May heads to Brussels as no deal preparations continue

Risk appetite appears to be gradually returning to markets following strong earnings-driven gains in the US overnight as attention now shifts to Brussels were Brexit talks will continue.

All eyes in Europe will be on the EU summit over the next couple of days as Theresa May heads to Brussels to try and break the impasse on the Northern Ireland border and the backstop arrangement. As the pressure has increased and the deadline neared, relations appear to have deteriorated rather than improved which has been worry but I still believe a deal will come, just not this month.

The EU has become renowned for its 11th hour deal making and I expect these negotiations to proceed in much the same way. For me, it’s the prospect of a deal not getting through parliament that represents the greatest risk rather than the leaders of the 28 deciding to suddenly abandon talks and shoot themselves in the foot in the process. We will hopefully be a lot clearer on the prospects of a deal by the end of the week.

Dollar in holding pattern; Asian equities follow Wall Street

Oil stable for now as Trump seeks to diffuse Saudi tensions

Oil prices appear to have stabilised a little in recent sessions after coming off their highs earlier in the month. Iranian sanctions have contributed strongly to the rise in oil prices in recent months but global growth concerns over the last week or two has clearly taken some of the heat out of the rally and at the very least, been the catalyst for some profit taking.

Brent Crude Daily Chart

OANDA fxTrade Advanced Charting Platform

The disappearance of journalist Jamal Khashoggi threatened to heighten tensions between the US and Saudi Arabia, which immediately drew attention back to oil as many saw it as being a potential weapon against US sanctions. But this was short-lived, with Trump clearly going out of his way to diffuse the situation rather than take his usual more combative approach, in a clear sign of his lack of appetite for a confrontation with Riyadh.

Asia market update: Focus on Yuan

Trump increasingly frustrated with the Fed

Trump once again weighed in on the central bank on Tuesday, claiming it is his biggest threat and that he’s not happy with what it’s doing as the inflation numbers are very low. Trump has repeatedly tried to pile pressure on the central bank to slow its rate hikes while claiming to respect its independence so the latest attack comes as no surprise.

And while the dollar has often softened in response to his comments, I don’t yet see them as a real risk to the central bank’s independence and we’re yet to see any evidence that it’s having any impact whatsoever on policy making. In fact, it’s simply another attempt by Trump to lay the groundwork for future finger pointing in the event that the economy falters, just as he did at the first sign of weakness last week.

The Fed minutes will likely highlight the Fed’s determination to plough on later on today, with the central bank having previously alluded to one more hike this year and a few more next. Given everything that’s happened since the meeting though, I wonder whether the minutes are already outdated and in fact, the comments we’ll get over the course of this week – including from Lael Brainard today – will be more relevant.

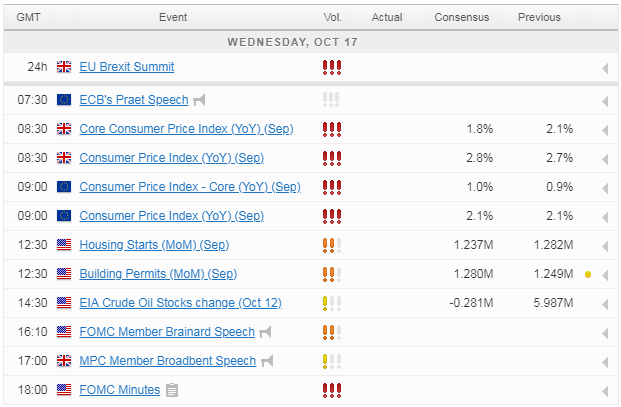

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.