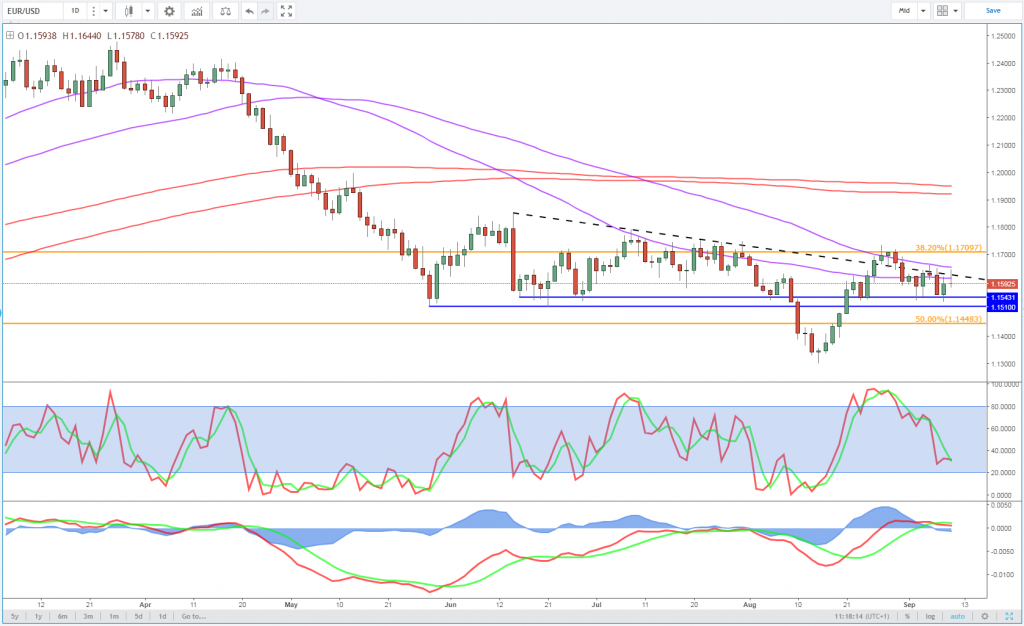

EUR edges lower despite better sentiment surveys

The euro has also been in gradual decline over the course of the morning in Europe. An improved and better than expected ZEW economic sentiment survey for the eurozone and Germany appears to have done little to halt the decline, which is potentially due to the fact that it continues to languish around multi-year lows despite this minor reprieve. The US engaging in a trade spat with the region and using its auto industry as the pressure point is not doing much to help confidence at a time when it already appears to be experiencing a slight slowdown.

EURUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Brexit, US/China tariffs and US/EU negotiations remain in focus

Trade continues to be at the forefront of people’s minds at the minute, be that the risk of a trade war between the world’s two largest economies, potential deals between the US and EU as negotiations get underway or the future relationship of two allies after Brexit. The EU has stolen much of the focus this week, with Michel Barnier yesterday talking up the prospect of a deal on the UK’s exit from the EU in the next six to eight weeks which would avoid a damaging no deal Brexit scenario.

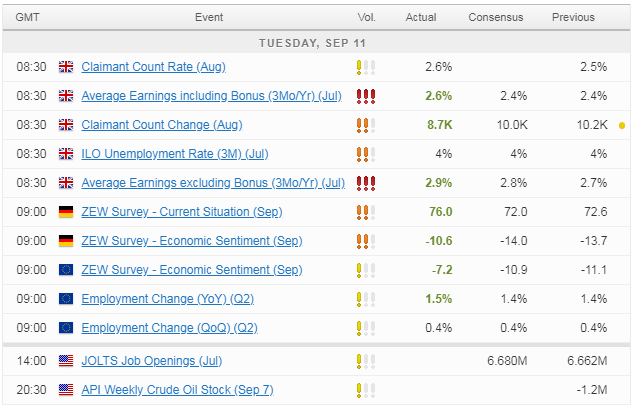

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.