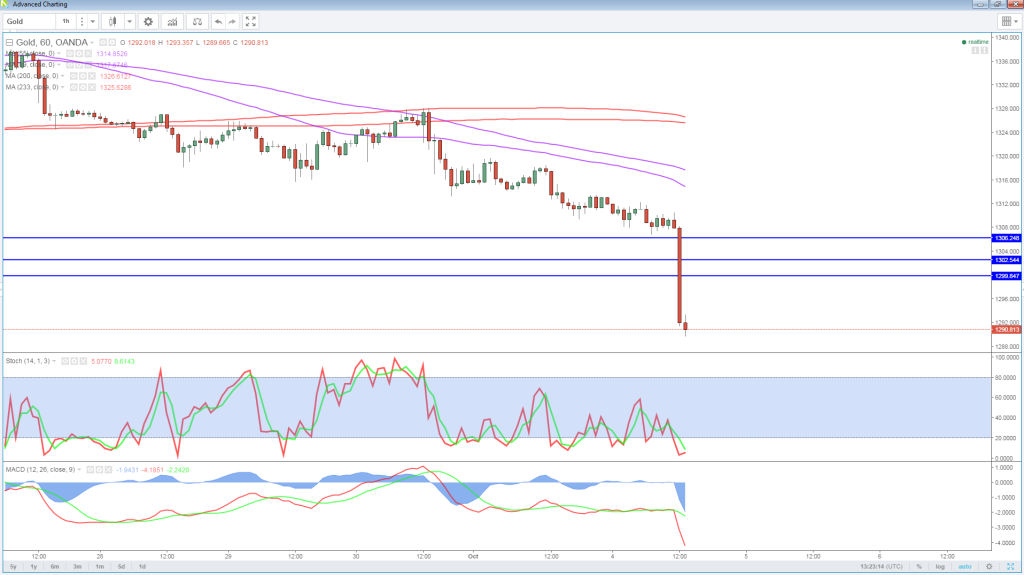

We’ve seen a big move in Gold in the early stages of the US trading day following what was previously a relatively quiet session in Asia and Europe.

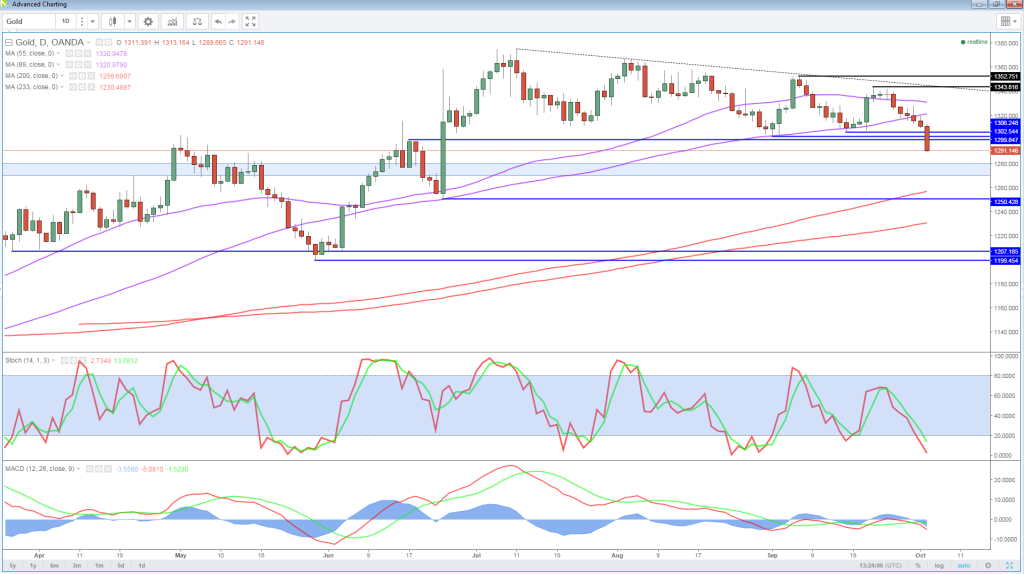

The initial trigger for the sell-off isn’t clear at this stage but it’s likely that the move through $1,300, an important technical support level, triggered a number of stops which quickly intensified the move lower.

It has since found support around $1,290 and how it behaves in the coming hours could offer important insight into whether we’re dealing with a false breakout or something much more bearish.

A legitimate breakout could prompt a move back towards $1,250, the next major level of support and a level that has been notable support and resistance in the past.

Sterling Hits New 31 Year Low on Hammond Comments

It may find support along the way around $1,270-1,280 having done so on a number of occasions over the last few years, but having not been key on recent tests, this could just be temporary.

A daily close back above $1,300 today may suggest we’re looking at a false breakout, at which point $1,330 to the upside could be key. The lack of buying action since the breakout would suggest this is unlikely, the 4-hour and 1-hour charts still look very bearish following the break.

Not only could it find resistance here from the descending trend line but the top of the moving average bands (55 and 89) could provide additional resistance having provided support over the last six months.