It’s been a relatively quiet start to the week in the markets but traders will be closely tracking some key economic data releases on Tuesday, as well as moves in oil which has come off its lows since last week.

In what is one of the quieter weeks on the economic data side, oil has once again taken the spotlight after WTI crude dipped briefly below $40 a barrel last week for the first time in almost four months. Oil entered into a bear market at the end of last month and even now remains just under 20% below its highs from June as oversupply continues once again resurfaced.

Source – OANDA fxTrade Platform

It would appear that OPEC’s plan to continue to pump at record levels and let the market price out higher cost competitors in the US shale industry has backfired.

WTI/USD – Crude Climbs as OPEC Talks Freeze

While some have inevitably gone bust or been bought out, the industry as a whole appears to have adjusted at a much faster pace than expected and now we find ourselves in a position in which oil rigs are rising again and the output decline appears to have stabilized.

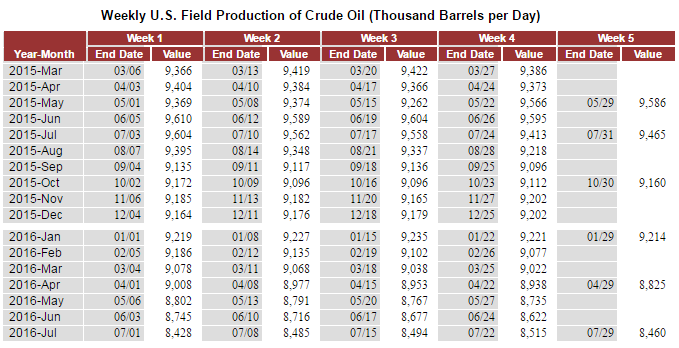

Source – EIA Weekly US Field Production of Crude Oil

Higher US production could be on the horizon and with other supply disruptions having been resolves, we appear to be headed for further supply driven declines.

Oil prices were supported yesterday by reports that OPEC plans to meet on the side-lines of the International Energy Forum in Algeria in September, on the possibility that an production freeze or cut could be agreed. Given how previous discussions have gone, this looks like a long shot at this stage but you never know, their previous tactic clearly hasn’t gone to plan. I can’t imagine more of the same will be well received by certain members. In what is an otherwise relatively quiet week, this story may remain at the forefront and even drive overall sentiment at times.

USD/CAD Canadian Dollar Lower Despite Oil Surge

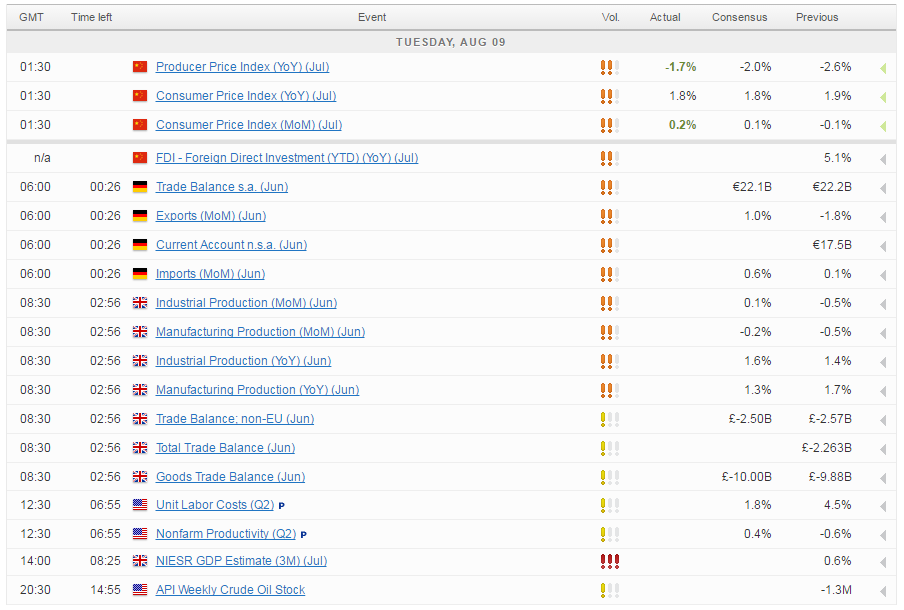

There is some economic data being released throughout the session today, with manufacturing and industrial production figures in the UK expected to point to further difficulties in the sector in June. This is concerning given that this would mean we’ve had two poor months of manufacturing data and these came in the month before and of Brexit. I imagine the data won’t get much better in the months following. Also to come this afternoon we’ll get non-farm productivity and unit labour costs data from the US.

For a look at all of today’s economic events, check out our economic calendar.