The sell-off in GBPUSD (cable) has been losing momentum for a couple of months now, with the pair having stalled around 1.30 despite one attempt to break below a couple of weeks ago, something that now looks like a false breakout.

The move has coincided with a general improvement in sentiment towards the greenback, with the already hot US economy getting an additional fiscal boost from tax reforms, leading to an increase in expectations for rate hikes in the near to medium term.

GBPUSD Weekly Chart

It has also coincided with a slowdown in other countries which has forced their respective central banks to take a more gradual approach to tightening plans, with the Bank of England being one of those to have adopted such an softening in stance.

The dollar has also benefited from its renewed safe haven appeal, with US Treasuries being favoured in trade-related risk averse environments thanks in part to the higher yield that is now on offer.

DAX trading sideways as eurozone inflation within expectations

This pair is not short of potential catalysts this week, with the BoE meeting on Thursday – or Super Thursday as it has now become known – being at the very top of these (Fed rate decision Wednesday and US jobs report on Friday also clearly stand out).

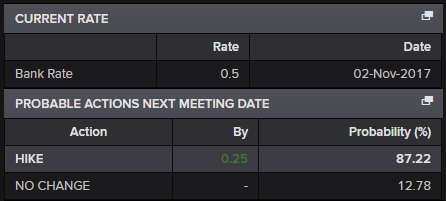

The UK central bank is widely expected to raise interest rates by 25 basis points at the meeting – 87% priced in – the second post-financial crisis rate hike but the first time rates will be above 0.5% which for some time was seen as the lowest they could reasonably go.

BoE Interest Rate Probability

Source – Thomson Reuters Eikon

While the decision to raise interest rates has been met with confusion and even criticism, due to the economy very much not firing on all cylinders and Brexit talks now at a crunch point and likely to be much clearer in only a few months, policy makers have done nothing to correct markets interpretation of events which if anything makes investors even more confident that it will happen.

This comes after policy makers backtracked on a rate hike in May due to the first quarter slow down, despite being confident at the time that it was largely weather related, something recent data has gone some way to confirming.

BoJ new script supports the carry-trade

This determination to raise rates may be one of the things supporting the pound recently but if a hike is so priced in, has sterling peaked? I’m not sure. For one, any progress in Brexit negotiations should be good for the pound. The same applies to the economy, with both providing comfort to the central bank. Something it can’t have much of right now given the sheer amount of uncertainty.

GBPUSD Daily

From a purely technical perspective, the sell-off appears to have potentially run its course. The pair has found support around a notable technical support level – 50 fib from lows to highs, previous support and resistance and a big round number just to complete the hatrick.

What’s more, upon reaching here, momentum had already started to decline and has continued to do so, with the MACD and stochastic making higher lows even as price made lower ones. This divergence, while not being a buy signal, is a sign that all may not be as bearish as it was and that there may be some profit taking or even buying creaping back in (remember, if this is a corrective move, then the recent weakness should prove only temporary and bulls become increasingly interested once again).

The pair may be flat on the day after US inflation, income and spending figures brought some life back to the dollar, but should it find some upward momentum again and break back above 1.32 – and the falling channel – it could be a bullish signal in the near-term.