Submitted by David Stockman via Contra Corner blog,

The U.S. has approximately $80 trillion of unfunded liabilities for social security, medicare and other entitlements sitting atop a work force that is rapidly aging and an economy that is lapsing into stasis. Yet in the midst of a campaign diatribe about Donald Trump’s alleged lack of preparation for the highest office in the land, the current White House occupant proved that in nearly eight years he has learned exactly nothing about the nation’s abysmal fiscal plight.

“And not only do we need to strengthen its long-term health, it’s time we finally made Social Security more generous and increased its benefits so that today’s retirees and future generations get the dignified retirement that they’ve earned,” Obama said in an economic call to arms in Elkhart, Indiana.

Don’t bother to say he must be kidding. After all, our President also claims the disaster known as Obamacare is a roaring success; and that he has created 14 million jobs—-when, in fact, there are fewer full-time, full-pay “breadwinner jobs” in America today than when Bill Clinton scuttled out of the White House 16 years ago.

Still, your don’t have to be even a know nothing about baby-boom demographics to recognize that the words “increase” and “social security benefits” will never again inhabit the same universe. To wit, there are about 50 million persons 65 or over at present, but this number will rise to 80 million by around 2040 and nearly 100 million a decade or two thereafter.

Moreover, as we keeping insisting, there is nothing in the OASDI trust funds except intergovernmental accounting confetti. Every dime that was ever collected from the social insurance taxes, which bring in more than $1 trillion per year in revenue, has already been spent on education grants, Federal salaries, aircraft carriers, cotton subsidies, windmill farms and thousands of other Washington boondoggles.

So that steep demographic curve in the chart above means only one thing. Namely, that to fund even the current wildly unaffordable benefit schedule, massive amounts of additional cash will have to be extracted from taxpayers, the bond market or other programs.

The graph below gives a hint of the magnitude of the cash shortfall that is already baked into the cake under current entitlements. Even under the optimistic economic forecasts of the government’s chief actuary, the OASDI funds will be running a $250 billion annual cash deficit before the next presidential term ends, and upwards of $1 trillion per year by 2040.

But the sheer mathematical impossibility of funding higher cash and medical benefits for what will soon by 80 million retirees is only part of Obama’s latest whopper. An even more egregious element was the notion that Washington ought to pony up “more generous and increased its benefits” because present and future retirees should “get the dignified retirement that they’ve earned.”

Well, no, they haven’t earned what they are getting now, let alone the gravy that Obama is proposing to spread on top. That’s because one of the great lies of Washington is that social security and medicare are “insurance programs” which workers earn by paying “premiums” in the form of taxes.

In fact, the whole rigmarole of trust funds and actuarial bookeeping is a just a smokescreen to provide political cover. These programs are actually intergenerational transfer payment schemes that shift massive amounts of funds from the working population to retirees.

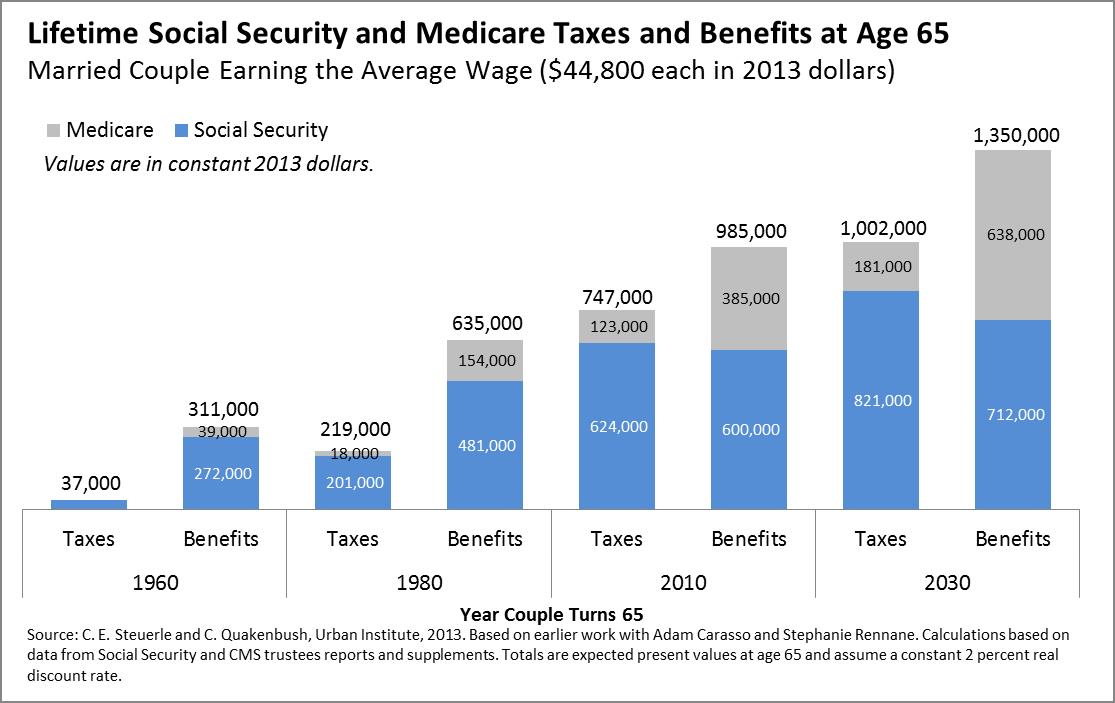

As shown in the chart below, the average beneficiary of social security and medicare does not pay lifetime taxes that are even close to expected lifetime benefits. Thus, beneficiaries who retired in the 1980s paid only 34% of their lifetime benefits in taxes, and the cohort of retirees from 2010 and beyond will have paid only 75%.

The cases shown above are actually generous because they are based on a married couple each earning the average wage over their working lifetime.

In fact, the benefits schedule is heavily skewed in favor of lower wage workers, beneficiaries without working spouses and/or eligible children. At the very bottom of the wage scale, for instance, the so-called “replacement rate” is 90% of monthly earnings compared to an average of 40% for all beneficiaries; and, of course, the non-working spouse and child’s benefits are pure welfare add-ons that have nothing to do with earnings or taxes paid.

Finally, our clueless President managed to jam a third whopper into the single sentence quoted above. Namely, that any fiscal issue relating to the social security system is not a matter of the here and now, but embodies a prudential need “to strengthen its long-term health” in the by-and-by.

Now that’s some beltway baloney if there ever was such. The fact is, the whole OASDI system will be bleeding massive red ink during the next President’s term. Even the funny-money trust fund accounting will give out by 2026. At that point, and politically long before, the trust funds will be technically exhausted, meaning an automatic benefit cut of nearly one-third or upwards of $600 billion per year!

The Washington beltway narrative, of course, is far more sanguine. But that’s based on Rosy Scenario economic assumptions that will be soon blown away when the next recession makes its inevitable arrival.

For example, the so-called “trustees” of the social security system issued their annual report recently and the stenographers of the financial press dutifully reported that the day of reckoning when the trust funds run dry has been put off another year—-until 2034.

The takeaway was apparently——take a breath and kick the can. That’s five Presidential elections away!

Except that is not what the report really said. On a cash basis, the OASDI (retirement and disability) funds spent $859 billion during 2014 but took in only $786 billion in taxes, thereby generating $73 billion in red ink. And by the trustees’ own reckoning, the OASDI funds will spew a cumulative cash deficit of $1.6 trillion during the 12-years covering 2015-2026.

The question thus recurs. How did the “untrustworthies” led by Treasury Secretary Jacob Lew, who signed the 2015 report, manage to turn today’s river of red ink into another 20 years of respite for our cowardly beltway politicians?

They did it, in a word, by redeeming phony assets; booking phony interest income on those non-existent assets; and projecting implausible GDP growth and phantom payroll tax revenues.

And that’s only the half of it!

The whole rigmarole of trust fund accounting enables these phony assumptions to compound one another, thereby obfuscating the fast approaching bankruptcy of the system. And, as will be demonstrated below, that’s what’s really happening—–even if you give credit to the $2.79 trillion of so-called “assets” which were in the OASDI funds at the end of 2014.

Stated differently, the OASDI trust funds could be empty as soon as 2026, thereby triggering a devastating 33% across the board cut in benefits to affluent duffers living on Florida golf courses and destitute widows alike. Needless to say, the army of beneficiaries projected for the middle of the next decade—what will amount to the 8th largest nation on the planet—- would not take that lying down.

So here follows an unpacking of the phony accounting edifice that obscures the imminent danger.

The place to start is with the one data series in the report that is rock solid. Namely, the projected cost of $15.5 trillion over the next 12 years to pay for retirement and disability benefits and the related (minor) administrative costs.This staggering figure is derived from the fact that the number of beneficiaries will grow from 59 million to 79 million over the next twelve years.

By contrast, the funny money aspect comes in on the funding side. The latter starts with the $2.79 trillion of “assets” sitting in the OASDI trust funds at the end of 2014, but as we indicated there is nothing there except government accounting confetti.

So when the untrustworthies claim that that social security is “solvent” until 2034 the only thing they are really saying is that this $2.79 trillion accounting artifact has not yet been liquidated according to the rules of trust fund arithmetic. And under those “rules” its pretty hard to actually accomplish that—-not the least due to the compounding of phantom interest on these phantom assets.

To wit, the 2015 report says that the OASDI funds will earn $1.2 trillion of interest income during the next twelve years. To be sure, the nation’s retirees and savers might well ask how Washington’s bookkeepers could manage to get the assumed 3.5% interest rate on the government’s assets compared to the 0.3% ordinary citizens earn on a bank account or even 2.2% on a 10-year treasury bond.

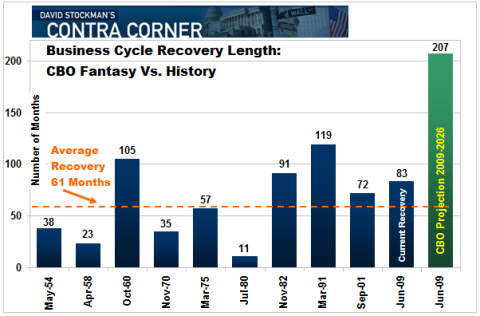

But that’s not the real scam. The skunk in the woodpile is actually the wholly unjustifiable assumption that nominal GDP and taxable wages will grow a rates sharply higher than recorded at any time during this century. For example, the trustees 5.1% nominal GDP growth assumption compares to just 2.7% over the last eight years, and they also assume that through 2026 there will be no recession.

That’s right. The untrustworthies report assumes a record business expansion of 207 months——or nearly 2X the longest recovery on record and 4X the average expansion cycle.

These projections of phony interest income and exaggerated revenues, in turn, ensure that the trust fund asset balance stays close to its current $2.7 trillion level in the years just ahead, and, mirabile dictu, permits it to earn upwards of $100 billion of “interest” each year.

Too be sure, beneficiaries could not actually pay for their groceries and rent with this sort of trust fund “income”. But it does keep the asset balance high and the solvency can bouncing down the road a few more years.

So here’s the thing. Plug in a realistic figure for GDP growth and payroll tax revenue increases and the whole trust fund accounting scheme collapses; the bouncing can runs smack dab into a wall of trust fund insolvency.

Needless to say, the law of compound arithmetic can be a brutal thing if you start with a delusional hockey stick and seek to bend it back to earth. In this case, the trustee report’s 5.1% GDP growth rate assumption results in $31 trillion of GDP by 2026. Stated differently, compared to only $3.5 trillion of nominal GDP growth in the last eight years we are purportedly going to get $14 trillion in the next 12 years.

But let’s see. If we have another recession before 2026 it will be difficult for nominal GDP growth to average even the current 2.7% per year trend over the next decade. Yet if that rate is somehow actually achieved, GDP would come in at just $24 trillion in 2026 or nearly 25% lower. Since OASDI payroll taxes amount to about 4.5% of GDP, it doesn’t take a lot of figuring to see that trust fund income would be dramatically lower in a $7 trillion smaller economy.

To be exact, the untrustworthies have goal-seeked their report to generate $1.43 trillion of annual payroll tax revenue 12-years from now. Yet based on a simple continuation of the deeply embedded GDP growth trend of the last eight years, payroll revenue would come in at only $1.10 trillion in 2026 or $325 billion lower in that year alone.

And here’s where the self-feeding illusion of trust fund accounting rears its ugly head. What counts is not simply the end-year delta, but the entire area of difference under the curve. That’s because every cumulative dollar of payroll tax shortfall not only reduces the reserve asset balance, but also cuts the phantom interest income earned on it.

So what happens under a scenario of lower payroll tax revenues is that the $2.7 trillion of current trust fund “assets” begins circling the accounting drain with increasing velocity as time passes. In effect, the permission granted to Washington to kick the can by this year’s untrustworthies report gets revoked, and right fast.

To wit, instead of a cumulative total of $13.2 trillion of payroll tax revenue over the next 12 years, the actual, demonstrated GDP growth path of the present era would generate only $11.2 trillion during that period. That $2 trillion revenue difference not only ionizes most of the so-called trust fund assets, but also reduces the ending balance so rapidly that by the final year interest income computes to only $25 billion.

Moreover, by 2026 trust fund revenue would be $400 billion per year lower owing to lower taxes and less phantom interest. Accordingly, the current modest projected trust fund deficit of $150 billion would explode to upwards of $600 billion after the last of the phony interest income was booked.

Needless to say, that massive shortfall would amount to nearly 33% of the projected OASDI outgo of $1.8 trillion for 2026. More importantly, instead of a healthy cushion of $2.4 trillion of assets (or two year’s outgo) as the untrustworthies projected last year, the fund balance would be down to just $80 billion at year-end 2026.

Now that’s about 15 days of the next year’s OASDI outlays. The system would go tilt.

Yes, Donald Trump may well need some tutoring on the issues. But better a few stray tweets than the incredulous whoppers being served up by the current incumbent.

The post Obama’s Latest Whopper – Let’s Raise Social Security Benefits! appeared first on crude-oil.top.