By Chris at www.CapitalistExploits.at

Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing.

Welcome to this week’s edition of “World Out Of Whack” where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all it’s glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the “World Out Of Whack” as your double thick armour plated side impact protection system in a financial world littered with drunk drivers.

Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live.

Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar – because, after all, we are capitalists.

In this week’s edition of the WOW we’re covering the yuan (and Donald Trump’s poor grasp of economics)

In the reality TV show US presidential debate aired live the other night Donald Trump had only just begun warming his vocal chords before delivering one of the most profoundly idiotic statements of the entire night. And this is saying something since there was (unsurprisingly) no shortage of nonsense to be heard.

“You look at what China is doing to our country in terms of making our product. They are devaluing their currency and there’s nobody in our government to fight them and we have a very good fight and we have a winning fight because they are using our country as a piggy bank to rebuild China and many other countries are doing the same thing. So we’re losing our good jobs, so many of them.”

Now, finding misleading, wrong, dead wrong, and plain bulls**t political statements is easier than picking up herpes from Bill Clinton. But what is more worrying than stupid politicians is the mainstream acceptance of this concept that China is devaluing the yuan.

Why, with the billions of dollars of personal wealth “the Don” couldn’t find someone to give him the facts is inexcusable. He’s not even in office yet and already I’d fire him, if it weren’t for the fact that the alternative is almost certainly worse. My friend Harris Kupperman is correct when he calls the contest “Crook vs Jerk”.

Perhaps readers could send this article to him to educate him along with the other articles we’ve written on the topic. If I had anything near as many followers on Twitter as he does I could charge them all 1 cent and still buy him a better hairpiece than he has. More importantly, we’d put an end to this nonsense that the Chinese government is currently trying to devalue the yuan.

————————————–

————————————–

Yes, China has been manipulating the yuan but by propping it up, NOT by devaluing it. The market itself has been devaluing the yuan and the PBOC has been trying desperately to contain the devaluation. They have in effect been doing the exact opposite of what Mr. Trump suggests they’re doing.

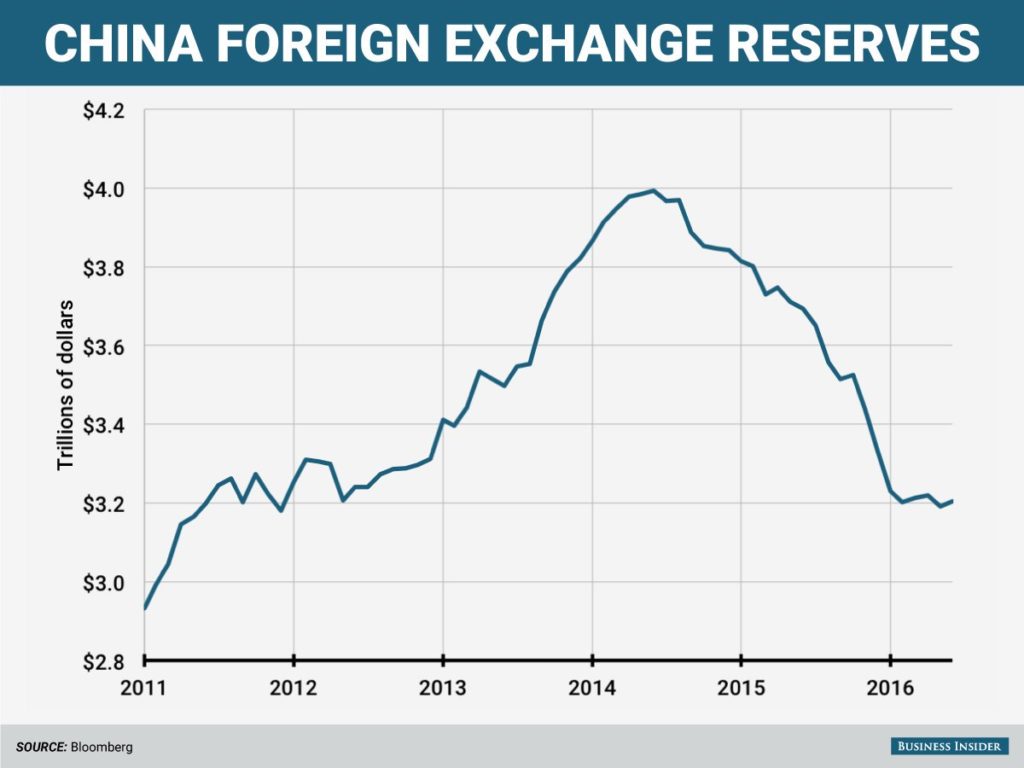

We can see these capital flows by looking at the FX reserves, which the PBOC has been draining faster than a fat kid drains a thick-shake.

Up until August of this year the PBOC has been blowing through roughly $100bn per month in an attempt to stem these capital outflows.

I have to wonder what Trump and other ignorants will be saying when the yuan really devalues – due to market forces and not the PBOC actively devaluing the currency.

Albert Edwards, a Societe Generale economist, points out the following:

“At $3.2bn the market remains content that massive firepower remains to support the renminbi. It does not. Our economists estimate that when FX reserves reach $2.8 trillion — which should only take a few more months at this rate — FX reserves will fall below the IMF’s recommended lower bound. If that occurs in the next few months, expect to see a tidal wave of speculative selling, forcing the PBoC to throw in the towel and let the market decide the level of the renminbi exchange rate.”

And SocGen’s China economist Wei Yao points out:

“If China’s reserves fell to $2.8tn, they would reach the lower end of the recommended range and could start to undermine confidence in the PBoC’s ability to resist currency depreciation and manage future balance of payments shocks.”

When it comes to understanding China’s credit bubble, the currency escape valve, and the relationships between all the moving parts, nobody has done a more thorough job than Worth Wray and Mark Hart of Corriente Advisors.

Focusing on FX reserves in isolation is somewhat meaningless. Worth and Mark are looking at foreign exchange reserves relative to M2, a broad gauge for domestic money supply. The problem, as Worth highlights, is that M2 has been growing faster than FX reserves and now in fact exceeds FX reserves.

Put another way, this means that the capital in the economy is growing faster than FX reserves. Realise that capital in the economy is also capital which is available to exit China and this measure (M2) now exceeds the FX reserves required to counteract those capital outflows. As Worth quite correctly points out:

“There’s a difference between having enough reserves to meet normal balance-of-payments needs and adequate reserves to defend resident-driven capital flight in a panic. My point is that the buffers continue to fall and Beijing can’t keep following this policy course forever.”

Mr. Trump’s campaign website says the yuan is “undervalued by anywhere from 15% to 40%”.

I would contend that the yuan is overvalued by anywhere from 15% to 40%.

The fact is, China is running out of money and will be forced to float the yuan. And when they do Mr. Trump will have difficulty in explaining how a freely traded currency is some 15% – 40% cheaper than it is today.

Clearly Trump doesn’t understand global capital flows and perhaps he shouldn’t. Provided he has people around him who can provide him with the correct information this needn’t be a problem but if that’s the case then perhaps he should refrain from opining on subjects he clearly knows nothing about.

This brings up an important question.

When events with global implications take place… events such as a floating of the yuan and the subsequent devaluation that inevitably comes with it…

Cast your vote here and also see who others think the lesser of two evils is

Cast your vote here and also see who others think the lesser of two evils is

Know anyone that might enjoy this? Please share this with them.

Investing and protecting our capital in a world which is enjoying the most severe distortions of any period in mans recorded history means that a different approach is required. And traditional portfolio management fails miserably to accomplish this.

And so our goal here is simple: protecting the majority of our wealth from the inevitable consequences of absurdity, while finding the most asymmetric investment opportunities for our capital. Ironically, such opportunities are a result of the actions which have landed the world in such trouble to begin with.

– Chris

“Why should China be forced to suffer deflationary effects of defending its currency when everyone else isn’t?” — Mark Hart, Corriente Advisors

————————————–

Liked this article? Don’t miss our future missives and podcasts, and

get access to free subscriber-only content here.

————————————–

The post The Day Donald Trump Flunked Econ 101 appeared first on crude-oil.top.