December meeting more likely to showcase a US rate hike in 2016

The majority of major central banks have opted to exercise caution in September. The Bank of England (BoE), Reserve Bank of Australia (RBA), Bank of Canada (BoC) and European Central Bank (ECB) have kept rates unchanged. The Bank of Japan (BOJ) and the U.S. Federal Reserve will close out the month with uncertainties surrounding their respective monetary policy decisions.

Most investment strategists and economists are anticipating the Fed to hold the benchmark interest rate unchanged opting instead to tweak the Federal Open Market Committee (FOMC) statement and use the dot plot to signal a December rate hike. Fed Chair Yellen is expected to drive the message further during her press conference.

The U.S. Federal Reserve will publish the Federal Open Market Committee (FOMC) statement and economic projections on Wednesday, September 21 at 2:00 pm EDT. Fed Chair Janet Yellen will face the financial press at 2:30 pm EDT to give more insights into the Fed’s monetary policy statement.

The EUR/USD lost 0.136 in the last 24 hours. The single currency is trading at 1.1160 ahead of a central bank heavy Wednesday. Monetary policy decisions in Tokyo, Washington and Wellington will dictate the pace of global markets. The USD has appreciated versus the EUR as the European Central Bank (ECB) stood pat in September and while the majority of analysts expects the U.S. Federal Reserve to do the same the difference will be in the statement and comments. The ECB made no change and did not differ from its wait-and-see approach. The Fed is heavily anticipated to keep rates unchanged, but at the same time point to December FOMC as the most likely candidate for a rate hike.

The Bank of Japan (BOJ) is under pressure to deliver further easing even as members from the central bank are questioning the effectiveness of that strategy. Negative rates launched in January did not endear the CB with Japanese corporates but as per “leaks” and reports from media BOJ Governor Haruhiko Kuroda favours that tool over increasing the size of the bond and stock buying program. The USD/JPY has gained 0.072 in the last 24 hours. The JPY has appreciated since last week as there are doubts in the market about how bold the rhetoric from BoJ Governor Kuroda can be to avoid the currency trading under 100. Economists are having a hard time predicting the next step the Bank of Japan will take as there are few avenues open and none have a clear shot at delivering results. There has been talk about reducing the lofty 2 percent inflation target that was at the core of Shinzo Abe’s pledge with something more realistic.

Fed Divided on September versus December

FOMC meetings with press conference are always going to have an edge versus those that don’t as the U.S. central bank has concerns about how the market will react to monetary policy decisions. September was always one of the least desirable meetings due to being the last one ahead of the U.S. presidential elections. December even from earlier in the year had the feeling of a token rate hike as it would be a repeat of last year when the central bank exasperated markets with the promise of multiple rate hikes that never materialized.

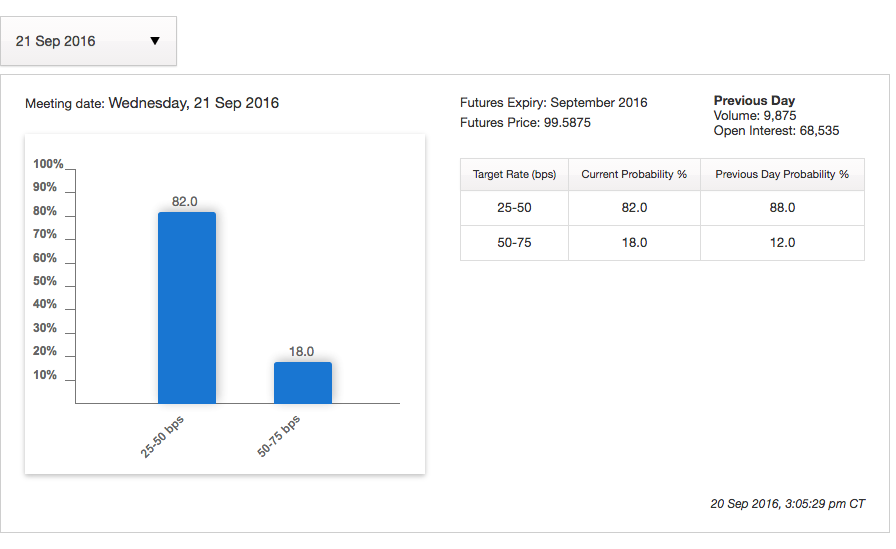

The U.S. presidential election are in full swing and it has always seen as an impairment of Fed monetary policy decisions. A December FOMC meeting would benefit from a known outcome and a stable market without adding volatility to the market. The CME’s FedWatch tool has shown investors are not expecting a rate hike in September. There is only 18 percent probability of a rate hike. It is worth mentioning that the probably did go up today as there was a rumour circling the market about two primary dealers to the Fed warning about a possible rate hike. This is the first time more than one primary dealer has bet against the majority. Interesting to note that Barclays and BNP Paribas are two non-US based institutions.

The Fed has managed to keep some of its credibility intact by exercising patient thanks to the growth of the economy. Other countries do not have that luxury and their central banks are in a tight spot. The combination of action/inaction from the Bank of Japan (BOJ) and the U.S. Federal Reserve could result in one of the biggest moves in the market and investors will be following developments from Tokyo and Washington.

Market events to watch this week:

8:30pm AUD Mid-Year Economic and Fiscal Outlook

Tentative JPY Monetary Policy Statement

Wednesday, September 21

Tentative JPY BOJ Press Conference

10:30am USD Crude Oil Inventories

2:00pm USD FOMC Economic Projections

2:00pm USD FOMC Statement

2:00pm USD Federal Funds Rate

2:30pm USD FOMC Press Conference

5:00pm NZD Official Cash Rate

5:00pm NZD RBNZ Rate Statement

Thursday, September 22

8:30am USD Unemployment Claims

9:00am EUR ECB President Draghi Speaks

Friday, September 23

8:30am CAD Core CPI m/m

8:30am CAD Core Retail Sales m/m

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar