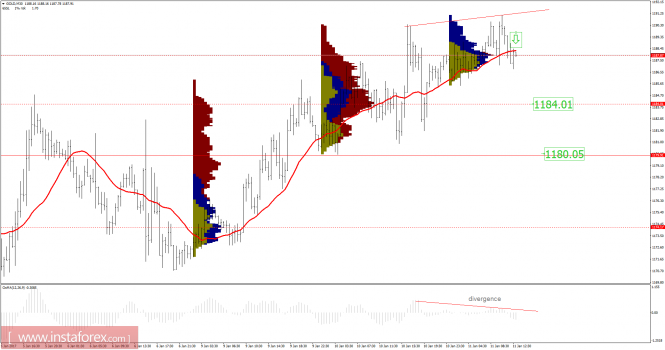

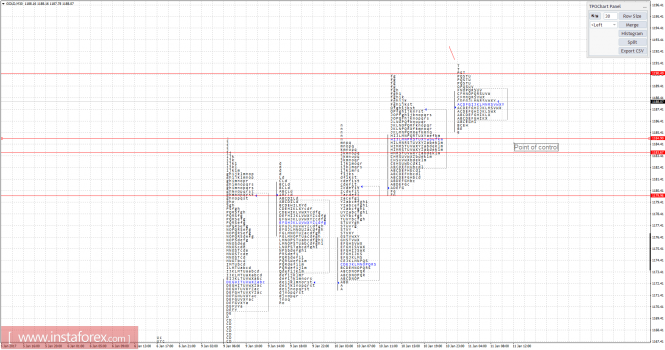

Recently, gold has been trading upwards. The price tested the level of $1,191.10 in an average volume. According to the 30M time frame, I found a fake breakout of yesterday’s high, which is a sign of weakness. There is also a divergence in the Moving Average Oscilator. The price made a higher high and the oscilator made a lower high. My advice is to watch for potential selling opportunities. The downward target is set at the price of $1,184.50. Using the TPO Chart, I found yesterday’s point of control at the price of $1,184.00. Anyway, if the price breaks the level of $1,191.10 in a high volume, we may see potential testing of $1,195.00

Resistance levels:

R1: 1,187.65

R2: 1,189.00

R3: 1,191.75

Support levels:

S1: 1,182.60

S2: 1,181.00

S3: 1,178.50

Trading recommendations for today: Watch for potential selling opportunities.

The material has been provided by InstaForex Company – www.instaforex.com

The post Gold analysis for January 11, 2017 appeared first on forex-analytics.press.