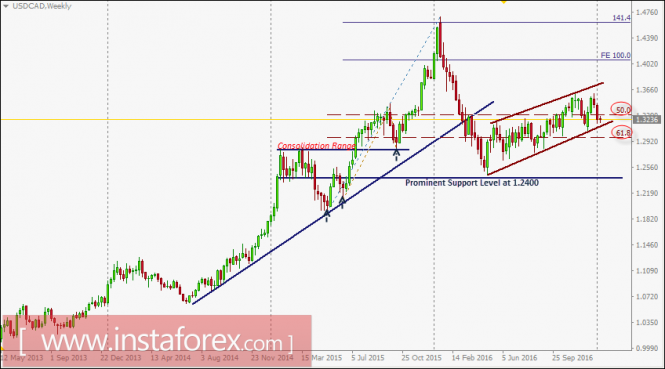

On August 18, signs of bullish recovery were manifested around the price level of 1.2830 which led to the current bullish breakout above 1.3000.

The USD/CAD pair was trapped between the price levels of 1.3000 (61.8% Fibonacci level) and 1.3360 (50% Fibonacci level) until a bullish breakout took place one month ago.

Note that the USD/CAD pair challenged the upper limit of the depicted channel around 1.3360-1.3400 which succeeded to apply enough bearish pressure on the pair.

Shortly after, a bearish engulfing weekly candlestick was expressed by the end of the week indicating strong resistance around 1.3550.

Bearish persistence below the price level of 1.3300 (50% Fibonacci Level) was achieved.

This allowed a further decline toward 1.3200 and 1.3080 (the lower limit of the depicted channel) where bullish rejection was expressed as anticipated.

A bullish breakout above 1.3360 (50% Fibonacci level) allows a bullish movement toward 1.3700-1.3750 (the upper limit of the depicted channel) where bearish rejection should be expected.

On the other hand, the current bearish pullback toward 1.3300 – 1.3250 (50% Fibonacci Level) should be watched for bullish rejection and a possible BUY entry. S/L should be placed below 1.3170.

The material has been provided by InstaForex Company – www.instaforex.com

The post USD/CAD intraday technical levels and trading recommendations for January 11, 2017 appeared first on forex-analytics.press.