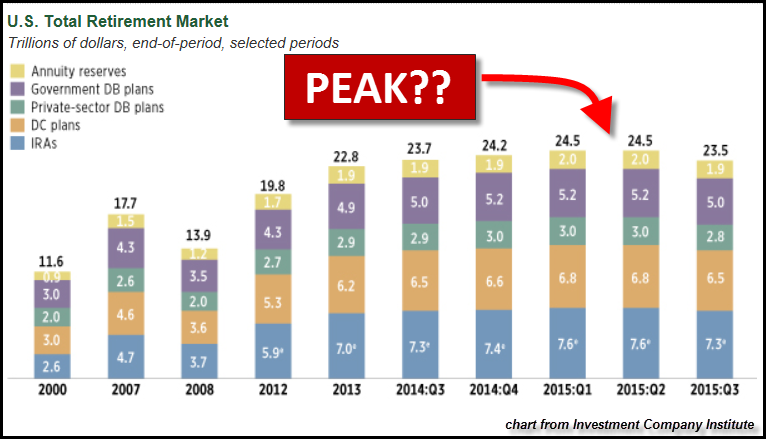

The biggest trade of a lifetime will occur when the value of silver switches from a mere commodity to a high-quality store of value. Actually, it’s not really a trade of a lifetime, but rather a fundamental repricing of real assets verses supposed assets. According to the Investment Company Institute, the supposed value of the total U.S. Retirement Market was $23.5 trillion in the third quarter of 2015:

As we can see, the value of the U.S. Retirement Market is down $1 trillion from its peak of $24.5 trillion in the previous two quarters. Could this be the peak of U.S. Retirement assets?? While the broader stock markets rebounded in the fourth quarter of 2015, they fell again during the first quarter of 2016.

If there are any investors who still believe the Fed and member banks aren’t propping up the markets, you need to get your head examined. We know many of the other Central Banks such as Japan and China have officially stated they were buying stocks, why wouldn’t the Fed and U.S. Govt?? Of course we are.

And it makes a lot of sense why they are doing it. The overwhelming majority of Americans that are invested in the markets are invested in the typical assets that comprise the U.S. Retirement Market. Only a tiny fraction of Americans are invested in physical precious metals. So, in order to keep “CALM” in the markets, the major indexes are not allowed to collapse…. well, for a while.

Look what happened to the Mainstream investor when the Dow Jones Index fell just 11% in the first two months of 2016… they moved into the Gold & Silver ETF’s and Funds in a major way. I discuss what is taking place in the Gold Market in detail in a new upcoming BULLET REPORT.

What on earth would happen to the Gold & Silver Markets if the Dow Jones Index was decimated by 30-50%?? I believe it would cause Mainstream investors to move into gold and silver in such a forceful way, that it would totally overwhelm the supply causing the prices to shoot up much higher. And the higher the price of gold and silver would go, the more Mainstream investors would pile in.

The Fed’s worst nightmare…..

Right now the values of the major stock indexes are extremely overvalued. However, the market isn’t allowed to find their true fundamental value, but it will. This will likely happen when gold and silver switch from a commodity pricing mechanism to a high-quality store of value. Let me explain this in silver’s case.

Silver Trades As A Mere Commodity Due To The Oil Price

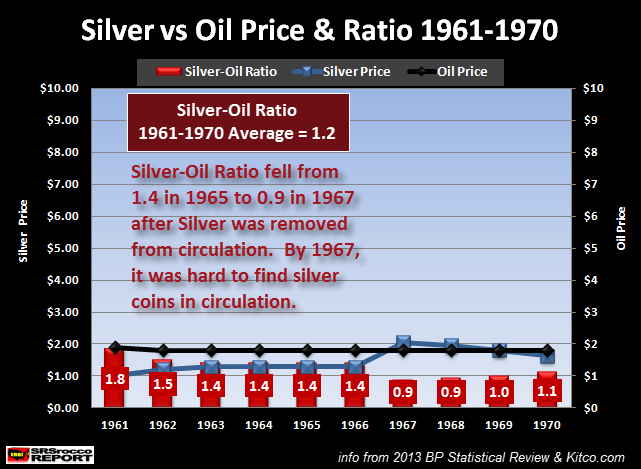

The value of silver has been tied to the price of oil for quite some time. While some analysts suggest this isn’t the case, the charts below provide ample evidence:

These charts were published in an article I wrote a couple of years ago. However, they still just as valid today. As we can see there was very little volatility in the price of oil and silver in the 1960’s. Why? Because the price of oil remained unchanged from 1962 to 1970 at $1.80. Can you imagine that? No change in the oil price for nearly a decade? Well, that all changed in 1970’s when the U.S. peaked in oil production and Nixon dropped the Dollar-Gold peg.

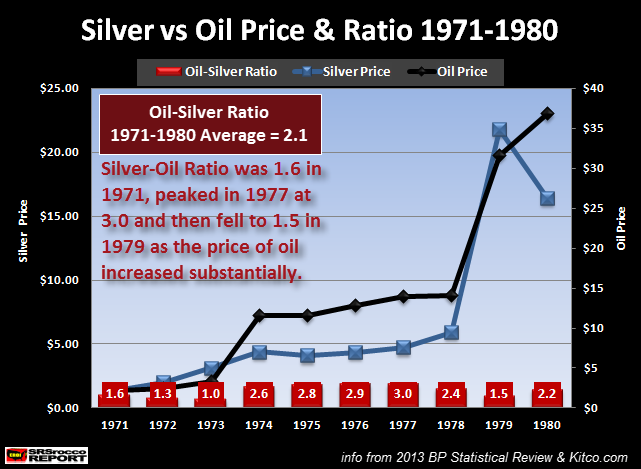

The next chart shows the change in the price of oil and silver due to two oil price shocks:

The price of oil jumped from $3.29 in 1973 to $11.58 in 1974 due to the Arab Oil Embargo. This impacted the value of silver as it increased from $1.98 in 1972 to $4.39 in 1974. Both the price of oil and silver increased slightly by 1978, but then jumped violently in 1979. This was due to the Iranian Revolution led by Ayatollah Khomeini which resulted in a huge reduction in the country’s total oil production. Total oil Iranian oil production fell from 5.3 million barrels per day (mbd) in 1978 to 1.5 mbd in 1980. This had a profound impact on the price of oil.

The price of oil jumped to $31 in 1979, up from $14 in 1978. Thus, the price of silver also skyrocketed to nearly $22 (average annual price), from $5.93 the previous year. Why did silver move up so high? Well, if silver mining costs were going to increase because of the jump in the price of oil, so would the price of silver. Of course, there was increased speculation as more investors piled into silver, but we can plainly see the rise in the price of oil was the underlying fundamental cause that impacted the silver price…. as well as gold.

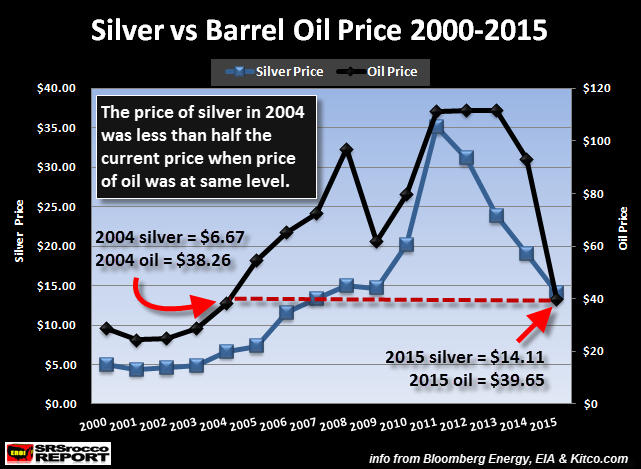

This the exact same thing that took place since 2000:

Again, the price silver moved up with the price of oil. And as we can see, it also fell with fall in the price of oil… even though prematurely. That is a discussion for another article.

The fact remains, that the cost to produce silver is based on the price of oil. This is called a “Commodity Price Mechanism.” Those folks who believe it will take a price of oil at $200 to see silver reach $50-$75, it’s likely not going to happen. Why? I don’t see a high price of oil as sustainable…. even if oil production starts to decline. That’s another topic for discussion in an upcoming report.

And decline it will. Especially, in the United States:

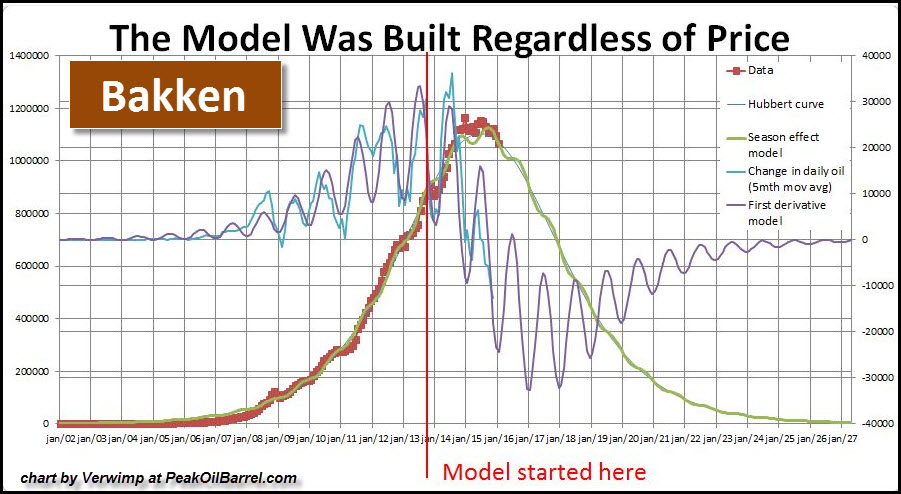

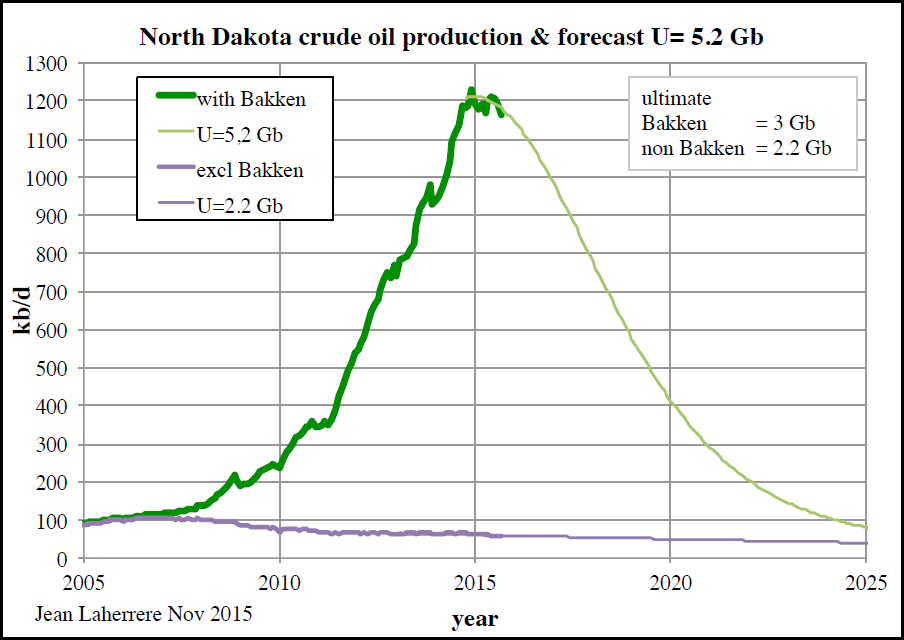

This chart is by one of the contributors (Verwimp) at the PeakOilBarrel.com website. This is an oil production profile of the Bakken, regardless of price. It has to do with the high decline rates and the amount of new wells. This isn’t the only person who believes the Bakken oil production is going to collapse. Jean Laherrere also arrives at the same production profile:

The Bakken is the second largest Shale oil field in the United States. The Eagle Ford Shale oil field is the largest, but it will suffer the same fate as the Bakken. With U.S. oil production to collapse over the next 5-10 years, this will have a profound impact on all paper assets including Stocks, Bonds and Retirement Accounts. Burning energy gives these paper assets their value. The collapse of this energy supply will cause a collapse of the paper assets.

For those who think the United States will just import more oil to make up the future shortfall… you are sadly mistaken. There is a reason why China and Russia are adding gold to the Official Reserves. They realize the value of the Dollar will be toast… and collapsing domestic oil production will be one of the leading causes.

Silver Investment To Become A High Quality Store Of Value

The collapse in U.S. oil production along with the disintegration in value of most paper assets will cause SILVER INVESTMENT to be finally based on its high quality store of value properties, not its historic commodity based mechanism. It will no longer matter what the price of oil is. The value of silver will rise as investors move into it to escape the ongoing collapse in paper assets values.

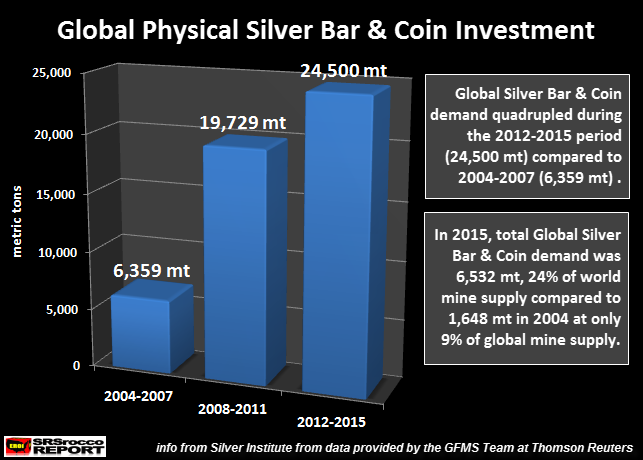

Some analysts like Jeff Christian of the CPM Group do not consider silver investment demand in their supply and demand figures. It seems as if Mr. Christian believes silver investment is just a mere store of silver supply ready to come on the market when it’s needed. Well, that may have been the case for the past fifty years, it will not be in the future.

Investors have been acquiring record amounts of silver for the past eight years. Total cumulative Silver Bar & Coin demand 2004-2007 was 6,359 metric tons (mt). This equals 204 million oz (Moz). This nearly quadrupled to 24,500 mt (788 Moz) 2012-2015. I see no sign of this trend reversing as investors realize the U.S. financial system is much worse off than it was in 2008.

The notion that investors are going to dump silver on the market at much lower prices to supply the Industrial machine will no longer make sense in the future as global industrial demand will continue to fall along with U.S. and world oil production.

In the future, investors will be learning to PROTECT their wealth, rather than try make a yield or dividends. Gold and especially silver will become the go to HIGH QUALITY STORES OF WEALTH as the majority of most paper assets head down the toilet.

I will be soon releasing a new BULLET REPORT on the Gold Market. It provides charts and data on how the recent flows into setting up the Gold Market for a big move in the future.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

Запись SILVER INVESTMENT: Switching From A Commodity To A High Quality Store Of Value впервые появилась crude-oil.top.