US third quarter GDP data will be a major focus for traders on Friday, coming days before the penultimate Fed meeting of the year, one which could deliver a very clear message of the central bank’s intention to raise interest rates in December.

What makes today’s GDP release all the more important is that is comes following two weak quarters of growth for the US economy which has already got people questioning whether the recovery has already stalled and if the Fed should be raising interest rates at this time. A third consecutive poor reading will only add to the voices calling for the Fed to hold off on hiking in December and with the markets having already heavily priced it in, I wonder whether it would also prompt some heavy selling in the dollar and spike in Treasuries.

EUR/USD – Euro Edges Above 1.09, US Advance GDP Next

While the polls may not look to close in the US Presidential race with only 11 days to go, I also wonder what another disappointing quarter of growth would do for Donald Trump’s chances. Trump has repeatedly criticised the current government for how the economy has performed this year, promising to get the economy growing by 4% if elected. A third quarter of low growth coming days before people head to the polls may well sway some of the undecided voters and I’m sure it will become a core message that Trump will want to drive home in the final days of the campaign.

Corporate earnings season continues to rumble on, with companies producing decent, albeit uninspiring, results in the third quarter. With it being the end of the week, fewer companies are scheduled to release their earnings but we will still hear from some very big names including Exxon Mobil and Chevron which could help drive sentiment throughout the session.

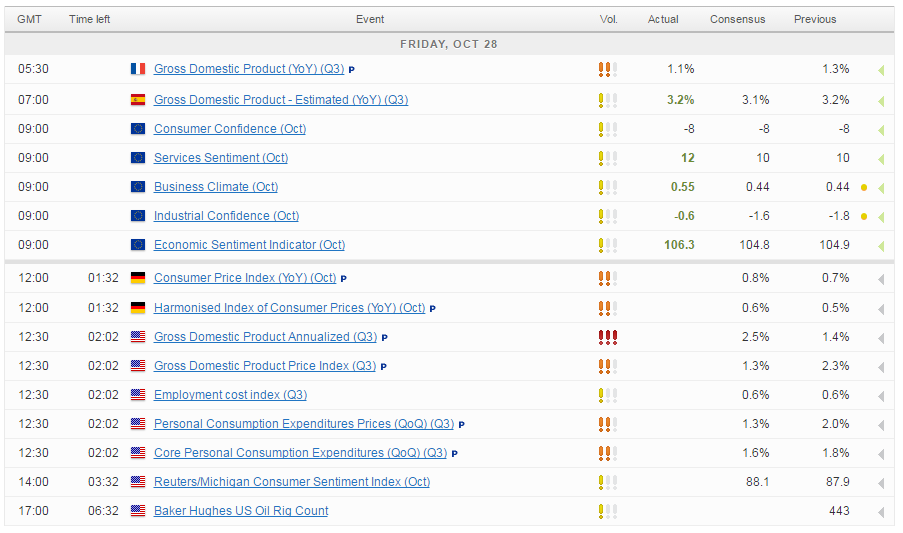

For a look at all of today’s economic events, check out our economic calendar.