Traders Look For Fourth Rate Hike Hint From Statement

US futures are treading water ahead of the open on Wednesday, as investors await the monetary policy announcement from the Federal Reserve and earnings from 49 US companies.

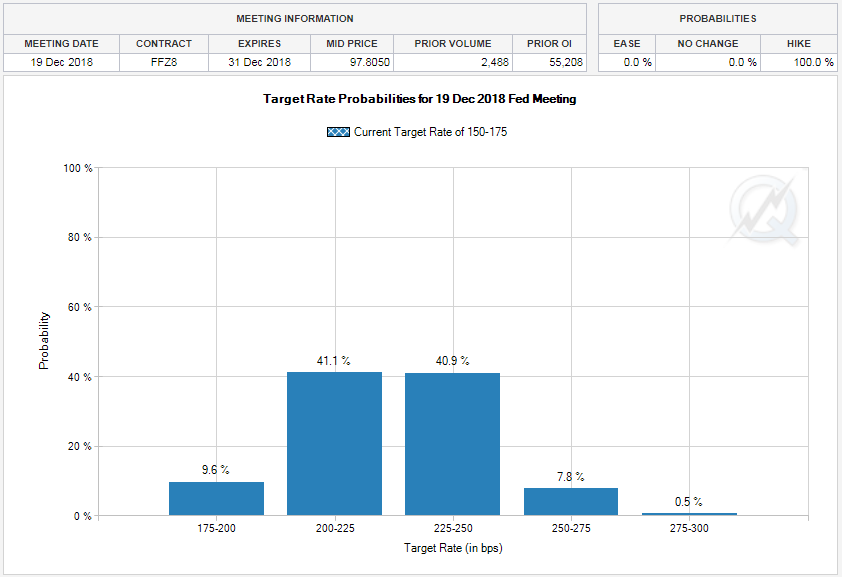

The interest rate decision from the Fed is expected later in the session on Wednesday and while no change is expected at this meeting, traders will be paying very close attention to the accompanying statement for clues on the number of rate hikes this year. The chances are, the Fed won’t stray too far from previous messaging and, if it decides to warn of the possibility of a fourth hike this year, it will probably do so in the economic projections next month.

CME Group FedWatch Tool

Source – CME

Still, with the central bank having previously projected three this year with an additional next, even a slight hawkish shift in the statement could convince traders that a fourth is more likely. As it stands, a fourth rate hike is around 50% priced in, having been around half that only a few weeks ago. With expectations on the rise, there’s plenty more room for a fourth hike to be priced in, as well as a faster pace of tightening further down the line.

Fed Likely on Hold, but what about the Dollar?

USD Takes a Breather After Strong Rally

The data is certainly supporting the case for faster tightening with even the Fed’s preferred inflation measure – the core personal consumption expenditure price index – almost at target. Tax reforms will likely continue to boost the economy in the near-term also and influence the Fed’s view on tightening with it.

The US dollar has seen something of a resurgence in recent weeks as well, with the slight increase in interest rate expectations in the US having coming at the same time as a softening in the tightening case for other central banks as well as some very strong earnings reports from US corporates. With the 2-year yield now at its highest since 2008 and the 10-year above 3%, after seriously struggling to breach this threshold for months, the near-term could be favourable for the greenback as it attempts to claw back some of the losses incurred over the last 16 months.

DAX Jumps Ahead of Fed Announcement

GBP Pares Considerable Losses After Better PMI

The pound is having a torrid time in comparison to and, particularly, against the greenback having fallen more than 5% over the last couple of weeks. The move has come as rate hike expectations for the Bank of England this month have fallen from around 70% to less than 20% at the time of writing. At one time, a hike looked an almost certainty due to the language from the central bank in recent months but that has changed recently with Governor Mark Carney claiming that there are other meetings this year at which they could raise interest rates.

GBPUSD Daily Chart

This comes as the economic data has turned sour with the economy barely growing in the first quarter, inflation falling in recent months closer to target and confidence in the outlook being less positive. While the construction PMI saw a stronger than expected bounce back in April, having suffered as a result of the bad weather in March, the manufacturing PMI was not so good having fallen again while the services PMI is expected to rebound slightly but point continue the trend of falling optimism.

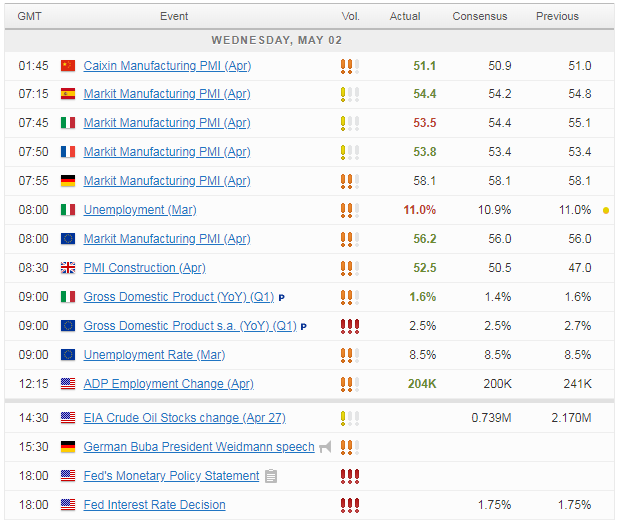

Still to come today we’ll get the ADP non-farm employment number, which traders will be eyeing ahead of Friday’s jobs report, 49 S&P 500 companies report on the fourth quarter and we’ll also get oil inventory data.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.