Flat start expected on Wall Street

A slow start to the week in European trade is offering little in the way of direction for US markets, ahead of the open on Wall Street, with futures indicating an almost unchanged open from Friday.

This week is likely to be much quieter than the one just passed, with trade in Asia likely to be muted as much of the region celebrates Chinese New Year. Elsewhere it’s unlikely to be much more lively with the major political events – most notably US/China trade talks and Brexit – probably going a bit quieter this week, with talks having taken place last week in Washington and a vote in the UK parliament.

The economic calendar is also looking much more slimmed down, compared to last week, with the only real standout events being the Bank of England and Reserve Bank of Australia meetings. And both of these are not expected to be knockout affairs, with the RBA very much in hold mode – and has been for some time – and the BoE hoping to await the outcome of Brexit negotiations before pulling the trigger again.

US earnings season could be more of a factor this week, in the absence of other catalysts. Last week it was tech stocks that were in the spotlight, with companies experiencing mixed fortunes. The bar has been set lower this earnings season following a torrid fourth quarter for equity markets, during which time fears about global and domestic growth surfaced. Alphabet will become the latest tech stock to report today and is one of almost 100 S&P500 companies reporting this week.

Europe flat as Asia goes into holiday mode

Gold weighed down by stronger dollar post-NFP

The dollar is trading higher again today, building on the gains of late last week. The US jobs report has been well received, albeit with some suspicion given the apparent immunity to the government shutdown. I guess we’ll see if the strong numbers continue in the coming months, not to mention whether we’ll get another huge downward revision to the headline NFP figure.

USD vs Gold

Source – Thomson Reuters Eikon

The rise in the dollar is keeping gold under temporary pressure. Gold has looked very bullish in recent weeks and the break above $1,300 further cemented that view. It struggled around $1,320 – prior support and resistance – and may now look to re-test $,300 from above. If this holds, it could be a very bullish signal for gold which could in turn be a bearish signal for the greenback.

Aussie dips on weak housing data

Oil testing major resistance

Oil is responding very differently to the jobs report it would seem, perhaps an indication of the bullish sentiment in the market. WTI and Brent surged in the aftermath of the jobs report and were further aided by the oil rig data, which showed a further 15 rigs going offline, continuing the trend since November. We’re now seeing both testing major resistance around $55 and $65, respectively, a break of which could be very bullish.

Oil (WTI and Brent) Daily Chart

OANDA fxTrade Advanced Charting Platform

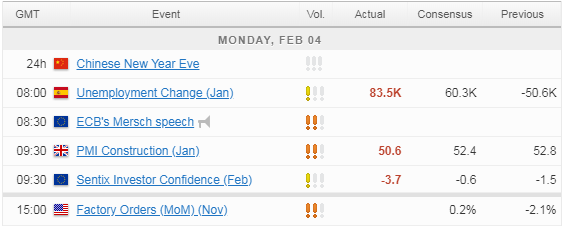

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.