The ECB will be the latest central bank to draw the attention of investors when it announces its monetary policy decision on Thursday and holds its corresponding press conference 45 minutes later.

The event often stokes volatility in the markets and I expect today to be no different, especially with there being so many questions regarding the future direction of monetary stimulus for the central bank. While policy makers may not see the need to announce any fresh measures at today’s meeting, the current quantitative easing program expires in six months’ time and so this will need to be addressed, preferably sooner rather than later so as to reassure the markets that this support is not going to be suddenly withdrawn.

While pushing this back, say another 12 months to March 2018, may seem a relatively simple process, the current structure of the program makes it far more complicated due to the availability of qualifying assets. The problem is believed to centre around the amount of qualifying German debt available for the ECB to purchase. In order to resolve the problem, the criteria needs to be adapted or the deposit rate cut, which would temporarily increase the amount of debt available for purchase and may then enable the program to be extended.

EUR/USD – Euro Climbs to 2-Week High Ahead of ECB Rate Decision

There are other options on the table but each of these comes with its own set of complications, most notably opposition from the German camp in regards to amending how much of each countries debt the ECB must purchase. As it is, the purchases are proportional to the size of the member country, which is where the problem of available German debt arises. Should this be changed or dropped altogether, it would allow the ECB to focus more on purchases of other higher yielding debt, potentially dragging down yields in the periphery even further and closing the gap on German yields. This move in particular is unlikely as it would face staunch opposition from certain policy makers as it would further blur the lines between monetary and fiscal support.

The chances are the ECB will do nothing today and continue to evaluate the best options for extending its QE program further in the coming months, while reassuring investors that the central bank will remain accommodative. The economic projections that will be released during the press conference are likely to be slightly worse than three months ago due to the Brexit vote, although probably not quite as much as may have been expected at the last meeting as the economy has thus far shown some resilience. For this reason, the ECB is likely to hold off on further stimulus via another avenue – such as more corporate bond buying – having unleashed the bazooka only six months ago.

Another focal point for traders today will be the EIA crude inventory numbers for last week after yesterday’s API report suggested there was a huge drawdown of 12.08 million barrels last week, despite expectations of a small build. Something in line with this would more than wipe out the increase in inventories over the last six weeks and cast doubt on just how oversupplied the market really is, unless of course a temporary supply disruption is responsible for the drawdown. Still, we could see another spike in oil prices should EIA report a similar number today.

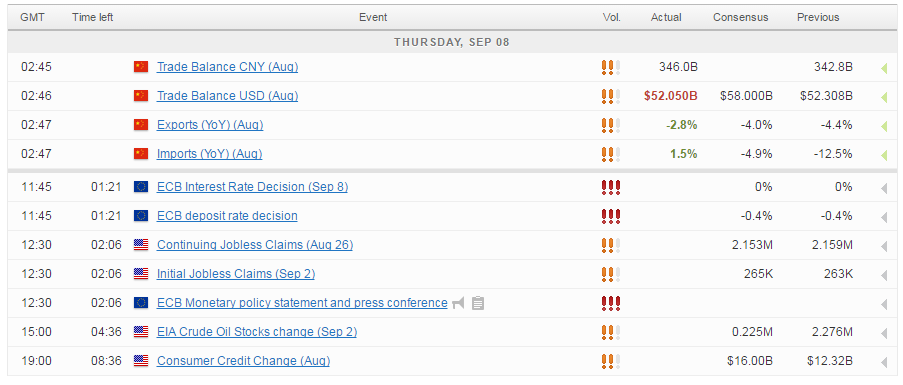

For a look at all of today’s economic events, check out our economic calendar.