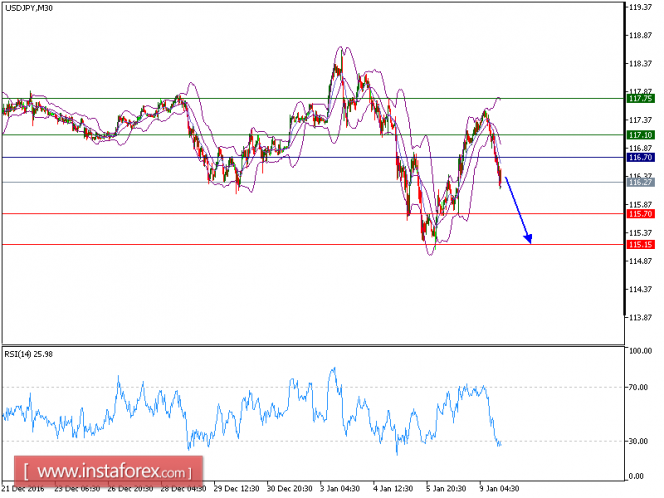

USD/JPY is expected to continue its downside movement. The pair is trading below its declining 20-period and 50-period moving averages, which play resistance roles and maintain the downside bias. The relative strength index is capped by a bearish trend line and is below its neutrality level at 50.

The U.S. Labor Department released a solid December jobs report. Employers added 156,000 nonfarm payrolls in the month (vs. +175,000 expected) with jobless rate edging higher to 4.7% from 4.6% in November (as expected). In addition, an average hourly wage for private-sector workers advanced 10 cents or 0.39% in November, to $26.00. Importantly, wages increased 2.9% on year in December, the strongest annual growth since 2009.

As long as 116.70 holds on the upside, look for a further drop toward 115.70 and even 115.15 in extension.

Recommendation:

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 115.70. A break below this target will move the pair further downwards to 115.15. The pivot point stands at 116.70. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 117.10 and the second one at 117.75.

Resistance levels: 117.10, 117.75, 118.05

Support levels: 115.70, 115.15114.70

The material has been provided by InstaForex Company – www.instaforex.com

The post Technical analysis of USD/JPY for January 09, 2017 appeared first on forex-analytics.press.