Italy Forms Government While Spain’s Rajoy Loses No Confidence Vote

You may not guess it based on the current levels in financial markets but it’s been quite a week for investors which has been reflected by a spike in volatility, with politics being the main driver of the unrest.

Over the course of this week, we’ve seen coalition talks in Italy fall apart, restart and reach a successful conclusion – although other eurozone leaders may not quite agree with the label “successful” – Spanish Prime Minister Mariano Rajoy toppled in parliament following a no-confidence vote and replaced by Socialist leader Pedro Sanchez and finally, the US impose steel and aluminium tariffs on its allies, the EU, Canada and Mexico.

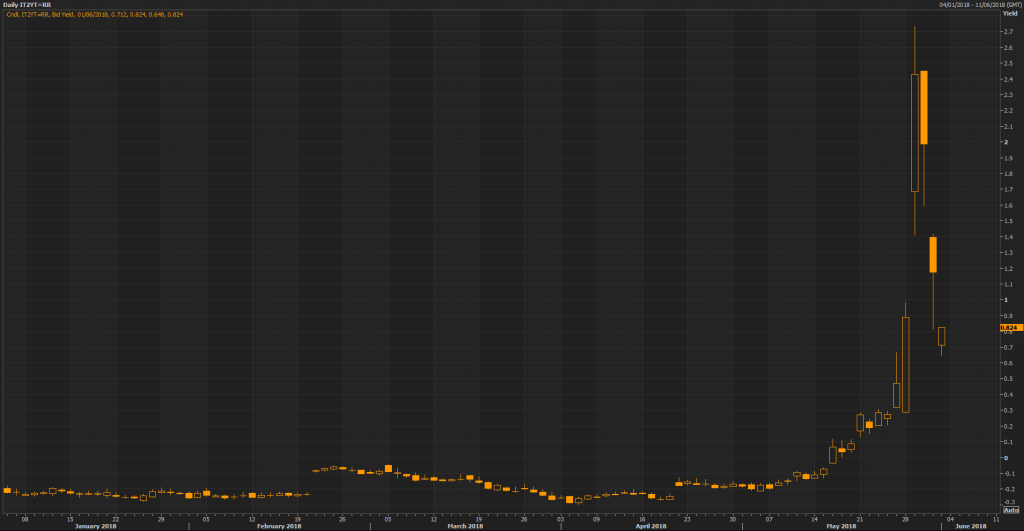

While many markets may now be trading back at levels they opened the week at, there has been volatility along the way with Italian 2-year yields peaking above 2.7% having been in negative territory two week ago, the Italian FTSE MIB falling more than 6.5% from Monday’s open before reversing these as a deal was agreed and the euro slipping to 10-month lows against the euro.

Italian 2-Year Yield Daily Chart

Source – Thomson Reuters Eikon

There have been other casualties along the way as well with overall risk appetite having taken a hit at the prospect of Italy returning to the polls in what was being labelled a vote on the euro. This naturally got investors all over quite nervous with the eurozone debt crisis still very much fresh in the memory. While this week has been a stark reminder of how quickly things can unravel in pockets of the European political scene and reminds us of the risks that still exist in Italy, there is a sense of relief that some form of stability has resumed for now.

Trade War On, but Non-farm Payroll (NFP) up next

Investors Unconcerned By Imposition of Tariffs By the US

We can now get back to concerning ourselves with more trivial matters like trade wars and the economy. The imposition of steel and aluminium tariffs by the US on Europe, Canada and Mexico has drawn plenty of criticism from officials but maybe in a sign of how markets can become less sensitive to certain issues, the response has so far been fairly muted. Focus will now be on the retaliatory measures that these countries have lined up and whether that in turn triggers a larger and quite unnecessary trade war. Investors currently appear at ease with the situation but that could quickly change.

Wages Once Again Eyed in US Jobs Report

On the economy we have a rather significant set of data out today that rarely takes a back seat to other things but that has certainly been the case this week. The US jobs report is one of the most highly anticipated releases we get as it provides important insight into the strength of the US economy, labour market and potential inflationary pressures. With unemployment already at 3.9% and the labour market looking quite tight, there is likely to be more emphasis on the wages number as opposed to job creation, although that never falls entirely under the radar.

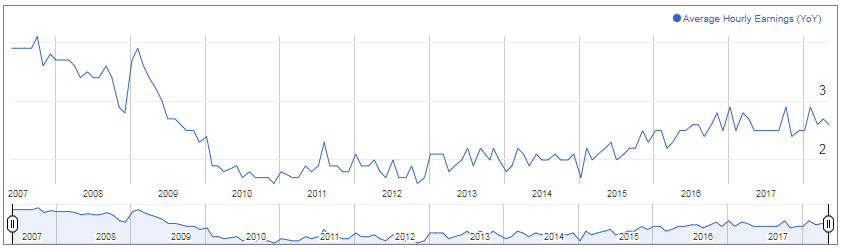

US Average Hourly Earnings

Strong wage growth has completely eluded this particular economic recovery, despite the apparent lack of slack in the labour market. Earnings are expected to have ticked slightly higher to 2.7% last month which is little changed on the last 18 months and doesn’t represent any shift that would be indicative of labour market tightness flowing through into higher inflation. Aside from the jobs report we’ll also get manufacturing PMIs from the US today.

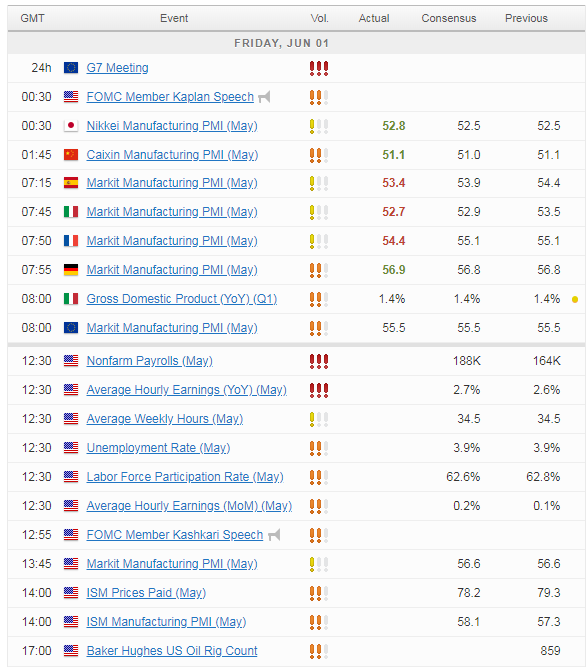

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.