NYSE Margin Debt Falling, Bearish Signal For Stocks

Most get concerned about margin debt when it’s shooting up, but now the problem now is that it is falling too fast.

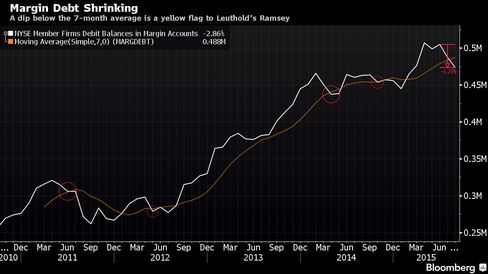

The tally of New York Stock Exchange (NYSE) brokerage loans flashed a Bearish sign when it slid more than 6% in July and August. The retreat took margin debt below a 7-month moving average that suggests demand for stocks is dropping at a rate that should give participants pause.

Bull Market skeptics have warned that surging equity credit portended disaster for US shares, pointing to a threefold runup between the market low on 9 March 2009 and the middle of this year. That surge was never strong enough to form the basis for a Bear.

The concern now is about how fast it is unwinding.

Margin debt contracting is a sign of loss of investor confidence and it is confirmation of other evidence of entry into a cyclical Bear market. The traditional warning signs leading up to the high in terms of market action, and deteriorating breadth and margin debt is important to the supply-demand analysis.

Margin debt, compiled monthly by the NYSE, represents credit extended by brokerages for clients to buy stock. It skews closely to benchmark indexes such as the S&P 500, primarily because equity is used to back the loans and as its value rises, so does the capacity to lend.

There is a natural progression of the 2 moving together.

NYSE margin debt surged from $182-B to $505-B in the 6 years ended in June 2015, roughly tracing the trajectory of the S&P 500, which 3X’d over the frame. The biggest gains came in Y 2013, with credit rising 35% as US stocks climbed 30% for the best returns in 16 years.

A lot of people said when the market broke out to a new high in margin debt a couple years ago that it was out of control, but the percentage change in margin debt from the low of Y 2009 was almost identical to the S&P’s, now that trend has rolled over.

Owning the S&P 500 when margin debt is above its 7-month moving average returned 10.9% on an annualized basis since Y 1960 compares with a 7.7% yearly return when owning stocks while margin debt is below the average.

As the market goes up people are willing to extend themselves and on the way down people become risk averse, so you do expect the 2 would move in the same direction. Margin debt is reflective of this, as a market where you are not going to step out onto a ledge if you do not know the support is there.

Have a terrific week.

HeffX-LTN

Paul Ebeling

The post NYSE Margin Debt Falling, Bearish Signal For Stocks appeared first on Live Trading News.