Overview:

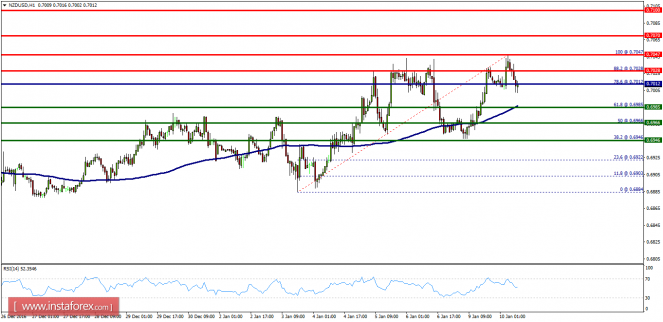

- The NZD/USD pair faces the key resistance at the level of 0.7047, while minor resistance is seen at 0.7028. Support is found at the levels of 0.6985, 0.6966 and 0.6946. Besides, a daily pivot point has already been formed at the level of 0.7012. Equally important, the NZD/USD pair is still moving around the key level at 0.7012, which represents a daily pivot on the H1 time frame at the moment. Today, resistance is seen at the levels of 0.7047 and 0.7028. So, we expect the price to set below the strong resistance at the levels of 0.7028 and 0.7028, as it is in a bearish channel now.

Amid previous events, the price is still moving between the levels of 0.7028 and 0.6946. Overall, we still prefer the bearish scenario as long as the price is below the level of 0.7028. Furthermore, if the NZD/USD pair is able to break the first support at 0.6985 and 0.6966, then the market will decline further to 0.6946 (daily support 3). Generally, the price will probably fall into a bearish trend in order to go further towards the strong support at 0.6946 to test it again. The level of 0.6946 will form a double bottom.

On the other hand, if the price closes above the strong resistance of 0.7047, the best location for a stop loss order is seen above 0.7075.

The material has been provided by InstaForex Company – www.instaforex.com

The post Technical analysis of NZD/USD for January 10, 2017 appeared first on forex-analytics.press.