US At Risk Of Being Shut Out Of Iran’s Opening-up Business

US investors are at risk of getting shut out of business deals in Iran while their European competitors have gotten a head start on billions of dollars in opportunities unlocked by the lifting of international sanctions.

“It seems like the U.S. might miss this opportunity because the Europeans are going to move regardless,” Hans Humes, Greylock’s CEO and Chairman who traveled to to Iran last June, said in an interview in Mexico City Saturday. “It almost doesn’t matter what the US does because once it starts opening up to Europe I think the economy in Iran will start to move.”

Foreign investors and multinationals are lining up to return to Iran after last year’s historic nuclear accord led to the lifting of international sanctions in January.

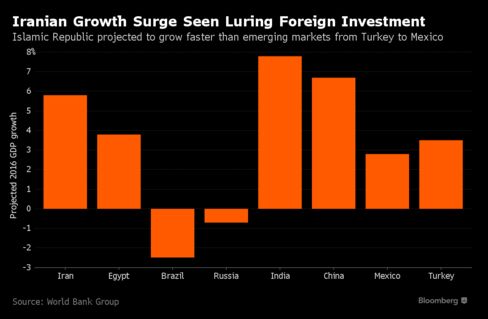

Until then, many firms were prevented from transferring money in and out of the Islamic Republic, whose $370-B economy is projected to grow 5.8% in Y 2016.

Changing the US Treasury Department’s Iran policy toward processing payments would “open things up,” said Mr. Humes. His New York-based hedge fund, which oversees about $1-B, focuses on distressed and high-yielding emerging-market debt.

The US severed ties with Iran a year after the Y 1979 Islamic revolution that toppled American ally Shah Mohammad Reza Pahlavi and led to the US embassy hostage crisis in Tehran.

US President Barack Hussein Obama initiated detente in Y 2013, eventually sealing an international accord with Iran sponsored by the world’s powers, despite Republican lawmakers’ opposition.

Republican presidential candidates Marco Rubio, Donald Trump and Ted Cruz have all pledged to either nullify or renegotiate the terms of the deal, which is pure campaign rhetoric.

Mr. Humes sees the biggest opportunities in Iran’s energy, infrastructure and corporate financial services.

He said that the investment opportunities may be worth “multiple tens of billions” of dollars in the next 5 to 10 years, assuming political stability.

“Everybody sees the opportunity in Iran,” he said. “It’s going to happen and the trigger for that will just be the payment system opening-up.”

Have a terrific weekend.

Paul Ebeling

HeffX-LTN

The post US At Risk Of Being Shut Out Of Iran’s Opening-up Business appeared first on Live Trading News.