Overview:

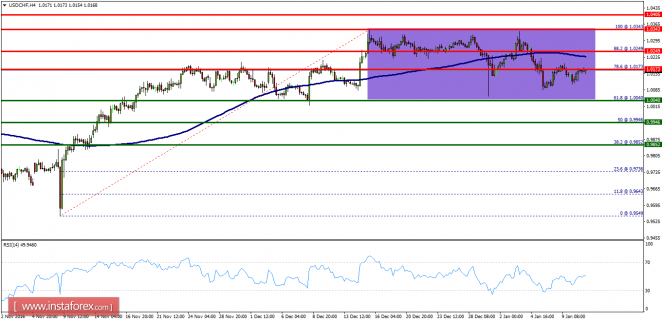

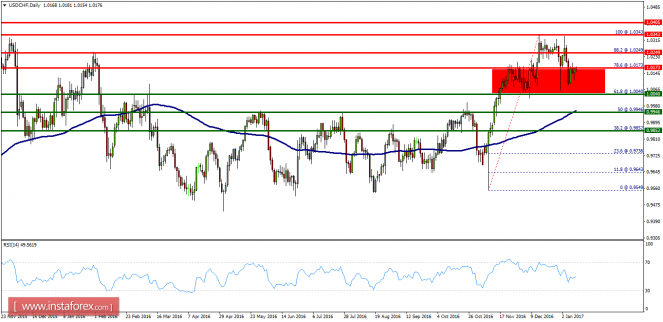

- The USD/CHF pair didn’t make any significant movements yesterday. There are no changes in our technical outlook. The bias remains bullish in the nearest term testing 1.0240 or higher.

The USD/CHF pair faced strong support at the level of 1.0040. The USD/CHF pair continues to move downwards from the level of 1.0249. The pair dropped from the level of 1.0249 (this level of 0.9965 coincides with the double top) to the bottom around 1.0090. Moreover, the price spot of 1.0040 remains a significant support zone.

Therefore, there is a possibility that the USD/CHF pair will move upside and the structure of a fall does not look corrective. In order to indicate the bullish opportunity above 1.0040, buy above 1.0040 with the first target at 1.0173. Additionally, if the USD/CHF pair is able to break out the top at 1.0173, the market will rise further to 1.0249 so as to test the daily resistance 2 again.

- Also, it should be noticed that resistance 1 is seen at the level of 1.0173 which coincides the ratio of 78.6% Fibonacci Expansion.

Generally, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100). This suggests the pair will probably go up in coming hours.

Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended above 1.0040 with the first target at the level of 1.0173. If the trend is be able to break the first resistance at the level of 1.0173, then the market will continue rising towards the daily resistance 2 at 1.0249.

The material has been provided by InstaForex Company – www.instaforex.com

The post Technical analysis of USD/CHF for January 11, 2017 appeared first on forex-analytics.press.