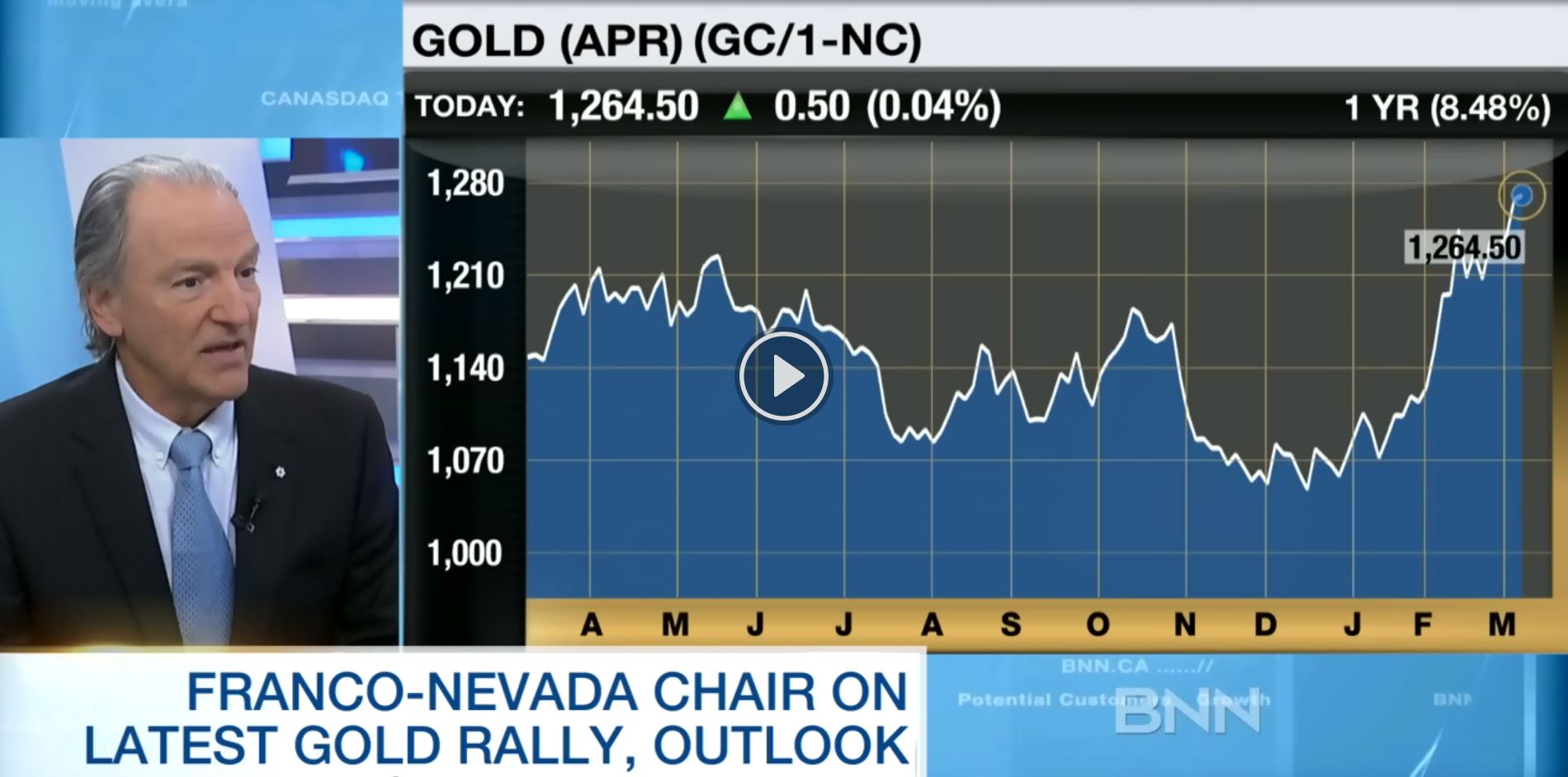

The gold bull market has returned and gold could surge over 1,000% to $8,000 per ounce in the coming years according to legendary gold investor, Chairman of Franco-Nevada Corporation and former Chairman of the World Gold Council, Pierre Lassonde.

Gold prices are heading higher, much higher and he is “very sure” that the five-year bear market for gold is over and we are at the beginning of a new bull market, the gold insider told leading Canadian business channel, BNN.

The primary reason for his very bullish outlook for gold is negative interest rates and the $7 trillion in bonds that now have negative yields:

“One of the big knocks on gold is that you have to pay to hold it,” Lassonde said. “Now even bonds have a negative carry.”

He also believes that the Dow Gold ratio suggests much higher gold prices:

During strong gold bull markets, the price of gold often hits a one-to-one ratio with the Dow Jones industrial average, says the chairman of Franco-Nevada Mining and former president of Newmont Mining.

That means gold could surge to US$8,000 an ounce or even higher, he says.

“In 1980 gold was at US$800 and the Dow was at 800; in 1934 gold was US$36 and the Dow was at 37 – where is the Dow today?” he asks BNN’s Catherine Murray. “Do I know it’s going to go back to 1:1 – I don’t know… even if it gets to 2:1, that’s US$8,000.

Lassonde says with understated humour that he is “slightly optimistic.”

The interview with Catherine Murray can be watched on BNN here.

LBMA Gold Prices

09 Mar: USD 1,258.25, EUR 1,146.69 and GBP 884.16 per ounce

08 Mar: USD 1,274.10, EUR 1,155.69 and GBP 894.35 per ounce

07 Mar: USD 1,267.60, EUR 1,156.96 and GBP 896.13 per ounce

04 Mar: USD 1,271.50, EUR 1,158.67 and GBP 898.93 per ounce

03 Mar: USD 1,241.95, EUR 1,141.48 and GBP 882.24 per ounce

Gold News and Commentary

Gold’s Best Start Since 1974 Shows It’s Not Just Inflation Hedge – Bloomberg

Gold’s Rally Belies Confidence in Global Stocks Rebound – Bloomberg

Gold slips as euro dips ahead of likely ECB easing – Reuters

Gold ETF Holdings Rise For Record 40 Straight Days – Bloomberg

Chinese exports plunge 25% in February – BBC

Video: Gold’s “Medium Term Outlook” Remains Positive – Bloomberg

“Battling” A Technically-Overbought Gold Market – Dollar Collapse

Exclusive: U.S. watchdog to probe Fed’s lax oversight of Wall Street – Reuters

These “X Factors” Could Send Silver Prices Soaring in 2016 – Profit Confidential

The Big Beneficiary of Negative Rates: Gold – WSJ

Read More Here

‘7 Real Risks To Your Gold Ownership’ – New Must Read Gold Guide Here

Please share our website with friends, family and colleagues who you think may benefit from it.

Thank you

Запись Gold Could Surge To $8,000/oz On Negative Interest Rates – Lassonde впервые появилась crude-oil.top.