Reduced Chinese Tariffs Further List Sentiment in Markets

US futures are pointing to another higher open on Tuesday, building on Monday’s strong gains and benefiting from an apparent easing in trade tensions between the world’s two largest economies.

The postponement of new tariffs by both the US and China and the revelation that the latter will cut import tariffs on cars from as much as 25% to 15% and on car parts to 6% is seen as an important step away from a trade war that could have negative implications globally. Trade protectionism was one of the fears of a Trump Presidency and his announcement of tariffs and his approach to trade agreements went some way to justifying such views but this could be an important breakthrough.

Fed Minutes Will Provide Further Insight on Interest Rates on Wednesday

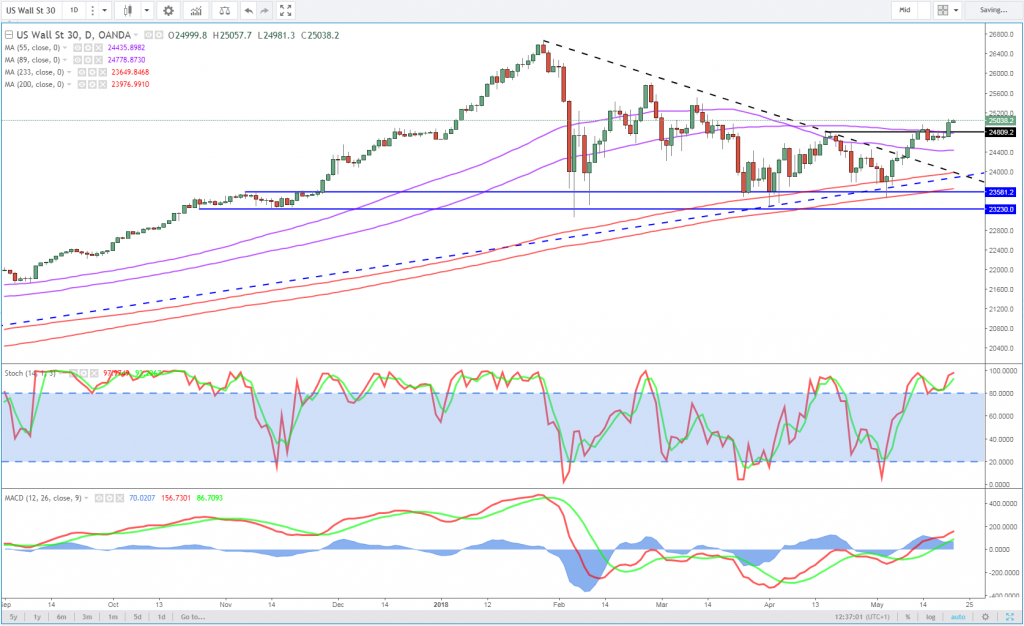

With sentiment gradually improving and risks subsiding, we could see stock markets edge their way back towards the levels we were seeing earlier this year, although we are still around 5% below those levels. It’s also worth noting the role that rising US yields could play with some citing the anticipated pick-up in yields as contributing to the less bullish environment.

Dow (US30) Daily Chart

OANDA fxTrade Advanced Charting Platform

The recent comments from the Federal Reserve suggest they’re in no rush to raise rate forecasts despite the uptick in some of the data, particularly inflation. If the central bank is willing to accept above target inflation for a time, as long as it doesn’t rise too much, it could ease investor concerns. We should find out more about policy makers views on this in the FOMC minutes which will be released on Wednesday.

DAX Unchanged, German PMIs Ahead

GBP Pares Gains as BoE Offers Little New Direction on Interest Rates

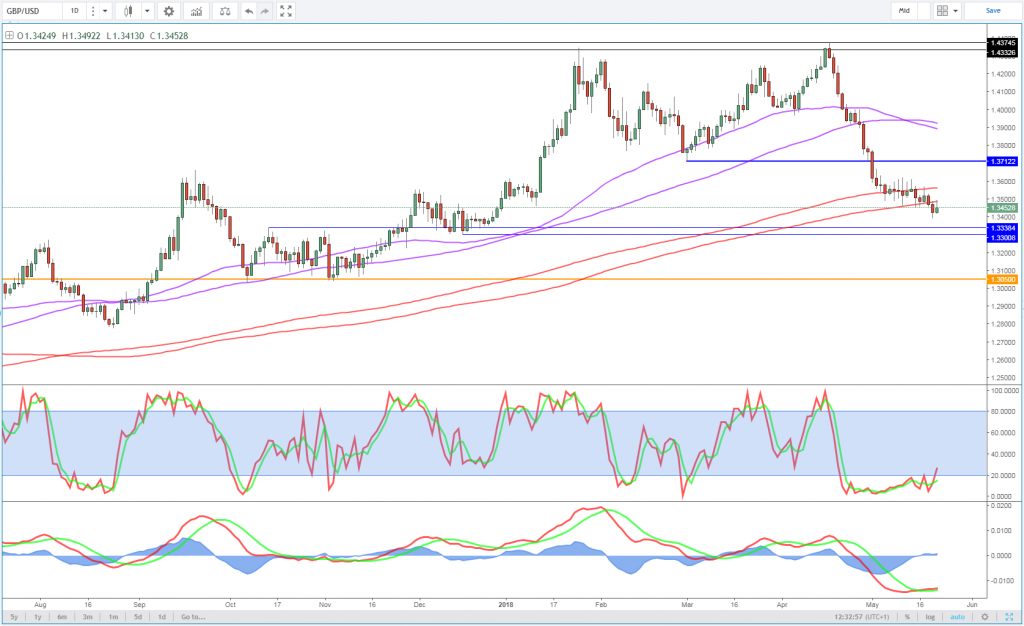

The Bank of England inflation report hearing today had the potential to be a very interesting event given the decision by the Monetary Policy Committee earlier this month not to raise interest rates, despite spending months laying the groundwork for such a move. Policy makers have come under fire on numerous occasions in recent years for failing to provide accurate and reliable forecasts both on the economy and for interest rates and the latest move will not help this reputation.

The hearing itself was quite tame compared to what it has been in the past and I’m not sure there was anything noteworthy to take away from it. Governor Mark Carney was keen to stress that the outlook of a few hikes over the next few years hasn’t changed and that the timing of the first is not overly important. There was also clear opposition to the suggestion of providing more precise interest rate forecasts each quarter which given the difficulty with them already seems sensible.

GBPUSD Daily Chart

While the pound pared earlier gains during the hearing, it’s clear that traders took little away from the event itself and will instead be more focused on how the data develops in the months ahead. With the markets now only pricing in a rate hike later this year, the central bank and the economy has plenty to do to convince traders that could come earlier in August if it’s planning to get the ball rolling earlier. Given the stage that Brexit negotiations are at, it may be worth waiting until the end of the year as policy makers will have a much clearer understanding of the outlook for the economy.

Trade Ceasefire Supports Risk Assets

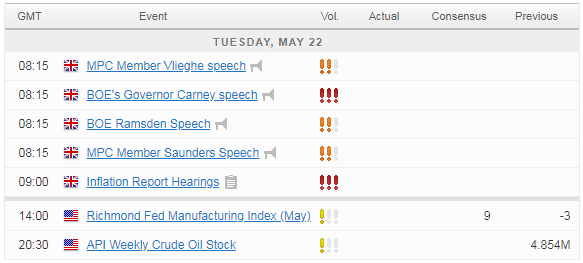

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.