A missed opportunity for Donald Trump at last night’s final Presidential debate may well be supporting US futures ahead of the open on Thursday, while European markets are currently treading water ahead of the ECB monetary policy decision and press conference.

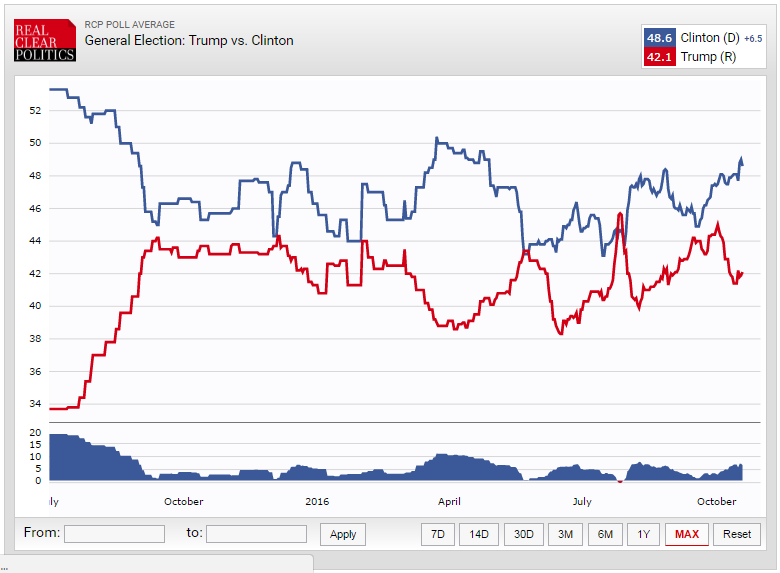

Trump headed into the final debate trailing Clinton in a number of polls and needing to outperform the Democratic Nominee in order to get his campaign back on track, with less than three weeks to go until the vote. The response in the markets most sensitive to a Trump victory, most notably the Mexican Peso, suggests Trump failed to close the gap last night and US futures may also reflect this sentiment. A Trump victory is widely seen as being a negative catalyst for equity markets, at least in the near term.

Source – Real Clear Politics Poll Average

Attention will now shift temporarily to the Frankfurt, where the ECB is due to announce its latest monetary policy decision and hold its press conference. The ECB is currently facing issues with its quantitative easing program as the current structure of it means the pool of German debt available for purchase is fast running out.

Market Focus on Commodity Currencies

Mario Draghi indicated at the last meeting that the central bank is looking at solutions to this, which would possibly involve changing the composition of debt it must purchase, the yields it can accept or the type of debt it can target, among many other things. As it stands, the QE program is scheduled to run until March, at which point a solution will have to be found or the ECB may be forced to begin tapering its QE program, an outcome that would be extremely undesirable for the markets and potentially damaging to the eurozone recovery. Any hint that this may happen today could spark a run on euro area debt and a strong rally in the euro. German yields have already started rising, possibly in anticipation that German bonds will be purchased on a smaller scale.

Source – Thomson Reuters Eikon Terminal – German, French, Spanish and Italian 10-Year Yields

A solution to the issue, and therefore any change in monetary policy, is widely expected to not come today which should make the press conference that much more eventful. Draghi is likely to be pressed strongly on the subject but is unlikely to want to give too much away until a solution has been found. Should we get a 6-9 month extension of the QE program today, we could see some euro weakness and an easing of the recent upward pressure on bond yields, but this may be limited by the widely held view that it was likely at some point in the coming months.

Mexican Peso Posts Huge Rally As 3rd Presidential Debate Ends.

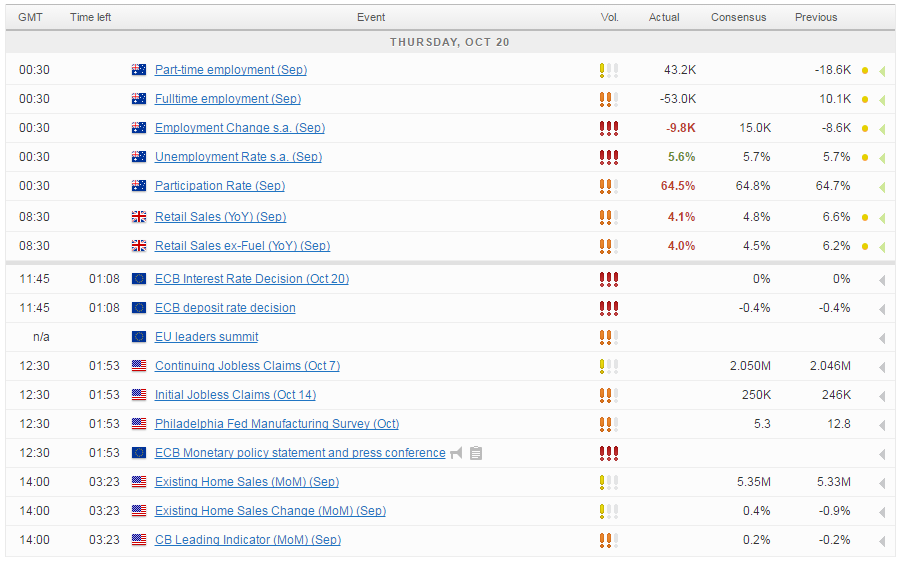

Also to come today we’ll get a number of US economic data releases, including jobless claims, Philly Fed manufacturing index, existing home sales and CB leading indicator. Earnings season also continues with 27 S&P 500 companies reporting today. It’s been a solid earnings season so far, helped by reduced expectations heading into it, but there is hope that the US has escaped its earnings recession in the third quarter.

For a look at all of today’s economic events, check out our economic calendar.