Submitted by David Stockman via Contra Corner blog,

In Part 1 we established the rather obvious point that in today’s world of flexible just-in-time production, hours-based labor scheduling and gig-based employment patterns, there is really no such standardized labor unit as a “job”.

Accordingly, the headcount-centered metrics of the BLS, such as the U-3 unemployment rate and the nonfarm payroll numbers, are a relic of a half-century ago world of mines, factories, warehouses and retail shops where a 40+ hour workweek on a year round basis was the standard practice.

In that context, a simple paint-by-the-numbers exercise demonstrates the foolishness of the Fed’s obsession with hitting a quantitative “full employment” target. Since the latter entails gunning the financial markets with monetary “stimulus” until every last iota of “slack” has been drained from the labor market, the question answers itself when viewed in an hours based framework.

To wit, the US working age population between 16 and 65 totals 205 million, meaning that on a standard work year basis of 2000 hours, the potential labor force amounts to 410 billion hours. However, according to the BLS’ own data, only 230 billion labor hours are currently being utilized by the US economy from that potential hours pool.

So all things being equal the unemployment rate is actually 44%!

The point, of course, is that virtually everything which impacts the 180 billion hours gap between potential and actual hours employed is beyond the reach of monetary policy. For instance, about 18 billion hours are removed from productive employment by social security disability recipients and 40 billion potential labor hours are unavailable owing to young adults enrolled in higher education.

Yet neither of these represent unchanging “natural” rates of unavailable labor supply. In fact, they are heavily impacted by public policies originating outside of the central bank, and which can change significantly over modest periods of time.

For instance, the ratio of disabled workers to the population aged 16-65 rose from 2.82% in 2000 to 4.34% at present. That gain is primarily due to the relaxation of eligibility standards for qualification in such areas as “back pain” and bureaucratic drift toward higher rates of favorable case determinations.

Thus, at the 2000 disability ratio of 2.82% there would currently be 5.8 million workers on the rolls or 11.5 billion unavailable labor hours. That compares to the actual level of 9 million workers on disability and 18 billion unavailable hours.

Needless to say, in the scheme of things the 6.5 billion hours lost to higher disability rates is not a trivial difference. It represents the equivalent of 3.7 million nonfarm payroll jobs. That’s more new jobs than have been celebrated on Jobs Friday for the last 18 months running.

The story is similar with the 40 billion labor hours not available owing to the 20 million students enrolled in higher education. In this case, the enrollment rate for the prime student age population (18 to 24 years) has risen from 35.5% in 2000 to about 40.5% at present.

Yet it is surely the case that the liberalization of the Pell Grant program and the eruption of student debt outstanding from about $150 billion to $1.3 trillion during the last 15 years has had a powerful impact on that gain. Accordingly, a reasonable estimate is that the massive ratcheting-up of state aid for higher education has caused a minimum of 4 billion labor hours to exit the jobs market.

Moreover, that begs the question as to the appropriateness and efficacy of the underlying public policy bias in favor of massive state support for 4-year higher education. Arguably, one-third or more of college students would be better served by on-the-job vocational training.

Accordingly, at the very time the central bank is operating its primitive “stimulus” tools in overdrive in order to push labor utilization higher, a countervailing set of state policies has the effect of pulling upwards of 15 billion labor hours out of the labor market.

Indeed, the impossibility of defining the “potential” labor supply at any given moment in time, let alone causing it to be fully employed through the primitive instruments of interest rate pegging and yield curve repression (i.e. quantitative easing), is illustrated in this context by a simple counterfactual.

Currently, student loan disbursements amount to $100 billion per year, Pell and related grants total about $40 billion and college work-study programs amount to about $4 billion (including state and college matching).

Just assume half of these grants and loans—or $70 billion per year—-were accompanied by a work requirement similar to the traditional work-study program (@20 hours per week). Presto, the potential labor supply would enlarge by upwards of 5 billion hours (500 hours per school year per student).

Beyond the impossibility of defining the potential labor supply and the complex multitude of factors which drive utilization rates, there is also the fact that in many instances it is none of the state’s business in the first place.

For example, there are 36.5 million women with children under 18 in the US today. Approximately 24.2 million or 66% of them are employed in the monetary economy and are counted in the labor force by the BLS.

At the same time, 12.3 million have chosen to stay at home and work in the unmonetized household economy, raising their children and keeping house. Self-evidently, cultural values and personal considerations far more than economics account for the removal of these 25 billion potential labor hours from the labor market.

More importantly, the impact of these largely private choices on the size of the potential labor force have varied substantially over time. I few decades ago, stay-at-home moms accounted for 40 billion labor hours which were unavailable to the monetary economy——-and which were therefore invisible to the headcount estimators at the BLS and the full-employment gunslingers at the Fed.

On the other end of the scale, there are also numerous examples of improper state interventions which powerfully impact the demand for labor hours offered by potential workers.

The current trend toward sharp increases in state and city minimum wages, for example, is reducing the demand for labor hours, and accelerating the substitution of automation and robots for low wage labor. When fully implemented, these misguided intrusions in the wage setting process will easily reduce demand for low-skill labor by billions of hours per year.

At the end of the day, therefore, the labor hours utilization rate is an outcome, not a proper or viable target of monetary policy or any other intervention of the state.

Instead, it is the happenstance result of the unfathomable interactions of taxes, welfare, trade, economic regulation, cultural preferences, demographics and the underlying efficiency and entrepreneurial dynamics (or lack thereof) of the market economy.

While the Fed claims that the Humphrey-Hawkins Act makes them pursue the impossibility of full employment labor utilization, that is specious nonsense. The statute is purely aspirational and content free on the quantitative measurement of “maximum employment”.

In fact, draining the labor slack from the bathtub of full employment GDP is just a pretext for what really motivates present day monetary policy. Namely, the Keynesian presumption that the business cycle is inherently unstable without the ministrations of the state, and that the tools of monetary policy need be deployed on a continuous and aggressive basis to prevent capitalism from lapsing into underperformance, slumps, recessions and worse.

That predicate, of course, is dead wrong. Every one of the 10 business cycle contractions since WWII have been caused by state action.

Two of these were owing to the sudden cooling of the economy after a war spending mobilization, as in the case of the recession after the Korean War in 1953 and the 1970 recession after the drawdown in Vietnam. The others were caused by the bursting of a central bank fueled credit bubble.

The deep recession of 1974-1975, for instance, was caused by the prior runaway growth of bank credit enabled by the money printing policies of Arthur Burns. As I detailed in The Great Deformation, during the 1972-1973 peak of monetary ease designed to put Nixon back in the White House, US bank credit erupted at a 30% annual rate.

At length the Fed was forced to throw on the brakes to prevent an inflationary blow-off—even after the US economy was throttled by Nixon’s wage and price control apparatus. By early 1975 the rate of bank credit growth had slowed to less than 3%, thereby generating a sharp curtailment of credit fueled household and business spending.

But that wasn’t evidence of capitalism’s inherent cyclical instability; it was proof of the folly of activist central banking under the post-Camp David regime of unanchored fiat money.

In any event, even the furtive efforts of the Fed to manage the credit cycle prior to the Greenspan era are no longer plausible. That’s because the crude instrument of manipulating the Federal funds rate to induce households and businesses to borrow and spend more than they would otherwise doesn’t work under the post-2007 condition of Peak Debt.

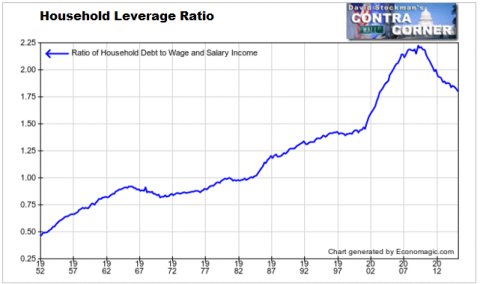

As we keep insisting, the major portion of Fed “stimulus” prior to the great financial crisis was actually nothing more profound than the ratcheting up of household leverage ratios to more than triple their stable pre-1980 levels. Over the period from 1970 to 2008, in fact, the Fed induced the nation’s households to undergo a cheap money driven LBO.

As is evident in the above graph, we are now in the payback phase of the great credit supercycle. Accordingly, the credit channel of monetary stimulus is blocked, over and done.

The Fed’s massive injections of liquidity into the financial system, therefore, never leave the canyons of Wall Street. They neither stimulate main street spending and output nor push the consumer prices higher toward the Fed’s arbitrary 2% target.

Instead, in the name of full employment labor utilization and filling the Keynesian bathtub of potential GDP full to the brim, 90 months of ZIRP and $3.5 trillion of balance sheet expansion via QE have simply inflated financial asset prices to the nosebleed section of history relative to income and growth. The Fed has thereby generated still another giant financial bubble that will inexorably collapse on its own weight.

That day is coming soon and will come as another shocking surprise to both the denizens of the Eccles Building and the gamblers still left in the Wall Street casino. Owing to their mutual presumption that the Fed’s lunatic policies have actually worked and that something again to the nirvana of Keynesian full employment is close at hand, they are utterly blind to the facts of approaching recession.

Yet when it becomes no longer deniable, the market will panic because the god of central bank stimulus will have self-evidently failed once again. In the meanwhile, the level of incredulity among the Cool-Aid drinkers becomes ever more remarkable.

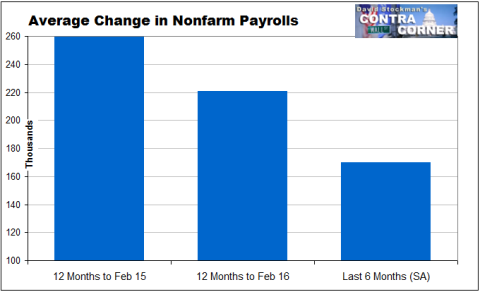

Even the BLS establishment survey——-a lagging indicator that is deeply flawed——indicates that US economy is cooling at a rapid rate. Indeed, the rate of gain during the last three months has slowed to 115,000.

But there is even more. The Fed itself has developed a composite labor market conditions index which combines data from approximately 19 series. During the last cycle, this index began turning down in January 2007. That was 12 months before the recession officially began, 14 months before the level of jobs in the nonfarm payroll report began to fall, and 20 months before the Wall Street meltdown in September 2008.

The fact is, the same pattern has materialized once again. The labor market conditions index began to rollover more than two years ago. And after stabilizing during mid-2015, it has resumed its downward course—–just as the rate of monthly gain in the establishment survey has begun to decisively weaken.

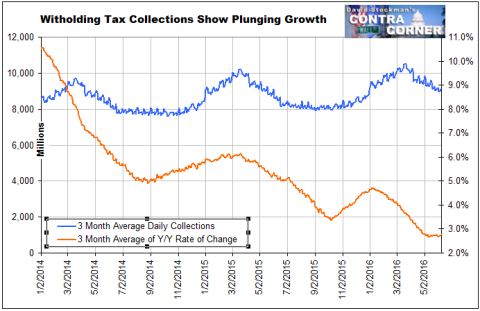

As we have frequently noted, there is one indicator of business conditions and the labor market situation that suffers no distortion owing to statistical artifacts like the BLS’ faulty season maladjustments and its obsolete birth-death model. To wit, the daily payroll withholding collections of the US Treasury Department.

As shown in the graph below, the smoothed three-month rolling average rate of gain has slowed sharply. After rising by nearly 10% over prior year in early 2014, the year-over-year rate of gain declined to the 4-5% range last year, and is now increasing at only 2.8%.

Given that hourly wage gains are running in the 2.0-2.5% range, the implied rate of growth in actual labor hours employed has slumped close to zero. That is, employers are sending in withholding payments from an economy that is operating at stall speed, at best.

Needless to say, the Fed has pumped the third financial bubble of this century with even more reckless abandon than it did during the dotcom boom and the housing boom.

For the time being, that has led to a massive $40 trillion gain in the value of financial assets held by US households——-85% of which are attributable to the top 10%of households.

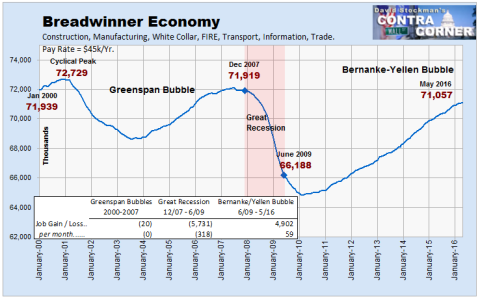

The same cannot be said for labor—-notwithstanding the Fed’s preoccupation with full-employment. In fact, there were nearly 2 million fewer full-time, full-pay “breadwinner jobs” in the US during May than there were in January 2001.

As we said in the beginning of Part 1, there is a huge irony here. Wealthy households—and especially Wall Street speculators and the 1%—– have never had it so good. And its all owing to the opening that two left/labor politicians gave to power-aggrandizing central bankers nearly four decades ago.

Hubert Humphrey and Augustus Hawkins are surely rolling in their graves.

The post The Fed Has Whiffed Again – Massive Monetary Stimulus Has Not Helped Labor, Part 2 appeared first on crude-oil.top.