A day after all three of the major indices closed at record highs, futures are pointing to a relatively flat open on Wall Street as focus turns to the US consumer ahead of the retail sales and sentiment figures.

It’s been a quiet week until today but finally we’ve had an influx of data from China and Europe and there’s still more to come from the US. The Chinese data overnight covering retail sales, fixed asset investment and industrial production disappointed across the board, falling short of expectations and heightening concerns about slowing growth. Yet, markets across Asia ended the week on a positive tone as weakness in the data just fuelled speculation that policy makers will jump to the rescue again with additional stimulus measures.

EUR/USD – Euro Listless after German GDP Meets Expectations

This sentiment did not spread to Europe though where indices are hovering around yesterday’s closing levels having not flinched at the GDP data from the euro area. Germany’s economy expanded at a much faster pace than was expected in the second quarter, recording annual growth of 3.1%, more than double that the consensus forecast. This more than offset the disappointing numbers from Italy which is continuing to contend with a banking crisis that is a major drag on the economy. The eurozone as a whole grew in line with expectations which the markets largely shrugged off.

AUD/USD – Aussie in Holding Pattern Ahead of Key US Retail Sales and CPI

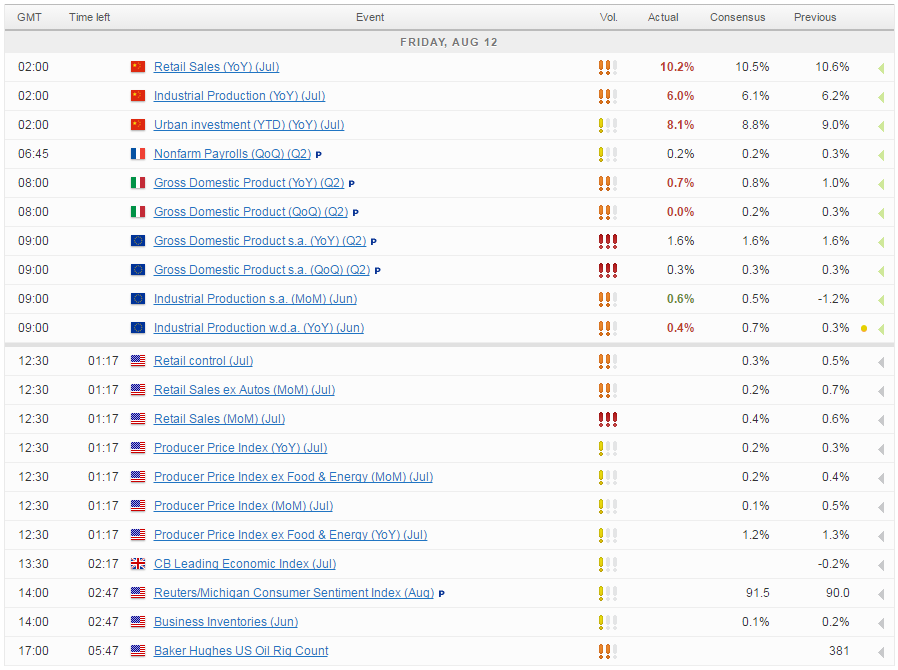

The US consumer will be under the spotlight now, with retail sales data for July due out ahead of the open followed by the UoM consumer sentiment reading shortly after. The consumer is of massive importance to the US economy so this data is always scrutinised more than most others. It’s been a few good months for the consumer and this is expected to have been extended into June, with sales seen rising 0.4%. If sentiment rises to 91.5 in August, as is expected, this would suggest the boost to consumer spending is not likely to ease off in the coming months. This is something the Fed will be paying close attention to also, with a hike this year still very much on the cards, especially as the labour market continues to perform well.

For a look at all of today’s economic events, check out our economic calendar.