EUR Adds to Gains as ECB Mulls Over QE Exit

It’s been a relatively quiet start to trading on Thursday, with much of the focus falling on the UK as it prepares for more Brexit talks with the European Union. Stock markets are trading relatively mixed while US futures are pointing to a similar open on Wall Street.

The dollar is making further declines today even as yields on US bonds tick higher on a combination of safe haven unwinding and an expectation of higher interest rates. It’s also worth noting that the greenback has made strong gains over the last couple of months and the recent weakness is actually only a small corrective move in that rise.

US Dollar Index Daily Chart

Source – Thomson Reuters Eikon

The decline in the dollar has been strongly aided by a sudden hawkish shift in some comments coming out of the ECB though, which has in turn lifted the euro since the start of the month. While the central bank was always likely to adopt a more hawkish tone if it was planning to exit QE this year, people were starting to question whether this would in fact happen due to slowdown in inflation, growth and PMI surveys at the start of the year. This contributed to the drop off in the euro against the dollar, the only question now is whether the pair has bottomed for now.

Dollar softer ahead of G7 Summit

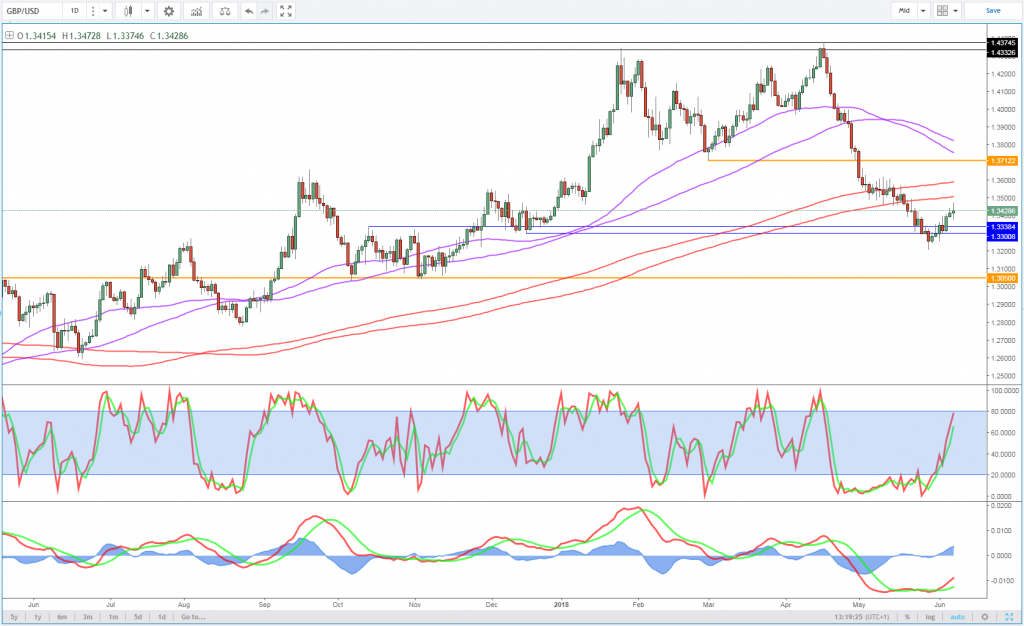

GBP Benefits From Weaker USD

The move in the greenback is also aiding other currencies, with the pound seeing decent gains on the day despite the lack of specific sterling positive news and as Brexit negotiations appear to have reached a very difficult point. Speculation has been growing that David Davis – Brexit Secretary – could resign in protest against Theresa May’s backstop plans, which would be a major blow to the Prime Minister and could risk triggering more if other Brexiteers are of similar views.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Still, that doesn’t appear to be weighing on the pound just yet and the gains in the currency is once again weighing on the FTSE 100 which is underperforming its peers in Europe. As negotiations progress, sterling traders may not be quite so forgiving to the constant splits on the Brexit “war cabinet” which is significantly hampering the process.

DAX Steady as Eurozone GDP Matches Expectations

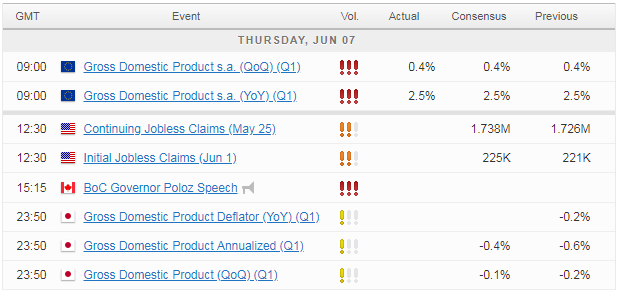

Jobless Claims and Central Bankers Today’s Notable Events

It’s going to be another relatively quiet session from an economic data standpoint, with the only notable release coming from the US in the form of weekly jobless claims, although it’s been some time since that’s been much of a market impacting release. We will also hear from Bank of Canada Governor Stephen Poloz and the Bank of England’s David Ramsden which may provide some comments of note.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.