Submitte dby David Stockman via Contra Corner blog,

The approximate hour Janet Yellen spent wandering in circles and spewing double talk during her presser yesterday was time well spent. When the painful ordeal of her semi-coherent babbling was finally over, she had essentially proved that the Fed is attempting an impossible task.

And better still, that the FOMC should be abolished.

The alternative is real simple. It’s called price discovery on the free market; it’s the essence of capitalism.

After all, the hot shot traders who operate in the canyons of Wall Street could readily balance the market for overnight funds. They would do so by varying the discount rate.

That is, they would push the rate upwards when funds were short, thereby calling-in liquidity from other markets and discouraging demand, especially from carry trade speculators. By contrast, when surplus funds got piled too high, they would push the discount rate downward, thereby discouraging supply and inciting demand.

Under such a free market regime, the discount rate might well be highly mobile, moving from 1% to 10% and back to 1%, for example, as markets cleared in response to changing short-term balances. So what?

Likewise, the world is full of long-term savers like pension funds, insurance companies, bond funds and direct household investors on the supply side, and a long parade of sovereign, corporate and household borrowers on the demand side.

Through an endless process of auction, arbitrage and allocation, the yield curve would find its proper shape and levels. And like in the case of a free market in money, the yield curve of the debt market would undulate, twist, turn and otherwise morph in response to changing factors with respect to supply of savings and demands for debt.

It goes without saying that under such a regime, savers would be rewarded with high rates when demands for business investment, household borrowings and government debt issuance were large. At the same time, financial punters, business speculators, household high-livers and deficit-spending politicians alike would find their enthusiasm severely dented by high and rising yields when the supply of savings was short.

What would be the harm, it must be asked, in letting economic agents in their tens of millions bid for savings in order to find the right price of debt capital at any given time as opposed to concentrating the task on 12 people who, as Janet Yellen admitted yesterday, can’t possibly figure it out, anyway?

There are three reasons given as to why capitalism’s monumental and crucial tasks of setting the price of money and debt cannot be trusted to the free market. But all of them are wrong; all of them are a variation of the giant Keynesian error that capitalism self-destructively tends toward entropy absent the ministrations of the state, and especially its central banking branch.

The three cardinal errors of which we speak are the claim that 1) debt is the keystone to prosperity, 2) the business cycle is inherently unstable and bleeds the economy of growth and wealth and 3) active central bank intervention is needed to stop bank runs and financial crises from spiraling into catastrophe.

Let’s start with the third claim. It’s the fear of financial contagion and catastrophe of the type which allegedly arose in September 2008 that is the bogeyman which ultimately undergirds the current cult of Keynesian central banking.

In a word, we didn’t need Ben Bernanke and his self-proclaimed courage to print—–and wildly and excessively so, as it happened.

Recall that the Fed’s balance sheet was about $900 billion before the Lehman meltdown, and it had taken 94 years to get there. The Bernanke Fed printed another $900 billion in just seven weeks after Lehman and $1.3 trillion more before Christmas eve that year.

In the process, any crony capitalist within shouting distance of the canyons of Wall Street got bailed out with ultra-cheap credit from the Fed’s alphabet soup of bailout lines.

Among these was the $600 billion AAA balance sheet at General Electric where CEO Jeff Imelt’s bonus would have been jeopardized by spiking interest costs on his imprudently issued $90 billion in short-term commercial paper. Ben had the courage save Imelt’s bonus by funding him at less than 4%.

He also had the courage to fund Morgan Stanley to the tune of $100 billion in cheap advances and guarantees. That gift kept this insolvent Wall Street gambling outfit alive long enough for CEO John Mack to jet down to Washington where he got short-sellers outlawed and collected a $10 billion TARP bailout—-and all in less than two weeks!

Well, there is a better answer and it requires no FOMC, Ben Bernanke or specious courage to rescue crony capitalist bandits like John Mack and Jeff Imelt.

It is called mobilizing the discount rate. Implementation only takes green eyeshades. Accountants.

Indeed, no Harvard, Princeton or even University of Chicago PhDs need apply.

For all the false jawing about Walter Bagehot’s rules for stopping a financial crisis, a mobilized discount rate, not a hyperactive FOMC running around with hair afire and monetary fire hoses spraying randomly, is actually what he had in mind.

To wit, Bagehot actually said that during a crisis central banks should supply funds freely at a penalty spread over a market rate of interest secured by sound collateral.

You don’t need macroeconomic modelers with PhDs in econo-algebra to do that. You need accountants who can drill deep into balance sheets and examine the collateral; and then clerks who can query the market rate of interest, add say 300-400 basis points of penalty spread, and hit the send bottom to eligible banks which have posted approved collateral.

Indeed, this was the sum and substance of the Fed’s original design by Carter Glass, the great financial statesman who authored it. That’s why he had 12 Reserve Banks domiciled in the different economic regions of the country and an essentially honorific but powerless board in Washington DC.

The latter had no remit to target macroeconomic variables like jobs, inflation, retails sales, housing starts or industrial production. It was not charged with managing, countering, flattening, or abolishing the business cycle. It could not even own government debt, and 91.7% (11/12) of its operations were to be conducted in the 11 regional banks away from Wall Street.

In short, the purpose of the Fed was actually to be a classic lender of last resort. Carter Glass called it a “banker’s bank”. Its job was liquefying the banking system on a decentralized basis, not monetary central planning or Keynesian macro-economic management.

Accordingly, the balance sheet of the Federal Reserve System was not intended to be a proactive instrument of national economic policy. It was to passively reflect the ebb and flow of industry and commerce. The expansion and contraction of banking system liquidity needs would follow from the free enterprise of business and labor throughout the nation, not the whims, guesstimates, confusions, and blather of a 12-person FOMC.

Needless to say, under the mobilized discount rate regime and Banker’s Bank that Carter Glass intended, the outcomes during the 2008 financial crisis would have been far different. Bear Stearns was not a commercial bank, and would not have been eligible for the discount window. It would have been liquidated, as it should have been, with no harm done except to the speculators who had imprudently purchased its commercial paper, debt and equity securities.

Likewise, Morgan Stanley was insolvent and its doors would have been closed on September 25, 2008. That is, long before John Mack could have gotten the short-sellers of his worthless stock banned or collected his $10 billion gift from Hank Paulson.

Needless to say, the world would have little noted nor long remembered the chapter 11 filing of what was (and still is) a notorious gambling house. Likewise, GE would have paid a 10% or even 20% interest rate for its commercial paper refunding, thereby dinging its earnings by a quarter or two and Jeff Imelt’s’ bonus that year.

So what?

In a word, what happened in the run-up to the great financial crisis and its aftermath never would have occurred under a mobilized discount rate regime conducted by a Banker’s Bank. Funding costs in the money markets would have soared, causing speculators who had invested long and illiquid and borrowed cheap and overnight to be carried out on their shields.

That’s exactly what happened during the great financial panic of 1907 when interest rates soared to 20% and even 60% of some days of extreme money market stress.

As it happened, the market cleared out the speculators and hopelessly insolvent, like the copper kings and real estate punters of the day. At the same time, JP Morgan and his syndicate of bankers with their own capital on the line, re-liquefied the solvent supplicants who came to Morgan ‘s library on Madison Avenue—–but only after their green eyeshades had spent long nights proving up solid collateral for JP Morgan’s liquidity loans.

By 1910 American capitalism was again booming. No Fed. No Bernanke. No harm done.

So in 2008, the money markets would have cleared, and any temporary expansion of the Fed’s balance sheet would have immediately shrunk once the crisis was over, and the discount loans were repaid. And, yes, at 10%, 20% or even 50% and a penalty spread to boot, they would have been paid off real fast.

That’s what a real lender of last resort would look like. Janet Yellen’s crony capitalist flop house is its very opposite.

As to the second proposition—–that debt is the keystone to prosperity—-that was true in a bad sort of way, but not any more. That’s because debt does not ultimately expand economic activity and wealth; it just pulls it forward in time, leaving the future to reckon with the morning after.

The chart below tells the story in a nutshell. Prior to 1970 the ratio of total debt in the US—-government, household, business and financial—-was about 1.5X national income or GDP. Other than a modest fluctuation in the early 1930s when the denominator (GDP) collapsed during the Great Depression, the nation’s aggregate leverage ratio oscillated around this golden mean through boom and bust, war and peace.

More importantly, immense output growth, technological progress, capital investment and living standard gains were made during that period with out any permanent change in the 1.5X leverage ratio. For a century, American capitalism thrived without stealing growth and prosperity from the future through the Keynesian parlor trick of ratcheting up the national leverage ratio.

Once the Fed was liberated from the yoke of Bretton Woods and the redeemability of dollars for gold by Nixon’s folly at Camp David in August 1971, however, financial history broke into an altogether new channel.

What happened was a rolling national LBO. As shown in the chart below, total debt outstanding soared from $1.6 trillion to $64 trillion or by 40X. By contrast, but nominal GDP expanded by only 16X.

Accordingly, the nation’s leverage ratio soared from its historical groove around 1.5X to 3.5X. That’s massive; it’s two extra turns of debt on national income. At the old pre-1971 ratio, which had been proved by a century of prosperity, total debt outstanding today would be only $27 trillion.

To wit, the American economy is now lugging around about $35 trillion of extra debt. Yet the results are unequivocal. The trend rate of real GDP growth has been heading steadily lower since the 1960s. More debt ultimately means less growth, not more.

Thus, during the period between 1953 and 1971, when the nation’s leverage ratio hugged closed to the 1.5X golden constant, real GDP growth averaged 3.8% per annum. During that period there was no acceleration of the leverage ratio, and therefore no temporary boost to spending derived from higher credit extensions rather than current production and income.

During the next three decades through the year 2000, by contrast, the national leverage ratio rose explosively. On the eve of Nixon’s Camp David follies in Q2 1971, total debt outstanding amounted to $1.7 trillion compared to GDP of $1.16 trillion. That meant the leverage ratio stood at 1.47X——-right in the heart of its historical channel.

In the interim there occurred the inflationary money printing era of the 1970s and the rise of the Greenspan easy money and wealth effects policies after 1987. Accordingly, by Q4 2000, total debt outstanding had soared to $28.6 trillion or to 2.73X the $10.5 trillion annual rate of GDP generated during that quarter.

Yet even as the nation’s debt ratio was soaring, the rate of real GDP growth slowed only modestly to 3.2% per annum. That’s because the sharp, one-time upward ratchet of the nation’s leverage ratio—–the first stage of its LBO—–did goose the growth rate by fueling household consumption with a massive gain in mortgage debt.

Greenspan proudly called this MEW or mortgage equity withdrawal. He argued that by extracting cash from their castles and using the proceeds for trips to the auto dealer lots, home improvement centers and Disneyworld, households were elevating their consumption levels and trigging a virtuous cycle of higher production, employment, output and wealth.

That is to say, having evolved from a gold bug to an ersatz Keynesian during his years in Washington, Greenspan was dead wrong. Some meaningful share of the 3.2% GDP growth during that three decade period was simply stolen from the future, and its not hard to see that the latter has already arrived.

The nation’s self-LBO was completed during the next 7 years. Total debt outstanding rose by a staggering $25 trillion to $53.6 trillion during that brief interval, but the expansion of nominal GDP was far more subdued. The latter rose by just $4.4 trillion to $14.8 trillion.

That meant the Keynesian parlor trick was rapidly loosing its potency. The national leverage ratio did get boosted from 2.73X to 3.61X during the final seven-year Greenspan/Bernanke credit party, but self-evidently it generated far less incremental GDP.

To wit, during the 1971 to 2000 period about $27 trillion of debt growth generated $9 trillion of GDP growth, representing a 3:1 ratio. By contrast, during the final 7 years of the Fed’s debt bubble, the ratio of new debt to GDP soared to just under 6:1.

But that wasn’t all. Even as it was taking more and more debt to generate a dollar of nominal income, the growth rate of real GDP was slowing further.

On a peak-to-peak basis between Q4 2000 and Q4 2007, real GDP growth averaged only 2.4% per year. The inevitable distortions, inefficiencies, misallocations and malinvestments generated by credit fueled growth were already catching up.

For all practical purposes, Peak Debt arrived during the final credit blow-off in 2007-2008. Since then, total debt outstanding has grown by another $10 trillion to $64 trillion, but the nation’s leverage ratio has stabilized in the nosebleed section of history at 3.5X national income.

Here’s the thing. The US economy is now deep in the payback phase of the great central bank credit bubble. Nominal growth of household spending now depends on current production and income; the Keynesian parlor trick of goosing consumption today by borrowing from the future is over and done.

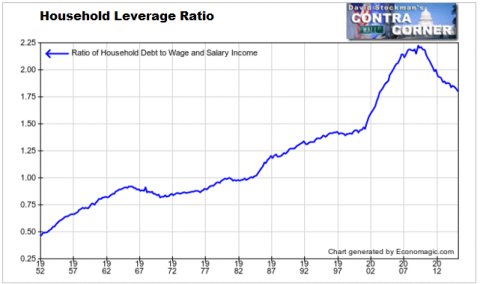

And since Keynesians believe that household consumption is the driving force of the economy, they are at an especially acute dead-end. Households not only reached Peak Debt in 2007-2008; they have been slowly ratcheting downward their leverage ratios of debt to wage and salary income ever since.

What had been stolen from the future is now being given back. Consumers could not shop the nation to prosperity if they wanted to.

Accordingly, real GDP has grown at only a 1.2% rate per annum since Q4 2007. That’s just 31% of the 3.8% annual growth rate generated during 1953-1971 by a US economy that had adhered to the golden leverage mean of 1.5X.

Needless to say, policymakers of that era—–most especially Fed Chairman William McChesney Martin, President Eisenhower, and even John Kennedy’s Treasury Department—–did not believe that rising debt was the keystone to prosperity. They feared it, and looked to the enterprise of business and labor on the free market to produce growth and prosperity.

Today’s FOMC, by contrast, is institutionally committed to this wrong headed proposition. After all, given 90 straight months of ZIRP and the fact that the FOMC has raised interest rates only once during its last 80 meetings, the implication is clear.

Janet Yellen and her destructive band of money printers self-evidently believe that left to its own devices free market capitalism would always generate interest rates that are too high, and therefore an economy that borrows too little and grows below its potential.

Based on the irrefutable historical record, of course, that’s rank nonsense. But it’s exactly what got us to Yellen’s pathetic babble-fest on Wednesday afternoon.

Finally, there is the strawman of business cycle instability. But every business cycle contraction since 1945 has been caused by the state and its central banking branch, not by some inner impulse in the free market toward underperformance, slumps, recessions and worse.

Thus, the recessions of 1953 and 1970 reflected the sudden cooling down of economies that had been mobilized red hot for the Korean and Vietnam wars. The modest GDP reductions during the subsequent 2-3 recession quarters in each case were caused by the sudden withdrawal of military spending and the resulting multiplier and adjustment effecst, not the inherent instabilities of market capitalism.

By contrast, the recessions of 1975, 1980-1982 and 1990-1991, 2001 and 2007-2009 were absolutely the handiwork of the Fed, not the free market. All five were preceded by periods of Fed enabled excessive credit growth that fueled unsustainable inflationary booms that had to be reeled in or they would have eventually crashed on their own accord. In fact, the last two did exactly that.

There is always the bogeyman of the Great Depression, which Keynesians resort to inevitably when all else fails. But that wasn’t caused by any death wish of capitalism, either.

As I demonstrated at length in The Great Deformation, it was first caused in the halls of parliament, which produced the carnage and monumental debt and inflation of the Great War. It was exacerbated by the folly of Versailles, which generated unpayable reparations debt and nationalistic resentments. And its arrival was guaranteed by the foolish efforts during the Roaring Twenties to restore prosperity and monetary stability on the cheap with easy money and subsidized exports.

In short, there is an alternative to Yellen’s Keynesian babble and the policies which fuel the Wall Street casino’s endless party for the 1% and the recurring financial market booms and busts. Even then, the latter take their toll on Flyover America far more destructively than on the fast money gamblers who always seem to get the word early and get out of the way in time; or get bailed-out like Jeff Imelt and John Mack, if they don’t.

So abolish the FOMC. Liberate interest rates and the yield curve so that the right price can be discovered on the free market. Restore the Banker’s Bank. Bring back the green eyeshades and a mobilized discount rate. Adopt Super Glass-Steagall and break-up the big financial conglomerates.

Finally, recognize that debt is not the keystone to prosperity and that if policy is to lean at all—–it must be in behalf of less debt, not more, as far as the eye can see.

The post There Is An Alternative To Yellen’s Keynesian Bubble – Stockman Rages “Abolish The Fed” appeared first on crude-oil.top.