Friday October 5: Five things the market is talking about

The granddaddy of economic indicators – U.S non-farm payrolls (NFP) for September – will be released later this morning (8:30 am EDT) along with the Canadian jobs report.

Today’s U.S number is ‘big,’ especially with this week’s aggressive backing up of the U.S yield curve. The sell-off in Treasuries, in part, has been justified by U.S data supporting the strength of their economy and the markets future inflation fears.

This morning’s payrolls headline print, coupled with wage growth numbers, will provide substance to what investors should expect, from an interest rate perspective in particular. Does the Fed’s dot-plot line up neatly or will the Fed push its benchmark past the neutral level?

Consensus is looking for a September headline print of +185K new jobs and an unemployment rate to ease another one-tenth to +3.8%. However, expect dealers to look beyond the headline and focus intently on the increase in average hourly earnings.

The August wage growth print at +2.9% was the largest y/y gain in nearly a decade. If September’s number comes in even stronger, will justify some dealers fears that inflation pressures are building, maybe faster than originally perceived.

Current expectations for wage growth m/m are +0.3%, which would equate to approximately +2.8% y/y.

1. Stocks mixed reactions ahead of payrolls

Euro equities are struggling for traction after the Asian session ended the week with a further sell-off overnight as the region’s tech companies were battered by concerns about their U.S business.

In Japan, the Nikkei fell to its lowest close in a fortnight, tracking Wall Street’s slide yesterday as rising U.S Treasury yields have reduced the attraction of most stocks except financial ones. The Nikkei share average ended -0.8%, while the broader Topix dropped -0.5%.

Down-under, Aussie shares edged higher on Friday, supported by gains from the financial sector, which managed to advance for a second session. The S&P/ASX 200 index closed +0.2% higher. The benchmark is off -0.4% for the week. In S. Korea, Kospi stock index also ended lower this morning (-0.31%) on fears of foreign fund outflows after U.S yields surged to a new seven-year high.

Note: China’s financial markets are closed for the National Day holiday and will resume trade on Oct. 8.

In Hong Kong, stocks fell for a fourth consecutive session, dragged by a selloff in tech stocks on fears that these companies will be the latest casualties in the Sino-U.S trade war. The Hang Seng Index was down -0.42%.

In Europe, regional bourses trade lower across the board, pressured by rising sovereign yields. Investors will take their cue from this mornings N. American employment reports.

U.S stocks are set to open in the ‘red’ (-0.2%).

Indices: Stoxx600 -0.7% at 377.2, FTSE -0.8% at 7359, DAX -0.8% at 12142, CAC-40 -0.5% at 5385, IBEX-35 -0.5% at 9264, FTSE MIB -0.9% at 20438, SMI -0.5% at 9053, S&P 500 Futures -0.2%

2. Oil prices rise on Iran sanctions, gold little changed

Oil prices trade atop of their four-year highs this morning as traders predict a tighter market due to U.S sanctions on Iran’s crude exports.

Brent crude oil is up +10c a barrel at +$84.68. Yesterday, Brent fell by -$1.34 a barrel or -1.6% – the contract is on course for a gain of +2.5% on the week. U.S light crude is up +30c at +$74.63, a gain of +2% on the week.

The market remains very ‘bullish’ with speculators gunning for $100 a barrel on fears that the U.S demands for an Iran oil embargo will create a significant supply shortfall.

Both benchmarks retreated yesterday following a rise in U.S oil indicated that they would raise output, however, pullbacks have been aggressively bought.

Ahead of the U.S open, gold prices are little changed as the market remains cautious after U.S Treasury yields hit seven year high yesterday and on expectations that a strong U.S payrolls report could boost the Fed case for a tighter monetary policy. Spot gold has inched down -0.1% to +$1,197.64 an ounce, while U.S gold futures are flat at $1,201.3 an ounce.

3. Reserve Bank of India (RBI) surprises

The RBI kept its policy steady in a surprise hold this morning, but changes its stance from “neutral” to “calibrated” tightening.

The central bank left the Reverse Repo Rate (RRR) unchanged at +6.25% (not expected) and the Cash Reserve Ratio (CRR) at +4.00% (as expected).

It’s the first pause in three-decisions in the current tightening cycle. Governor Patel is to keep a ‘close vigil’ on inflation outlook for the coming months, as the outlook is clouded with several uncertainties. He indicated that the benefits of a weaker INR currency would become somewhat muted from a slowdown in global trade and escalating tariff war.

INR stays near record lows as the ‘big’ dollar hit a fresh record high of $74.05 vs. $73.65 before the statement.

The euro area bond market is heading for its worst week in five-months, with fears about tighter central bank monetary policy and strong U.S economic data will push borrowing costs to new highs.

Germany’s 10-year Bund yield has gained +2 bps to +0.55%. In the U.K, the 10-year Gilt yield has climbed +3 bps to +1.697%, the highest in almost three-years. While further anti-E.U. rhetoric by Italy’s Deputy PM Salvini is again pushing BTP yields higher. Italy’s 10-year yield has jumped +3 bps to +3.363%.

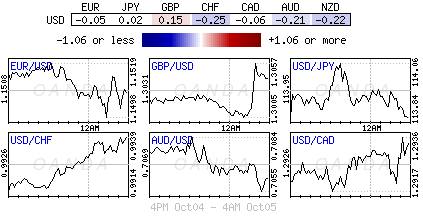

4. Dollar remains strong ahead of payrolls

The ‘big’ dollar is maintaining a firm tone, trading atop of its three-month high, against G10 currency pairs ahead of this morning’s NFP print.

EUR/USD (€1.1497) remains within striking distance of this week’s low outright. Italian anti-E.U rhetoric coupled disappointing Italian draft budget details is again providing EUR ‘bears’ with further ammo.

GBP/USD (£1.3034) is holding above the psychological £1.30 handle as EU Brexit negotiators were said to believe that an agreement with Britain was ‘very close.’

USD/JPY (¥113.88) remained below the ¥114 level after testing above it earlier in the week due to higher U.S Treasury rates.

4. German factory orders

Data this morning showed that factory orders in Germany rose strongly in August after two months of declines, boosted by strong foreign demand from outside the eurozone.

Orders, seasonally adjusted, rose +2% m/m. That follows a -0.9% drop in July and a -3.9% drop in June.

Note: Orders are still down -2.1% on the year, however, current data would suggest solid German growth has appeared in H2, 2018.

Digging deeper, domestic orders dropped -2.9% in August, but that was offset by a +5.8% rise in foreign orders.

Foreign orders from countries using the EUR dropped -2.2%, but those from non-eurozone countries rose +11.1%.