Submitted by David Stockman via Contra Corner blog,

You have to wonder whether there are any carbon units left in the casino. The robo traders and HFTs, of course, have an attention span of 10 milliseconds. So their utter lack of concern about context, fundamentals and history is readily explainable. They never get around to it.

But somebody besides the machines is getting paid the big bucks on Wall Street. Do they really think that dancing on a live volcano, as the estimable Ambrose Evans-Pritchard put it recently, is not semi-suicidal?

Yet for the last 18 months that is exactly what they have been doing. The S&P 500 closed today exactly where it first crossed in November 2014. In the interim, it’s been a roller-coaster of rips, dips, spills and thrills.

The thing is, however, this extended period of sideways churning has not materialized under a constant economic backdrop; it does not reflect a mere steady-state of dare-doing at the gaming tables.

Actually, earnings have been falling sharply and macroeconomic headwinds have been intensifying dramatically. So the level of risk in the financial system has been rocketing higher even as the stock averages have oscillated around the flat-line.

Thus, GAAP earnings of the S&P 500 in November 2014 were $106 per share on an LTM basis compared to $86.44 today. So earnings are down by 18.5%, meaning that the broad market PE multiple has escalated from an already sporty 19.3X back then to an outlandish 23.7X today.

And the latter is by no means reflective of an expected stick save turnaround in earnings. Analysts have been furiously marking down their estimates for Q1 for weeks now. At the latest reading profits are projected to fall by 10%, marking the fifth straight quarter of decline.

Always and everywhere, such persistent profit collapses have signaled recession just around the corner. And there are plenty of macro-economic data points signaling just that.

For instance, total US business sales have fallen by 5.1% since mid-2014—-even as inventories have soared. This means that while Wall Street speculators have been dancing on the edge of the volcano for 18 months, the US economy’s tepid rebound has been petering out.

Indeed, there has never been an inventory ratio surge of the magnitude shown in the chart below—-from 1.29X to 1.40X in 18 months—- that did not signal a recession dead ahead.

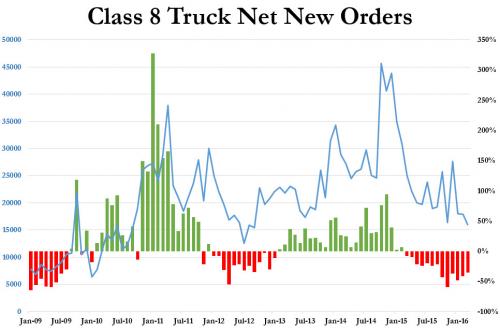

During the stock market’s most recent dead-cat bounce, the signals that the US economy is drifting into a downturn have only grown more frequent and intense. For instance, class 8 truck orders—-a classic leading indicator—–are now plunging. At the same time, inventories haven’t been this high since early 2007.

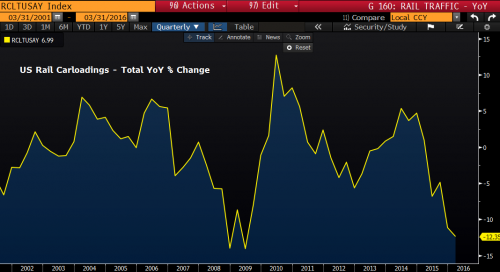

Likewise, rail car loadings were down 13.7% year-to-date compared to 2015. As is evident in the chart below, the plunge in shipments is now approaching the depths of 2008-2009. Perhaps that is why some market technicians are fretting about the non-confirmation of the rally by the transports.

Then there is the latest reading on GDP by the unusually accurate running gauge published by the Atlanta Fed. As of this morning, there isn’t any. Q1 GDP is now forecast to come in at stall speed or just 0.1%. Not even the Chinese can measure things that finely!

In light of these fundamentally negative trends it might be wondered why in the world every attempt at correction in the casino gets short-circuited in another dead-cat bounce. Presumably, the remaining carbon units would recognize the danger at some point, thereby precipitating a sell-off that would eventually trigger a spasm of liquidation by the machines.

Needless to say, the latter will happen. It’s only a matter of time and the right catalyst.

But in the interim, there can be no doubt as to what explains the stock market’s treacherous dance on the crater’s edge. To wit, honest price discovery in the financial markets was destroyed by heavy-handed central bank intrusion long ago. So what remains is simply episodic spasms of stock buying in response to open mouth actions emanating from the Eccles Building.

In that context, Janet Yellen’s risible proclamations and recurrent bouts of incoherence play a major role. She let loose of a patented barrage of Keynesian jabberwocky at the Fed heads soirée yesterday.

In fact, her response to a question about whether the Fed is stimulating a dangerous bubble was so unattached from reality that it deserves to be quoted in full. If there were a modicum of honesty left in the casino they would be stampeding for the exists on the basis of this gem alone:

So I would say the US economy has made tremendous progress in recovering from the damage from the financial crisis. Uh, slowly but surely the labor market is healing. Um, for well over a year we’ve averaged about 225,000 jobs a month. The unemployment rate now stands at 5%.

So, we’re coming close to our assigned congressional goal of maximum employment. Um, inflation which, um, my colleagues here Paul and Allen um, spent much of their time as chair um, bringing inflation down from unacceptably high levels. For a number of years now inflation has been running under our 2% goal and we’re focused on moving it up to 2%. Um, but we think that it’s partly transitory influences, namely declining oil prices, and uh, the strong dollar that are responsible for pulling inflation below the 2% level we think is most desirable. So, I think we’re making progress there as well, and this is an economy on a solid course, um, not a bubble economy. Um, we tried carefully to look at evidence of potential financial instability that might be brewing and some of the hallmarks of that, clearly overvalued asset prices, high leverage, rising leverage, and rapid credit growth. We certainly don’t see those imbalances. And so although interest rates are low, and that is something that could encourage reach for yield behavior, I wouldn’t describe this as a bubble economy.”

With 102 million adult Americans not employed and only 48 million of them retirees and spouses, it is amazing that Yellen still has the audacity to cite the U-3 unemployment rate as indicative of anything meaningful about the state of the economy; and let alone to say that it is indicative of “tremendous progress” and that the US economy is now “close to our assigned congressional goal of maximum employment”.

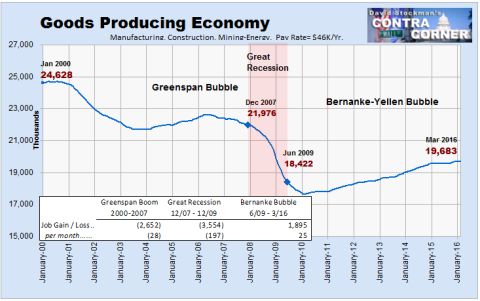

That’s just paint-by-the-numbers ritual incantation. If the Fed weren’t ensnared in a Keynesian time-warp the completely specious U-3 metric would never even be mentioned. What might be mentioned, instead, is that employment in the core sectors of productivity and wealth creation—–mining, energy, manufacturing and construction—-has been declining since the turn of the century.

Nor would they babble endlessly about inflation being possibly not what it seems and less than they want. It is self-evident that the price of goods is been repressed by massive excess capacity and cheap labor in the world market and that the Fed has no power or reason to fight it.

At the same time, the US economy has plenty of inflation—well more than 2% per annum—for items like shelter, health care, education and other services. These are the items which are eroding middle class living standards—-even as the ship of fools in the Eccles Building keeps gumming about undershooting their inflation target.

In fact, during the last 15 years, the CPI for durable goods has declined at a 1.0% annual rate. By contrast, the index for shelter rose by 2.6% annually, while medical costs increased by 3.8% per year and education prices by just under 6.0%. In today’s open world economy, the Fed’s capacity to guide the blended average consumer inflation rate precisely to 2.00% is somewhere between zero and none.

Or as Yellen said yesterday “for a number of years now inflation has been running under our 2% goal and we’re focused on moving it up to 2%.”

Please don’t!

Let’s see. US corporate debt as a percent of GDP is at an all-time high, and nearly one-third above where it stood on the eve of the Great Financial Crisis. This is not “rising leverage”?

And on the matter of reaching for yield, just exactly who has been buying trillions of corporate debt that now reflects the highest leverage ratios ever?

In fact, central bank interest rate repression has elicited a tsunami of corporate debt that will now come washing back to shore in a high tide of redemptions during the balance of this decade. To wit, in 2006 there was $4.6 trillion of US corporate bonds outstanding (IG and HY combined) compared to $8.2 trillion at present. Not only has the total soared by 77% during the last decade, but during the next five years $4.1 trillion of these bonds will mature.

In short, unless the Fed has miraculously outlawed the business cycle, a historically unprecedented level of maturing debt will rollover right into the next recession. And under conditions of swooning corporate sales and cash flow, a lot of the current HY portion of this $4 trillion mountain will carry a triple hook at the time, while a not inconsiderable portion of the marginally investment grade bonds (BBB) will tumble into the HY ratings categories.

Needless to say, refinancing this mountain of deteriorating debt in the midst of a cyclical downturn will bestow on the concept of “tightening credit conditions” a whole new definition.

So there is a colossal problem with corporate leverage. But when it comes to assessing financial risk, our Keynesian school marm is apparently blind as a bat.

Likewise, on the alleged absence of “high debt”, presumably total US credit outstanding at $62 trillion and counting isn’t it.

Why in the world is Yellen so complacent? The Great financial crisis was widely blamed on too much debt, but there has not been a wit of deleveraging in the US economy as a whole since then.

The aggregate US leverage ratio still stands at 3.4X or roughly two turns higher than its pre-1980 average of 1.5X. Stated differently, the US economy is now carrying an implied $35 trillion of extra debt compared to the historic norm that prevailed during the century prior to 1980. During that bygone era, the US economy grew on average at nearly twice the anemic 1.6% rate that has materialized since the turn of the century.

Yet Simple Janet sees no signs of excess or bubbles. For crying out loud, the $62 trillion of debt reported in the Fed’s own flow-of-funds data is the very embodiment of a debt bubble. And one that is as alien to the free market as are unicorns to the animal kingdom.

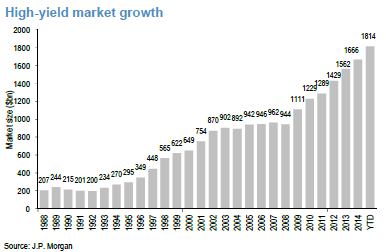

The evidence that Yellen is clueless or a blatant liar is endless. Junk bonds outstanding currently total $1.8 trillion and are nearly double where they stood on the eve of the 2008 meltdown. Is Yellen unaware that junk bonds are used almost entirely to fund speculations like LBOs, leveraged recaps, stock buybacks and ultra risky investments in cyclical industries like the oil and gas shale patch?

In short, the casino gamblers keep dancing on the edge of a live volcano in the belief that Yellen has their back. In fact, her statements this week prove once again that she is right there on the edge with them – jabbering incoherently.

One of these days, even the silicon units in the casino will take notice. The dancing will then turn into diving for the doors.

The post Janet’s Jabbering Leaves Investors “On The Edge Of A Live Volcano” appeared first on crude-oil.top.