Submitted by Soren K via MarketSlant.com,

Government subsidized technology is developed and Musk cashed in. Then cashed out. Then left stock holders holding the bag. It's like the Simpsons monorail episode…

In light of Tesla's earnings miss and Musk's admission of the firm's cash crunch just a month after Tesla announced it would bail out its weaker cousin, Solar City, We ask you: how can a visionary such as he not see 30 days down the road?

Here is a repost from our observations just 3 weeks ago on the likelihood of fraud at Tesla and Musk's other companies.

Summary

Businesses cannot stand on their own feet without some form of Government aid. Whether that be in QE form or direct subisidies, the marketplace is no longer a "Free Market". Tesla and its dependents are an example of what is wrong with our capital market system.

Elon Musk is using the Government as a backstop for his businesses. He is depending on easy money to support companies that would otherwise fail from debt. In short, the business structure of Tesla, SolarCity and SpaceX is a microcosm of the problem with our current capital markets.

– By Soren K. with contributions by Doug and Dinsdale Piranha and the CFO of a prominent hedge fund that has no position in the stock.

The Business of Crony Capitalism

Overview

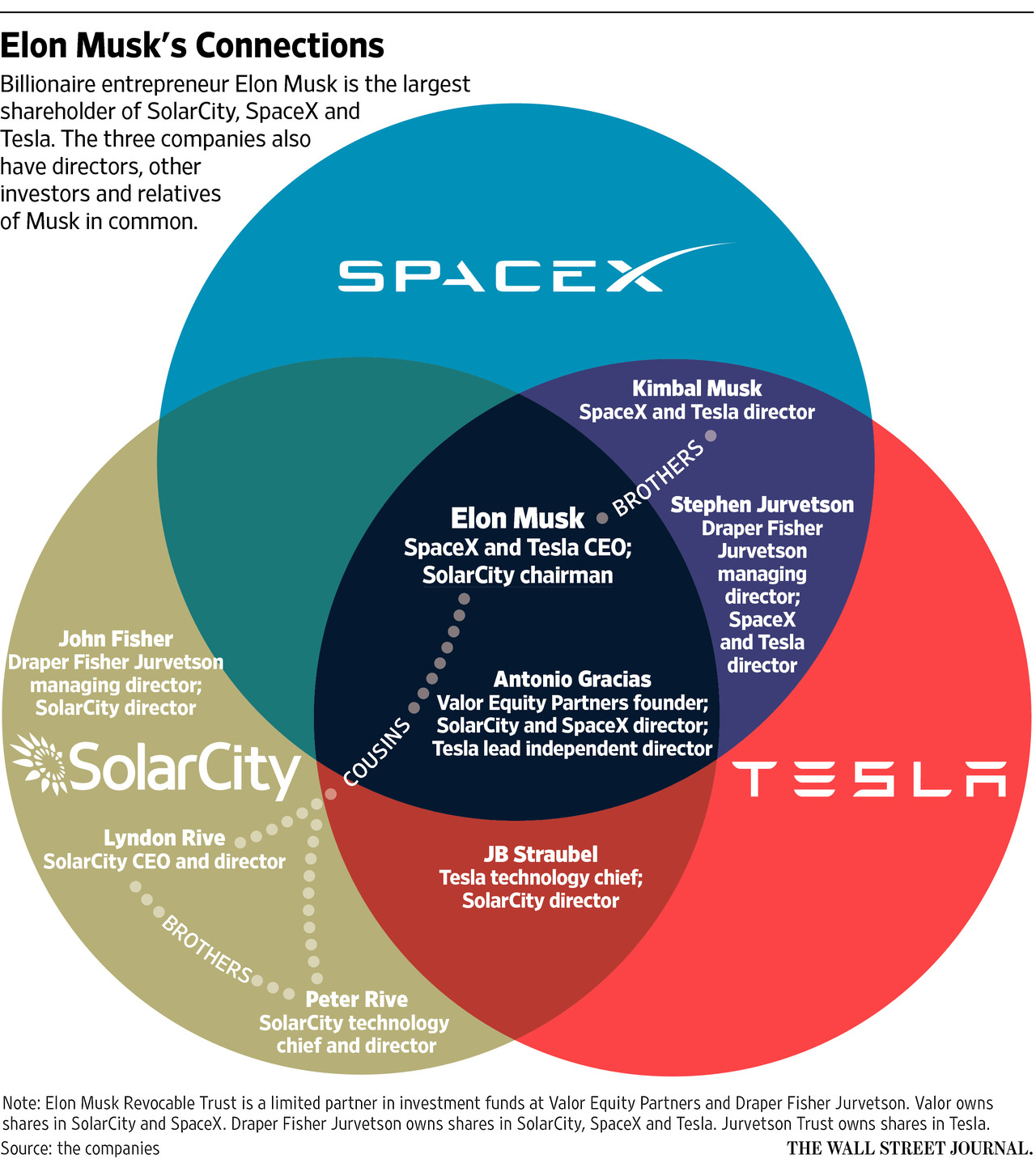

Elon Musk has controlling stakes in 3 companies: Tesla, SolarCity, and SpaceX. Tesla and SolarCity are publicly traded. SpaceX is not publicly traded. This document's focus will be soley on the financial interdependencies of the companies. There are also incestuous business practices, and nepotism within the leadership of each company Musk controls.

We hope to illustrate simply and clearly the immense risk the US government has taken with your money by giving it to a man who is essentially telling them what they want to hear while picking their pockets doing it.

Background

Tesla borrowed Venture Capital (VC) money from Elon Musk at VC rates. It borrowed VC money from taxpayers at non-VC rates

Tesla needed $500MM to get started in 2008. The US Government lent $465MM to Tesla at 3% interest under its push for Green Energy. Elon Musk lent the company $38MM at10% interest plus stock options. Here are the profits on those loans:

- Elon Musk’s $38MM generates profit of $1.4BB, or 3,600% ROR- a VC payout

- Taxpayers’ $465MM- generates profits of $12MM or 2.6%ROR- not a VC Payout

Taxpayers took VC risk without VC returns. The table is set for Elon to arbitrage the Government’s largesse much more. All in, the US Government committed about $4.9BB to finance Tesla’s operations

Musk Gets More Government Money

Using Government loans, Elon Musk creates 2 more companies; SolarCity and SpaceX. He now controls three government sponsored clean energy companies financed by taxpayer money.

The Companies

Tesla– makes electrical cars, develops technology for same. Loses money hoping for future profits

- Loans money to SolarCity via its own stock

- Borrowed $465MM from Gov’t at 3% and $38MM from Elon Musk at 10% plus stock options

- Does not make money

SolarCity– makes and leases solar panels to homeowners. Loses money hoping for a back-end profit

- Borrows money from Tesla

- Borrows Money from SpaceX

- Does not make money

SpaceX– will provide future service related to satellite launches. It makes money via prepaying customers

- Loans money to SolarCity at approx. 10%

- Borrows Money from Government at approx. 4%

- Makes money

Elon Musk now has 2 companies that do not make money. He has 1 that makes money from prepayments for services yet to be given. All are financed by the US taxpayer at ridiculously below market rates. The table is now set for financing using inflated currency (sound familiar?) in the form of Tesla stock to get real cash in Mr. Musk's pockets.

The SolarCity Problem

Despite gov’t subsidies SolarCity still needs money to operate. SpaceX, while not profitable, has cash on hand form prepayments and Gov’t subsidies. Tesla, also not profitable, has no cash, but has highly (over)valued stock it can use as currency or loans for cash. Elon Musk owns major stakes in all 3 companies.

- SolarCity borrows $165MM from SpaceX at market rates of about 4.4%

- SpaceX uses govt loans (2.0%?) to lend $165MM SolarCity

- SolarCity borrows another $90MM from SpaceX to avoid defaulting on first SpaceX loan

Yet SolarCity is still in trouble. It needs cash. Government subsidies are on hold. Its stock price is sinking and it is in danger of defaulting on existing loans. Enter Tesla and Elon Musk

Tesla and Musk Bail Out SolarCity

Elon Musk and Tesla loan stock to SolarCity. SolarCity margins that stock for cash so they can make their loan payments to SpaceX.

- Elon Musk used money loaned to him at 2.6% to generate 3,600% from Tesla stock sales

- SolarCity was failing. If It failed, it likely would take SpaceX with it.

- Elon Musk and Tesla used his govt sponsored inflated currency (Tesla stock) to prop up a failing SolarCity.

Not Enough

But that was not enough money. Tesla then makes a bid outright to buy all of SolarCity at above market valuations using Tesla stock. This essentially ensures a payout to himself and his partners at SolarCity while eliminating the SpaceX debt. Now it all depends on the price of Tesla stock. And Tesla has been punished by the market since the announcement.

Finally there is the loaned stock by Elon Musk to SolarCity. If Tesla drops enough for amargin call, it is all over in our opinion. what we have not covered includes the valuation offerred to buy SolarCity. Public shareholders of Tesla should be incensed atthe price being paid for SolarCity. Meanwhile, much of SolarCity's stock is still in the hands of Musk and family members.

If Tesla stock drops enough, it could take out potentially all 3 companies. Essentialy Musk is at the center of an American Keiretsu.

Conclusion

The interdependent relationships between the 3 government subsidized companies Elon Musk owns or has a controlling stake in are an abuse ofgovernment largesse towards Green Energy. Taxpayer money is being used at market risk without market returns to prop up 3 unprofitable companies. While we do not debate the technology Tesla has developed, we question the leverage with which these companies are able to operate under. If something were to go wrong, we feel an eventual Solyndra Greenmail situation would occur. Tesla would be TBTF to the Government and have to pay. We feel Elon Musk knows this and is will play that card if need be.

Not Discussed: Business practices, Neoptism, valuations used for buyouts and other in depth proofs of what we are merely glossing over for now.

In a Graph

Here is a simple flowchart of the cash-flow situation between the 3 companies and the Goverment. None of these companies make money. Only SpaceX has positive cash flow from prepaid "orders". The "currency" that supports it all is the Tesla's stock Price

The post How Elon Musk Used A Broken Marketplace To Play Us All appeared first on crude-oil.top.