The US and it’s central bank will be centre of attention once again on Friday as we get the latest labor market report for August and try to determine what it means for interest rates in the coming months.

The US jobs report is always a major economic release for the economy but this one carries additional weight following comments at Jackson Hole last week from a number of Fed officials who suggested we’re on the cusp of the next rate hike. Stanley Fischer, vice Chair, referred to the report directly a week ago when he claimed it will “weigh in our decision”.

Dollar Weaker Ahead of Jobs Report

Ultimately, regardless of this one report I think the Fed is determined to continue the tightening process this year, barring another destabilizing event, the question is whether that will be September or December. The problem the Fed has faced is one of damaged credibility which has prevented markets accurately pricing this in but I think a third stellar report on the bounce would help overcome this.

The problem is that August has traditionally not been a great month for the labor market and so to expect a good enough NFP number to warrant a hike this month would be to expect an anomaly. That’s not to say it won’t happen of course but it would suggest that it’s unlikely, which therefore makes December still the most likely month for the next hike.

A number similar to last month’s would both catch the markets off guard and put a September hike firmly on the table which would require a significant repricing from the markets. It’s easy to ignore the Fed when it’s credibility is being questioned, but to ignore a third great report as well as the Fed commentary would be foolish. I don’t think the markets will make that mistake, especially if wages continue to grow as they have. What may be more likely is we get a decent to good report which puts the emphasis more on December but puts serious doubt on this month.

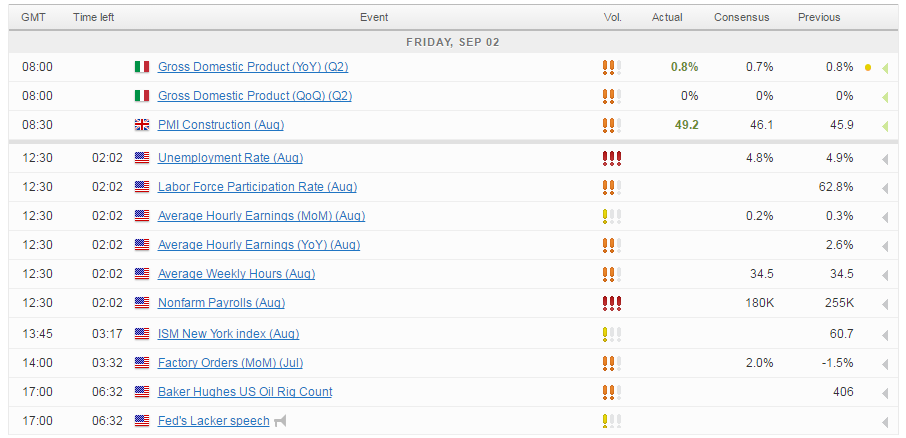

For a look at all of today’s economic events, check out our economic calendar.