Submitted by Jeffrey Snider via Alhambra Investment Partners,

In the late 1990’s, economists attempted to get reacquainted with something that they previously believed was an artifact of long ago history. The plight of Japan during that decade had revived fears of deflation and depression. Some economists, those daring enough to challenge entrenched notions, began even to contemplate whether or not it could happen here.

Writing in the New York Times in early July 1999, Louis Uchitelle noticed not just the increased interest but also the distinct lack of available literature. He noted in his article, appropriately titled Reviving The Economics of Fear; In Bad Times, Consumers Might Simply Refuse To Spend, that one economics professor at Northwestern revised at the last minute his latest undergraduate textbook from a single footnote discussing fear of spending among consumers to a full-blown discussion within it about it. As the professor said, “When you go 50 years without a phenomenon being relevant, it dies out of the curriculum.”

This was the dot-com era, a period where it seemed nothing might ever go wrong in the United States. The Fed had, it was believed, engineered the perfect expression of technocratic accomplishment, the Great “Moderation.” It was exceedingly far-fetched at that time that the United States or anywhere else in the world orthodox economics was practiced would ever become Japan except Japan.

”One could imagine that happening here,” said N. Gregory Mankiw, a Harvard economist and textbook author who nevertheless puts the odds of a consumer freeze-up in America at less than 1 in 100, and does not yet mention the concept in either his beginning or intermediate economics texts. ”I deal with rules, not exceptions,” Mr. Mankiw said. ”My market is mainly American students, not Japanese.”

Less than 1 in 100? Maybe we need to first define terms, as what was discussed then might not be exactly comparable to what should be discussed now. The world is certainly trapped in a “low growth environment” but that isn’t necessarily the same as the world of the 1930’s. In other words, Mankiw might be forgiven his arrogant estimate on a technicality that in the end may be much more than that.

Just a few months before Louis Uchitelle’s article, the Economist broached the same topic with an article titled Could It Happen Again? From just this historical perspective, it was a curious development given how much certainty there was about the US economy in the late 1990’s, almost as if deep down economists knew there was something a little wrong about it all. Japan was, of course, more than a little troubling as a poignant counterexample to where all that was thought theoretically true was found in practice false, but for the most part economic “experts” talked themselves into believing that Japan was Japan and not anything more than that.

The Economist piece started by recounting the relatively new phenomenon of sustained inflation, the very point of pride for modern central banking.

Until about 60 years ago prices in general were as likely to fall as to rise. On the eve of the first world war, for example, prices in Britain, overall, were almost exactly the same as they had been at the time of the great fire of London in 1666.

Economists gave up on that price stability through the gold standard because they charged gold with the crime of the Great Depression; indeed as with every other depression and bank panic before it. To sustain a little inflation, they theorized, was to buy insurance against the worst parts of the worst economies of the past. To gain a little inflation meant to destroy the gold standard. Having done that, economists like Mankiw were absolutely sure (take him at his word) that nothing more than a commitment to “a little” inflation would always be effective.

As the article in the economist further explored, however, there was a global burst of “deflation” around the end of the 20th century, but that was properly distinguished from the kind that central bankers and policymakers abhorred. It was the productive advance of widespread adoption of technology and innovation, the beneficial pattern of the rise in living standards that economists also associated with their inflation calculations. As long as both living standards and inflation were rising, with the first more than the second, that would mean never Japan.

Deflation is dangerous, on the other hand, when it reflects a sharp slump in demand, excess capacity and a shrinking money supply—as in the early 1930s. In the four years to 1933, American consumer prices fell by 25% and real GDP by 30%. Runaway deflation of this sort can be much more damaging than runaway inflation, because it creates a vicious spiral that is hard to escape.

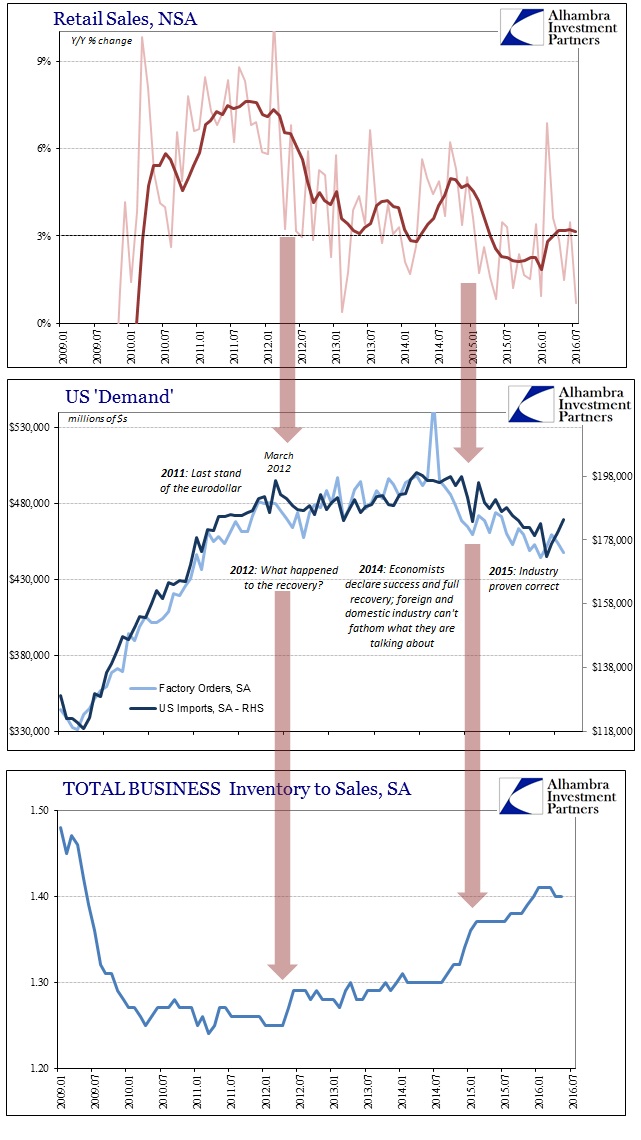

But is that the only definition that fits with global reality? I believe that is just the sort of rigid definition that is preventing widespread realization of what is happening to the world of the middle 2000’s onward. All those symptoms are absolutely present and even readily and easily identified: slump in demand, excess capacity, and shrinking money supply. Economists will fight over that last one, especially taking account of QE’s, but even their resistance is easily overcome by using the criteria of one of their own (below).

The difference between today and the 1930’s seems to be nothing more than magnitude. As the quote above recalls, prices fell sharply, unbelievably so, in the 1930’s because money supply fell sharply before them. The economics of fear that Uchitelle was writing about was for the most part due to these massive declines that shocked consumers into long-lived behavioral changes. But can we also find these symptoms where the negatives in money and even prices are far gentler?

That was what economists truly missed about Japan in the 1990’s. Its deflation was nothing like the US in the 1930’s, yet the economy there persisted in its slow burn decline for more than a decade. No matter what monetary policy or the ceaseless fiscal “investment” of doing nothing in as many places as possible, the lack of success there was what got economists to start revisiting the topic in the first place.

The leverage and ability of central banks through monetary policy was thus called into question. Though reluctant in general public, internally there was great debate about how monetary policy actually worked. In a relatively well-known inside paper published in the Journal of Economic Perspectives in its Fall 1995 issue, authors Ben S. Bernanke (yes, that Ben Bernanke) and Mark Gertler attempted to fill in the gaps between monetary policy and the longer run effect on the real economy. Trying to work themselves Inside the Black Box, as the paper was titled, Bernanke and Gertler start by acknowledging what many outside of monetary economics might take for granted even today.

There is far less agreement, however, about exactly how monetary policy exerts its influence: the same research that has established that changes in monetary policy are eventually followed by changes in output is largely silent about what happens in the interim. To a great extent, empirical analysis of the effects of monetary policy has treated the monetary transmission mechanism itself as a “black box.”

To illustrate and perhaps illuminate how A (change in money) becomes B (change in economy), the authors state what they claim are several facts.

Fact 1: Although an unanticipated tightening in monetary policy typically has only transitory effects on interest rates, a monetary tightening is followed by sustained declines in real GDP and the price level.

Fact 2: Final demand absorbs the initial impact of a monetary tightening, falling relatively quickly after a change in policy. Productivity follows final demand downward, but only with a lag, implying that inventory stocks rise in the short run. Ultimately, however, inventories decline, and inventory disinvestment accounts for a large portion of the decline in GDP.

Fact 3: The earliest and sharpest declines in final demand occur in residential investment, with spending on consumer goods (including both durables and non-durables) close behind.

Fact 4: Fixed business investment eventually declines in response to a monetary tightening, but its fall lags behind those of housing and consumer durables and, indeed, behind much of the decline in production and interest rates.

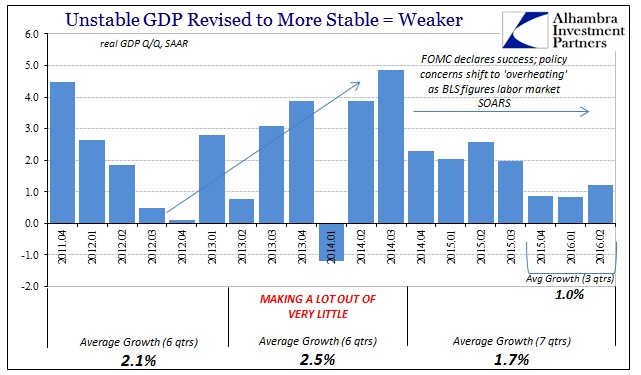

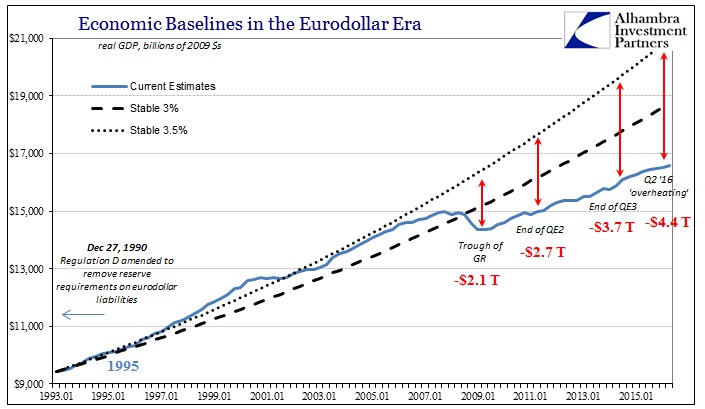

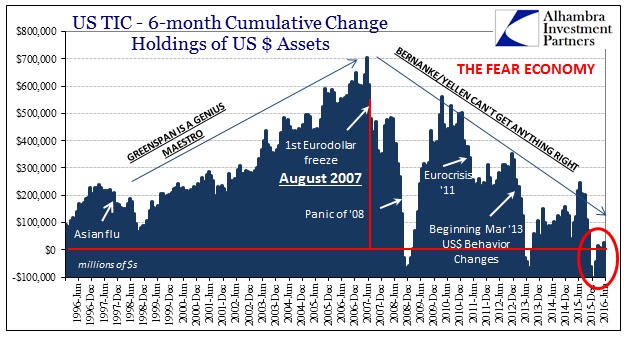

Though that was written in 1995 about a generic economy responding to monetary tightening as a matter of policy, it is almost spot on to the economy we see right now as it has responded globally to the “rising dollar” and tight money environment that has come with it. More amazing, however, is how the very same set of “facts” also describes the longer run global economy post-August 2007. In other words, tightening within tightening. We might quibble about the order as, for example, in the initial stages of what is now this “rising dollar” the earliest and sharpest declines were not residential investment, but overall these very processes are playing out right before our eyes (up to the inventory liquidation point, though that keeps being indicted by persistent recessionary imbalance).

Even real GDP has fallen in line with and in sight of monetary tightness – both as a matter of the aftermath of the eurodollar crisis 2007-09 and the most recent amplification after the middle of 2014.

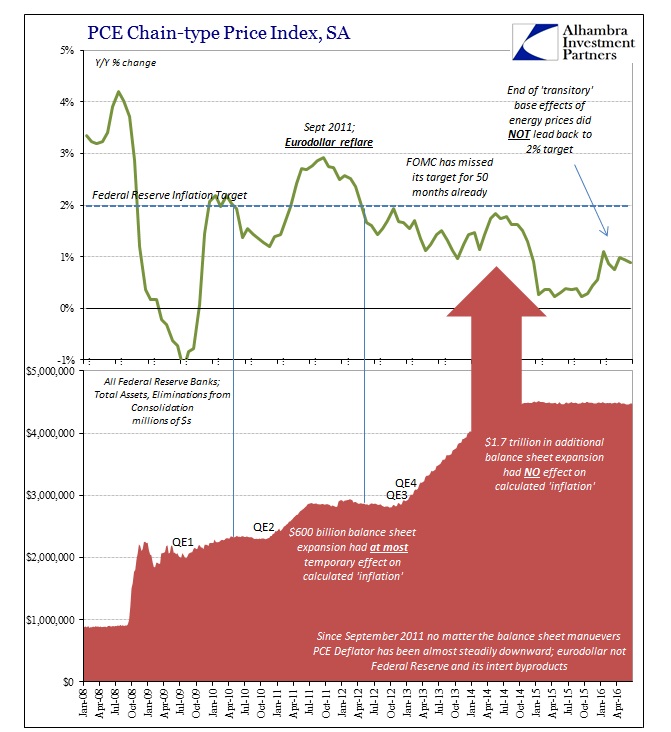

However, this view from inside the “black box” exposes the current state of economic theory to two major fallacies. The first is the reason that deflation theory fell into disuse in the first place; namely the idea that any central bank committed to a small amount of inflation will both get it and that will be sufficient margin to prevent the “fear economy” of persistent overcapacity and the sustained slump in demand that monetarily creates it. On this count we need only remind ourselves of Alan Greenspan’s confession from June 2000:

The problem is that we cannot extract from our statistical database what is true money conceptually, either in the transactions mode or the store-of-value mode. One of the reasons, obviously, is that the proliferation of products has been so extraordinary that the true underlying mix of money in our money and near money data is continuously changing. As a consequence, while of necessity it must be the case at the end of the day that inflation has to be a monetary phenomenon, a decision to base policy on measures of money presupposes that we can locate money. And that has become an increasingly dubious proposition.

Unfortunately for economists, this lack of clarity on money was also a very prominent feature in Japan’s as-yet unsolved struggle. Quite simply, if money isn’t what central banks believe is money, then the surety of insurance in a “little inflation” isn’t surety at all; it is instead quite dubious perhaps more a matter of coincidence than intent (eurodollar rises, central banks look good no matter what they do; eurodollar falls, central banks fail no matter what they do). Bernanke, as the others, viewed money supply as a direct extension of monetary policy, but the implications of what Greenspan was saying fundamentally alters that very proposition. Inflation would still be a monetary phenomenon, but it was no longer just a matter of intentional policy; and thus deflation, or the potential for harmful disinflation, which is what we are really talking about today, would likewise be a probability or property no longer exclusively related to central banks.

The second fallacy is how all that might manifest as different from the Great Depression or other past eras of unusual money tightness. There is every reason to suspect that monetary innovation and changes have increased the flexibility by which the money and banking could absorb “tightness” such that it need not turn into the worst of the worst cases; 25% declines in prices and 37% declines (as Milton Friedman calculated of the collapse portion of the Great Depression) in overall money supply. But this would create a new set of challenges whereby symptoms are far more ambiguous; an obvious monetary collapse leaves little argument for cause and effect. Gentle money tightening would confuse economists with the “strange” or “unexpected” inability of intentional policy, no matter how intense and large, to hit the inflation target or to escape the low growth “trap.”

Thus, the trap is not anything like a liquidity trap but rather confusion over what is actually causing the lingering and seemingly intractable malfunction – all symptoms of what ailed Japan in the 1990’s. Even Milton Friedman got it wrong after being right, exhorting the Bank of Japan to alleviate money tightness in the real economy (correct; the interest rate fallacy) by drastically increasing the level of bank reserves (incorrect; QE had no effect because money wasn’t the same money).

If it walks like a duck and quacks like a duck it is not in search of the right mix or level of monetary policy. We find the symptoms of monetary tightness all over the world but economists keep making the same mistakes that they made when almost twenty years ago they said it could not possibly happen here. It did. And here we are. It’s not the 1930’s, but that is so very small comfort and had even less to do with central banks and economists.

The post The Fear Economy: It Couldn’t Possibly Happen Here But It Did appeared first on crude-oil.top.