Submitted by Daniel Drew via Dark-Bid.com,

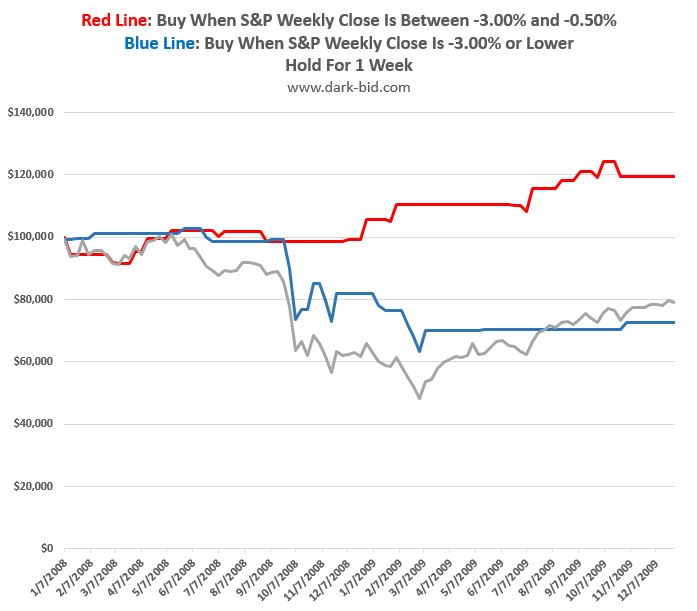

In my recent article How To Avoid Being A Retail Bag Holder, I discussed a trading strategy where one only buys the market when it's down between -3.00% and -0.50% for the week. I also mentioned that it was important to avoid buying when the market was down more than 3% for the week. One observant reader asked, "Where's the chart for the down 3%+ strategy?" To satisfy any lingering curiosity, I decided to create that chart.

What I found was stunning: An investor could have avoided the entire 2008 collapse by refusing to be a hero trader.

There is a stark difference between BTFD and trying to save the world. While BTFD can be a valid strategy within shorter time frames, it's not appropriate when the market closes down 3% or more for the week. Buying the market when it's down that much is like joining the military: you get shipped off to fight someone else's war.

So the next time you see the market down big and you feel the urge to hero trade, remember, you're only a hero after you're dead.

The post The Entire 2008 Crash Could Have Been Avoided With One Simple Trading Rule appeared first on crude-oil.top.