Investors unconvinced by promises to trim Italian deficit

It’s been a slightly more positive start to trading on Wednesday as investors welcome reports that the Italian government will seek to reduce the deficit over the next few years.

This follows a week in which the populist coalition government has embarked on a collision course with Brussels over its spending plans, as both parties attempt to stand by election pledges on spending and tax cuts while staying within the euros budget rules and not spreading panic among investors. After it was initially reported that the budget deficit would be 2.4% next year, investors bolted for the exits as this both exceeded expectations and was likely to be very problematic.

News that this will be reduced over the following years with the aim of falling to 2% by 2021 has come as a mild relief – enough for the FTSE MIB to pare some losses and Italian yields to drop slightly – but it’s still higher than investors are clearly comfortable with. It has raised serious questions over the assumptions that have coincided with the projections, whether the targets are achievable and how the government would respond if the deficit doesn’t shrink as they expect.

DAX under pressure over Italy budget

Eurosceptic coalition on collision course with Brussels

This leaves the Italian government on a collision course with Brussels, something I have no doubt they will relish given the eurosceptic views they hold and the opportunity it presents to cast them as unelected and unaccountable dictators seeking to prevent them following the will of the voters. The constant claims about how much better off Italy could be outside the euro – with yesterday’s claims on its own currency solving most problems being the latest – are clearly an attempt to sway public opinion and the budget presents an ideal opportunity to continue these efforts.

In the near-term, concerns about Italy are primarily related to spending and the impact on its already bloated debts but in the longer-term, they also reflect the very real risk that the public could become more eurosceptic and talk of referendums could follow. For now, this is likely to be some time away and the fragility of the Italian banking sector and still large holdings of Italian bonds make investors very nervous.

May takes to the podium as Brexit talks stall

In the UK, all eyes will be on the Tory annual conference where Prime Minister Theresa May is due to speak. With Brexit negotiations at a standstill as both sides are seemingly unable to agree on a solution to the North Irish border and support for May’s Chequers plan hanging by a thread, people are looking for some much needed clarity on how things will proceed, although they may have to instead settle for more generic optimistic rhetoric and hope for no repeat of last year’s quite shambolic performance.

The pound has been extremely sensitive to any Brexit developments, no matter how significant, so we could see plenty of volatility during today’s speech. There have been reports that May is preparing a compromise on the border issue, in an attempt to get talks moving again, but I struggle to see where May will generate support on this from so it may have the same lifespan as the numerous other failed proposals.

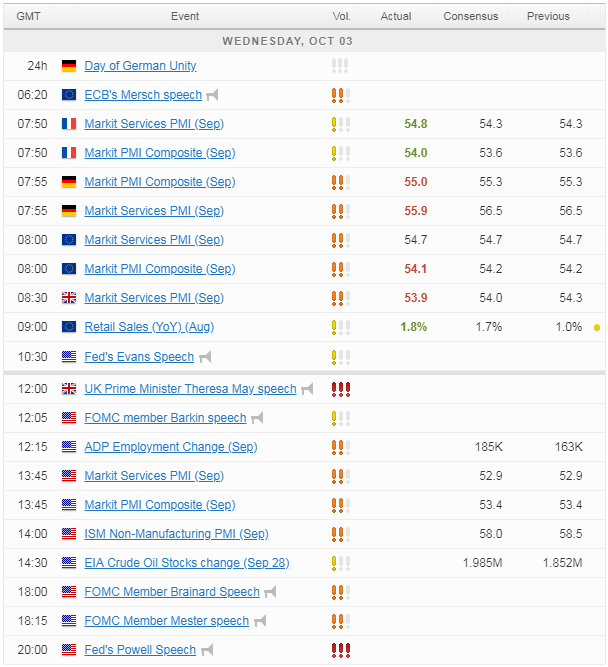

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.