Submitted by Charles Hugh-Smith of OfTwoMinds blog,

This predatory exploitation is only possible if the central bank and state have partnered with financial Elites.

After decades of denial, the mainstream has finally conceded that rising income and wealth inequality is a problem–not just economically, but politically, for as we all know wealth buys political influence/favors, and as we'll see below, the federal government enables and enforces most of the skims and scams that have made the rich richer and everyone else poorer.

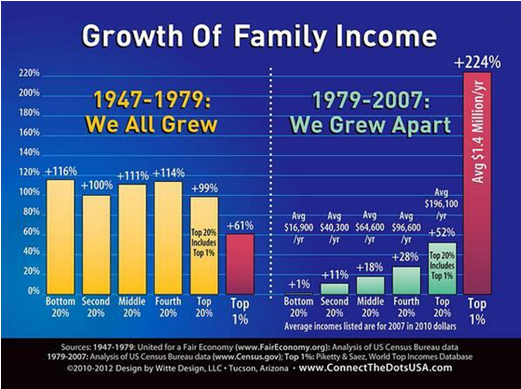

Here's the problem in graphic form: from 1947 to 1979, the family income of the top 1% actually expanded less that the bottom 99%. Since 1980, the income of the 1% rose 224% while the bottom 80% barely gained any income at all.

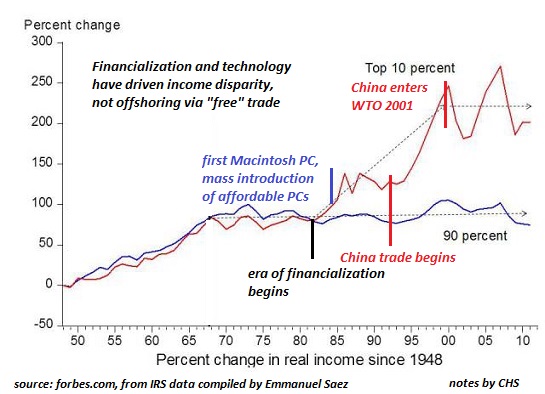

Globalization, i.e. offshoring of jobs, is often blamed for this disparity, but as I explained in "Free" Trade, Jobs and Income Inequality, the income of the top 10% broke away from the bottom 90% in the early 1980s, long before China's emergence as an exporting power.

Indeed, by the time China entered the WTO, the top 10% in the U.S. had already left the bottom 90% in the dust.

The only possible explanation of this is the rise of financialization: financiers and financial corporations (broadly speaking, Wall Street, benefited enormously from neoliberal deregulation of the financial industry, and the conquest of once-low-risk sectors of the economy (such as mortgages) by the storm troopers of finance.

Financiers skim the profits and gains in wealth, and Main Street and the middle / working classes stagnate. Gordon Long and I discuss the ways financialization strip-mines the many to benefit the few in our latest conversation (with charts): Our "Lawnmower" Economy.

Many people confuse the wealth earned by people who actually create new products and services with the wealth skimmed by financiers. One is earned by creating new products, services and business models; financialized "lawnmowing" generates no new products/services, no new jobs and no improvements in productivity–the only engine that generates widespread wealth and prosperity.

Consider these favorite financier "lawnmowers":

1. Buying a company, loading it with debt to cash out the buyers and then selling the divisions off: no new products/services, no new jobs and no improvements in productivity.

2. Borrowing billions of dollars in nearly free money via Federal Reserve easy credit and using the cash to buy back corporate shares, boosting the value of stock owned by insiders and management: no new products/services, no new jobs and no improvements in productivity.

3. Skimming money from the stock market with high-frequency trading (HFT): no new products/services, no new jobs and no improvements in productivity.

4. Borrowing billions for next to nothing and buying high-yielding bonds and investments in other countries (the carry trade): no new products/services, no new jobs and no improvements in productivity.

All of these are "lawnmower" operations, rentier skims enabled by the Federal Reserve, its too big to fail banker cronies, a complicit federal government and a toothless corporate media.

This is not classical capitalism; it is predatory exploitation being passed off as capitalism. This predatory exploitation is only possible if the central bank and state have partnered with financial Elites to strip-mine the many to benefit the few.

This has completely distorted the economy, markets, central bank policies, and the incentives presented to participants.

The vast majority of this unproductive skimming occurs in a small slice of the economy–yes, the financial sector. As this article explains, the super-wealthy financial class Doesn’t Just Hide Their Money. Economist Says Most of Billionaire Wealth is Unearned.

"A key empirical question in the inequality debate is to what extent rich people derive their wealth from “rents”, which is windfall income they did not produce, as opposed to activities creating true economic benefit.

Political scientists define “rent-seeking” as influencing government to get special privileges, such as subsidies or exclusive production licenses, to capture income and wealth produced by others.

However, Joseph Stiglitz counters that the very existence of extreme wealth is an indicator of rents.

Competition drives profit down, such that it might be impossible to become extremely rich without market failures. Every good business strategy seeks to exploit one market failure or the other in order to generate excess profit.

The bottom-line is that extreme wealth is not broad-based: it is disproportionately generated by a small portion of the economy."

This small portion of the economy depends on the central bank and state for nearly free money, bail-outs, guarantees that profits are private but losses are shifted to the taxpaying public–all the skims and scams we've seen protected for seven long years by Democrats and Republicans alike.

Our "Lawnmower Economy" (with host Gordon Long; 26:21 minutes)

The post The Root Of Rising Inequality: The “Lawnmower” Economy (And You’re The Lawn) appeared first on crude-oil.top.