Risk appetite remains strong at the start of the new week, aided by a softening in tone of some of the more controversial campaign promises as Donald Trump, the candidate, continues to morph into Donald trump, President elect.

It’s still to be seen what Trump is going to prioritize once he gets into the White House in January and, possibly more importantly, what Congress will support him in doing, but it seems at least initially the focus will be on growth initiatives which is why markets are getting so carried away. Given the Republicans previous reluctance to run large deficits, there may be a case to say markets are getting a little ahead of themselves but I think it’s probably being helped by the growing belief that some of his more radical promises will likely be dialled back quite considerably which has come as a relief.

Trump-economics Boosts Dollar, Bond Rout Deepens

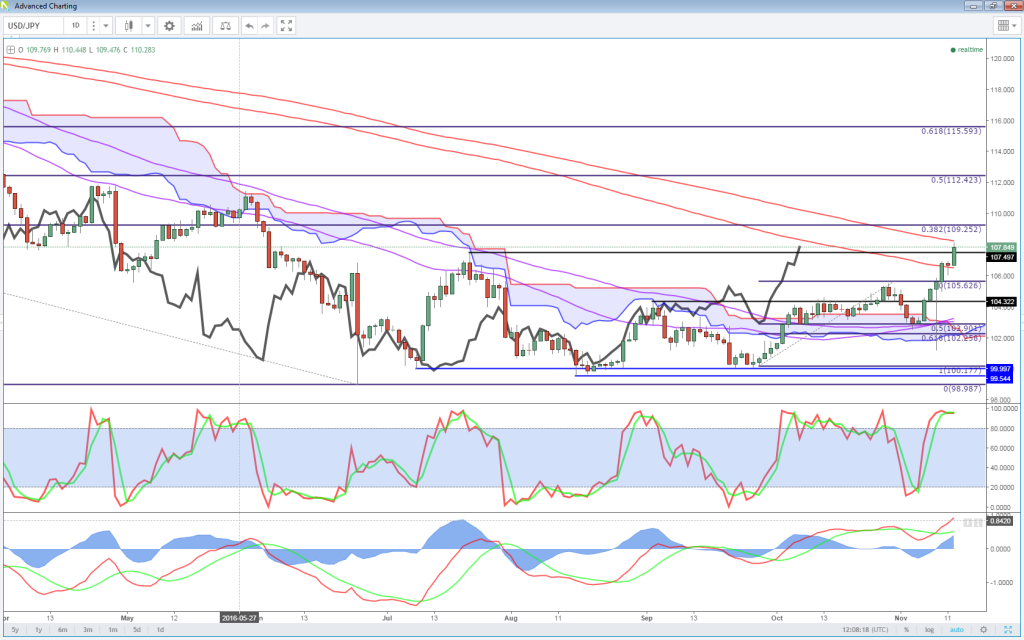

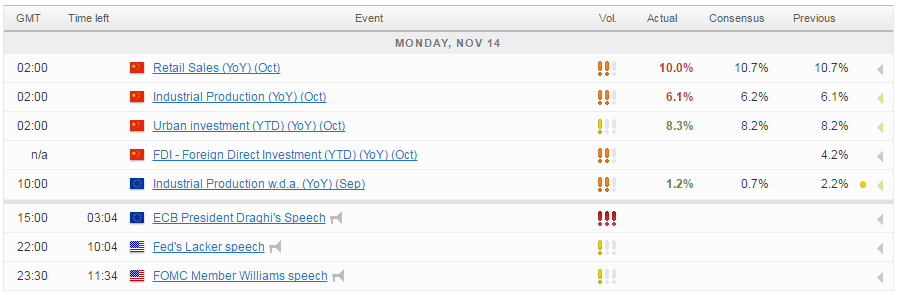

In the absence of much data or events on Monday, today will probably once again be a case of markets assessing the fallout from the election and what it means for not just the US, but the global economy. The message we’ve had so far is that Trump’s policies will stimulate growth and inflation which has driven Treasury yields to their highest level since the start of the year when an overly hawkish Fed was aiming to raise interest rates four times in 2016. The dollar has responded in kind, rallying strongly, particularly against the safe haven yen which has dramatically lost its appeal having been a favourite in the immediate aftermath of the election.

Safe haven gold is another to have lost its appeal. A combination of a stronger dollar, strong risk appetite and higher inflation expectations has led to a meltdown in the previous metal that could see it break below $1,200 in the not too distant future.

US Yields Clear Fields of Gold

Emerging markets are looking to be another victim of the more hawkish market views, although it should be noted that they are better positioned to deal with this than they were a year or two ago so I don’t currently expect the kind of meltdown that we observed in August last year, or again in January.

For a look at all of today’s economic events, check out our economic calendar.