European equity markets are expected to open a little higher on Thursday, with the FTSE rebounding from Wednesday’s declines helped by a similar rebound in oil prices overnight.

Brent and WTI crude tumbled on Wednesday following the release of the EIA crude inventory data which reported a larger build in oil stocks than markets expected. The move wasn’t helped by the resurgence in the dollar over the last week which has chipped away at commodities, as markets responded to rate hike warnings from numerous Fed officials.

OANDA MP – ADP Offers Little Insight (Video)

Gold has been hit quite hard by the change in rate expectations over the last week and we’re now seeing pressure building on its $1,300 support, after it fell to a two month low yesterday. Prices appear to have stabilised over the last 24 hours but that is only likely to last as long as the corresponding stabilisation in the dollar.

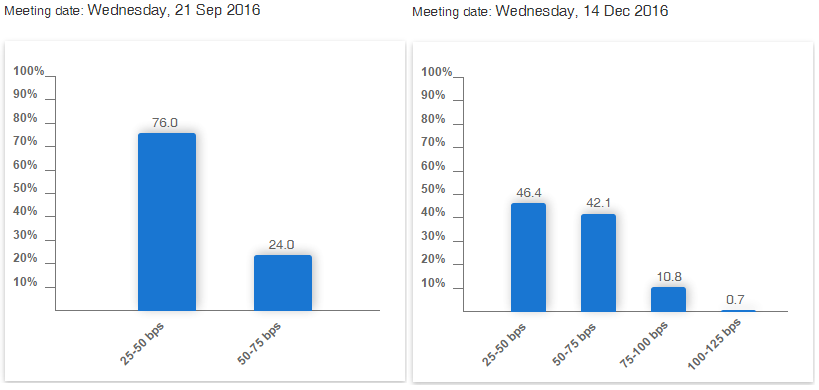

As far as I’m concerned, markets are still under-pricing the possibility of a rate hike this year, with September still only at 24%, despite numerous warnings, and December at 54%.

Source – CME Group FedWatch Tool

As long as tomorrow’s jobs report isn’t dreadful, I would expect the hawkish rhetoric to pick up further in the coming weeks and markets to price in a hike more which would likely mean a stronger dollar and further declines in Gold.

While there will be a focus on tomorrow’s US jobs report, being by far the standout risk event this week, there is plenty of data being released throughout the day which should ensure it’s a lively session. Already overnight we’ve had PMIs from China which painted a relatively mixed picture. The official manufacturing PMI moved back into growth territory and recorded its highest reading in almost two years while the Caixin PMI – which focus more of small to medium sized private firms – fell to 50 indicating a stagnation. The non-manufacturing PMI also fell a little but remained comfortably in growth territory.

USD/CAD Canadian Dollar Falls on Oil Tumble and Mixed Economic Data

We’ll get final PMI readings throughout the morning from Europe, followed by the officials and ISM manufacturing PMI readings from the US this afternoon. This will be accompanied by non-farm productivity and unit labour costs data for the second quarter which should ensure it’s a busy session.

For a look at all of today’s economic events, check out our economic calendar.