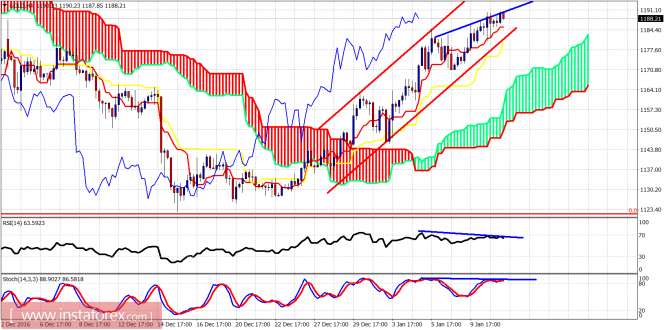

Gold price made a new higher high yesterday but it was not confirmed on the 4-hour chart by the RSI, which means that bulls need to be very cautious as a pullback is imminent. Trend remains bullish in the short-term and I continue to target $1,200-$1,220 for a reversal.

Red lines- bullish channel

Blue lines – divergence signs

Gold price continues to trade inside the bullish channel and above the 4-hour Ichimoku cloud. There are bearish divergence signs that provide a warning for Gold bulls. A pullback is justified and expected in the short term. Short-term support is at $1,180 and resistance at $1,200-$1,220.

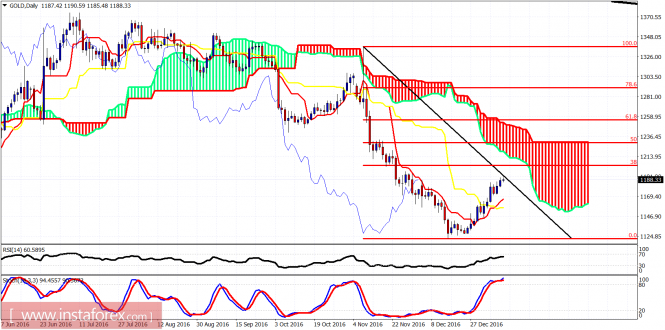

Gold price should at least reach the 38% Fibonacci retracement of the decline from the post election highs at $1,210 and ideally it would test the daily Ichimoku cloud resistance at $1,215-20. A pullback should be expected after that. Support is at $1,150-60. Gold bulls will need to see a higher low and an upward reversal in order to assume that $1,122 is an important long-term low.The material has been provided by InstaForex Company – www.instaforex.com

The post Technical analysis of gold for January 11, 2017 appeared first on forex-analytics.press.